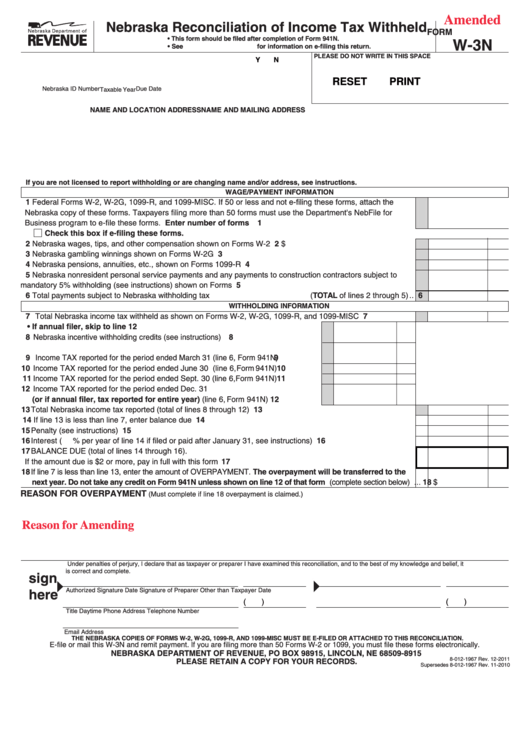

Amended

Nebraska Reconciliation of Income Tax Withheld

FORM

•This form should be filed after completion of Form 941N.

W-3N

• See for information on e-filing this return.

PLEASE DO NOT WRITE IN THIS SPACE

Y

N

RESET

PRINT

Nebraska ID Number

Due Date

Taxable Year

NAME AND LOCATION ADDRESS

NAME AND MAILING ADDRESS

If you are not licensed to report withholding or are changing name and/or address, see instructions.

WAGE/PAYMENT INFORMATION

1 Federal Forms W-2, W-2G, 1099-R, and 1099-MISC. If 50 or less and not e-filing these forms, attach the

Nebraska copy of these forms. Taxpayers filing more than 50 forms must use the Department's NebFile for

Business program to e-file these forms. ......................................................................... Enter number of forms

1

Check this box if e-filing these forms.

2 Nebraska wages, tips, and other compensation shown on Forms W-2 .................................................................

2 $

3 Nebraska gambling winnings shown on Forms W-2G ...........................................................................................

3

4 Nebraska pensions, annuities, etc., shown on Forms 1099-R ...............................................................................

4

5 Nebraska nonresident personal service payments and any payments to construction contractors subject to

mandatory 5% withholding (see instructions) shown on Forms 1099-MISC..........................................................

5

6 Total payments subject to Nebraska withholding tax

6

(TOTAL of lines 2 through 5) ..

WITHHOLDING INFORMATION

7 Total Nebraska income tax withheld as shown on Forms W-2, W-2G, 1099-R, and 1099-MISC ...........................

7

• If annual filer, skip to line 12

8 Nebraska incentive withholding credits (see instructions) ..............................................

8

9 Income TAX reported for the period ended March 31 (line 6, Form 941N) .....................

9

10 Income TAX reported for the period ended June 30 (line 6, Form 941N) ................... 10

11 Income TAX reported for the period ended Sept. 30 (line 6, Form 941N) .................... 11

12 Income TAX reported for the period ended Dec. 31

(or if annual filer, tax reported for entire year) (line 6, Form 941N)........................ 12

13 Total Nebraska income tax reported (total of lines 8 through 12) .......................................................................... 13

14 If line 13 is less than line 7, enter balance due ...................................................................................................... 14

15 Penalty (see instructions) ....................................................................................................................................... 15

16 Interest (

% per year of line 14 if filed or paid after January 31, see instructions) ................................... 16

17 BALANCE DUE (total of lines 14 through 16).

If the amount due is $2 or more, pay in full with this form ...................................................................................... 17

18 If line 7 is less than line 13, enter the amount of OVERPAYMENT. The overpayment will be transferred to the

next year. Do not take any credit on Form 941N unless shown on line 12 of that form (complete section below) ... 18 $

REASON FOR OVERPAYMENT

(Must complete if line 18 overpayment is claimed.)

Reason for Amending

Under penalties of perjury, I declare that as taxpayer or preparer I have examined this reconciliation, and to the best of my knowledge and belief, it

is correct and complete.

sign

here

Authorized Signature

Date

Signature of Preparer Other than Taxpayer

Date

(

)

(

)

Title

Daytime Phone

Address

Telephone Number

Email Address

THE NEBRASKA COPIES OF FORMS W-2, W-2G, 1099-R, AND 1099-MISC MUST BE E-FILED OR ATTACHED TO THIS RECONCILIATION.

E-file or mail this W-3N and remit payment. If you are filing more than 50 Forms W-2 or 1099, you must file these forms electronically.

NEBRASKA DEPARTMENT OF REVENUE, PO BOX 98915, LINCOLN, NE 68509-8915

8-012-1967 Rev. 12-2011

PLEASE RETAIN A COPY FOR YOUR RECORDS.

Supersedes 8-012-1967 Rev. 11-2010

1

1 2

2