Form Nc-478 - Pass-Through Schedule For Nc-478 Series

ADVERTISEMENT

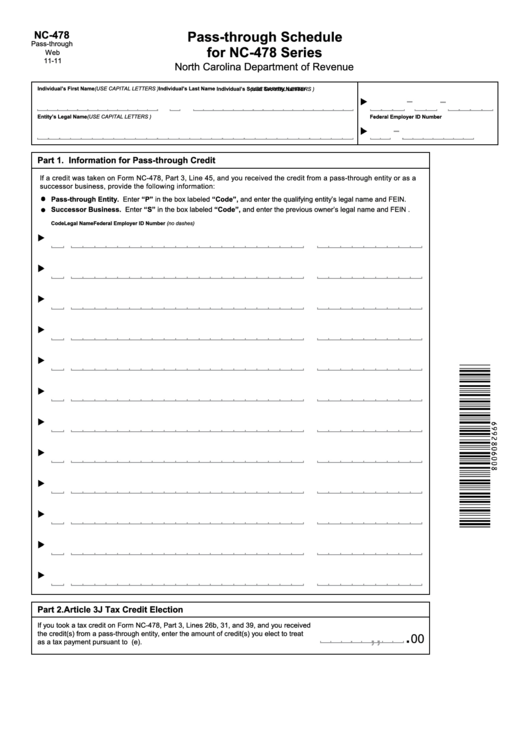

Pass-through Schedule

NC-478

Pass-through

for NC-478 Series

Web

11-11

North Carolina Department of Revenue

Individual’s First Name (USE CAPITAL LETTERS )

M.I.

Individual’s Last Name

Individual’s Social Security Number

(USE CAPITAL LETTERS )

Entity’s Legal Name(USE CAPITAL LETTERS )

Federal Employer ID Number

Part 1. Information for Pass-through Credit

If a credit was taken on Form NC-478, Part 3, Line 45, and you received the credit from a pass-through entity or as a

successor business, provide the following information:

Pass-through Entity. Enter “P” in the box labeled “Code”, and enter the qualifying entity’s legal name and FEIN.

Successor Business. Enter “S” in the box labeled “Code”, and enter the previous owner’s legal name and FEIN .

Code

Legal Name

Federal Employer ID Number (no dashes)

Part 2. Article 3J Tax Credit Election

If you took a tax credit on Form NC-478, Part 3, Lines 26b, 31, and 39, and you received

,

,

.

the credit(s) from a pass-through entity, enter the amount of credit(s) you elect to treat

00

as a tax payment pursuant to G.S. 105-129.84(e).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1