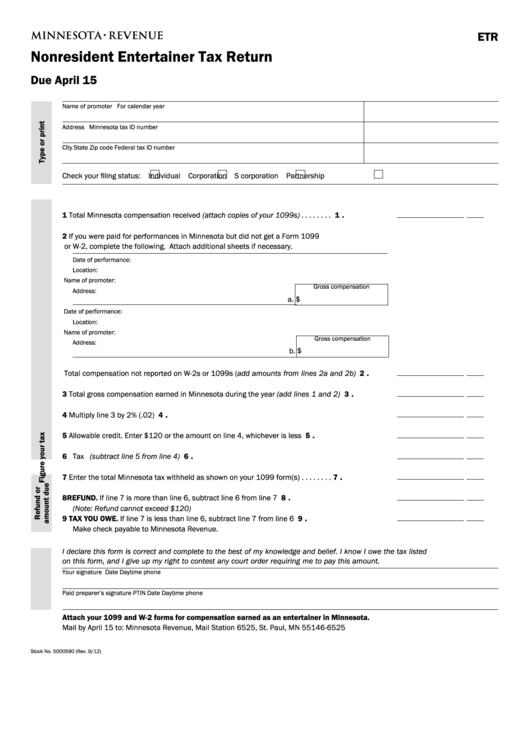

ETR

Nonresident Entertainer Tax Return

Due April 15

Name of promoter

For calendar year

Address

Minnesota tax ID number

City

State

Zip code

Federal tax ID number

Check your filing status:

Individual

Corporation

S corporation

Partnership

.

1 Total Minnesota compensation received (attach copies of your 1099s) . . . . . . . . . . . . . . . . . . . . . 1

2 If you were paid for performances in Minnesota but did not get a Form 1099

or W-2, complete the following. Attach additional sheets if necessary.

Date of performance:

Location:

Name of promoter:

Gross compensation

Address:

a. $

Date of performance:

Location:

Name of promoter:

Gross compensation

Address:

b. $

.

Total compensation not reported on W-2s or 1099s (add amounts from lines 2a and 2b) . . . . . 2

.

3 Total gross compensation earned in Minnesota during the year (add lines 1 and 2) . . . . . . . . . . . 3

.

4 Multiply line 3 by 2% (.02) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

.

5 Allowable credit. Enter $120 or the amount on line 4, whichever is less . . . . . . . . . . . . . . . . . . . . 5

.

6 Tax (subtract line 5 from line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

.

7 Enter the total Minnesota tax withheld as shown on your 1099 form(s) . . . . . . . . . . . . . . . . . . . . . . 7

.

8 REFUND. If line 7 is more than line 6, subtract line 6 from line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . 8

(Note: Refund cannot exceed $120)

.

9 TAX YOU OWE. If line 7 is less than line 6, subtract line 7 from line 6 . . . . . . . . . . . . . . . . . . . . . . 9

Make check payable to Minnesota Revenue.

I declare this form is correct and complete to the best of my knowledge and belief. I know I owe the tax listed

on this form, and I give up my right to contest any court order requiring me to pay this amount.

Your signature

Date

Daytime phone

Paid preparer’s signature

PTIN

Date

Daytime phone

Attach your 1099 and W-2 forms for compensation earned as an entertainer in Minnesota.

Mail by April 15 to: Minnesota Revenue, Mail Station 6525, St. Paul, MN 55146-6525

Stock No. 5000590 (Rev. 9/12)

1

1 2

2