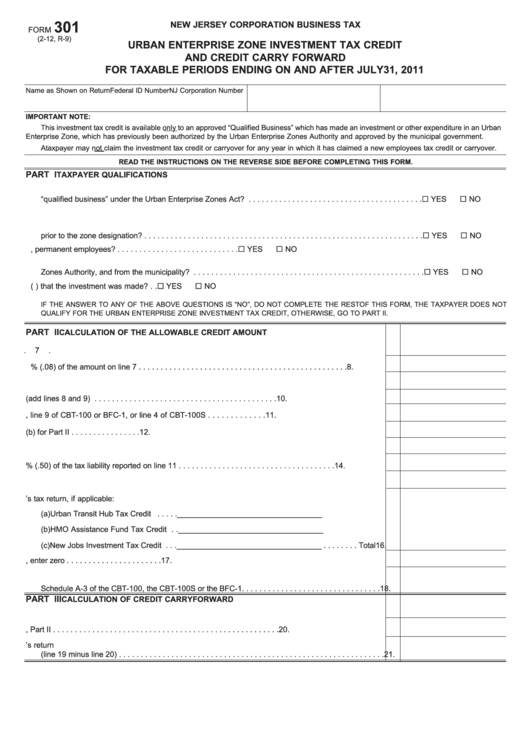

Form 301 - Urban Enterprise Zone Investment Tax Credit And Credit Carry Forward

ADVERTISEMENT

301

NEW JERSEY CORPORATION BUSINESS TAX

FORM

(2-12, R-9)

URBAN ENTERPRISE ZONE INVESTMENT TAX CREDIT

AND CREDIT CARRY FORWARD

FOR TAXABLE PERIODS ENDING ON AND AFTER JULY 31, 2011

Name as Shown on Return

Federal ID Number

NJ Corporation Number

IMPORTANT NOTE:

This investment tax credit is available only to an approved “Qualified Business” which has made an investment or other expenditure in an Urban

Enterprise Zone, which has previously been authorized by the Urban Enterprise Zones Authority and approved by the municipal government.

A taxpayer may not claim the investment tax credit or carryover for any year in which it has claimed a new employees tax credit or carryover.

READ THE INSTRUCTIONS ON THE REVERSE SIDE BEFORE COMPLETING THIS FORM.

PART I

TAXPAYER QUALIFICATIONS

1. Is the taxpayer certified by the Department of Commerce and Economic Development as a

“qualified business” under the Urban Enterprise Zones Act? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

2. Enter your Urban Enterprise Zone permit number ____________________________________

3. Was the taxpayer engaged in the active conduct of a trade or business in the zone for at least one year

prior to the zone designation? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

4. Does the taxpayer employ fewer than 50 full-time, permanent employees? . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

5. Has the taxpayer attached copies of the written approval for the investment from the Urban Enterprise

Zones Authority, and from the municipality? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

6. Has the taxpayer attached proof (i.e. copy of underlying receipt or contract) that the investment was made? . .

YES

NO

IF THE ANSWER TO ANY OF THE ABOVE QUESTIONS IS “NO”, DO NOT COMPLETE THE REST OF THIS FORM, THE TAXPAYER DOES NOT

QUALIFY FOR THE URBAN ENTERPRISE ZONE INVESTMENT TAX CREDIT, OTHERWISE, GO TO PART II.

PART II

CALCULATION OF THE ALLOWABLE CREDIT AMOUNT

7. Enter the amount of the approved investment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8. Enter 8% (.08) of the amount on line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

9. Investment tax credit carried forward from prior tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

10. Total investment tax credit (add lines 8 and 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.

11. Enter tax liability from Page 1, line 9 of CBT-100 or BFC-1, or line 4 of CBT-100S . . . . . . . . . . . . . 11.

12. Enter the required minimum tax liability as indicated in instruction (b) for Part II . . . . . . . . . . . . . . . . 12.

13. Subtract line 12 from line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

14. Enter 50% (.50) of the tax liability reported on line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.

15. Enter the lesser of line 13 or line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.

16. Tax Credits taken on the current year’s tax return, if applicable:

(a) Urban Transit Hub Tax Credit . . . . .__________________________________

(b) HMO Assistance Fund Tax Credit . .__________________________________

(c) New Jobs Investment Tax Credit . . .__________________________________ . . . . . . . . Total 16.

17. Subtract line 16 from line 15. If the result is less than zero, enter zero . . . . . . . . . . . . . . . . . . . . . . 17.

18. Allowable credit for the current tax period - Enter the lesser of line 10 or line 17 here and on

Schedule A-3 of the CBT-100, the CBT-100S or the BFC-1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.

PART III

CALCULATION OF CREDIT CARRY FORWARD

19. Enter amount from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19.

20. Enter amount from line 18, Part II . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20.

21. Amount of Urban Enterprise Zone Investment Tax Credit Carry Forward to following year’s return

(line 19 minus line 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2