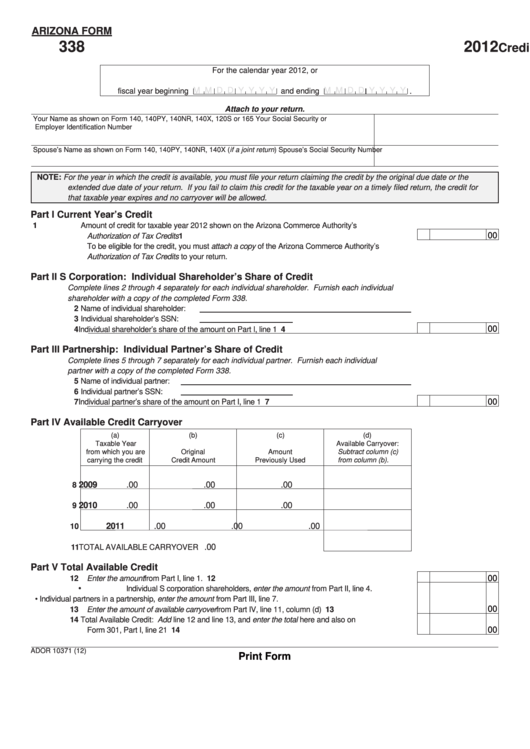

ARIZONA FORM

338

2012

Credit for Investment in Qualified Small Businesses

For the calendar year 2012, or

M M D D Y Y Y Y

M M D D Y Y Y Y

fiscal year beginning

and ending

.

Attach to your return.

Your Name as shown on Form 140, 140PY, 140NR, 140X, 120S or 165

Your Social Security or

Employer Identification Number

Spouse’s Name as shown on Form 140, 140PY, 140NR, 140X (if a joint return)

Spouse’s Social Security Number

NOTE: For the year in which the credit is available, you must file your return claiming the credit by the original due date or the

extended due date of your return. If you fail to claim this credit for the taxable year on a timely filed return, the credit for

that taxable year expires and no carryover will be allowed.

Part I

Current Year’s Credit

1

Amount of credit for taxable year 2012 shown on the Arizona Commerce Authority’s

00

Authorization of Tax Credits ...................................................................................................................

1

To be eligible for the credit, you must attach a copy of the Arizona Commerce Authority’s

Authorization of Tax Credits to your return.

Part II

S Corporation: Individual Shareholder’s Share of Credit

Complete lines 2 through 4 separately for each individual shareholder. Furnish each individual

shareholder with a copy of the completed Form 338.

2

Name of individual shareholder:

3

Individual shareholder’s SSN:

00

4

Individual shareholder’s share of the amount on Part I, line 1 ..............................................................

4

Part III Partnership: Individual Partner’s Share of Credit

Complete lines 5 through 7 separately for each individual partner. Furnish each individual

partner with a copy of the completed Form 338.

5

Name of individual partner:

6

Individual partner’s SSN:

00

7

Individual partner’s share of the amount on Part I, line 1 ......................................................................

7

Part IV Available Credit Carryover

(a)

(b)

(c)

(d)

Taxable Year

Available Carryover:

from which you are

Original

Amount

Subtract column (c)

carrying the credit

Credit Amount

Previously Used

from column (b).

2009

.00

.00

.00

8

2010

.00

.00

.00

9

2011

.00

.00

.00

10

.00

11 TOTAL AVAILABLE CARRYOVER ...................................................

Part V Total Available Credit

00

12

Enter the amount from Part I, line 1. ...................................................................................................... 12

•

Individual S corporation shareholders, enter the amount from Part II, line 4.

• Individual partners in a partnership, enter the amount from Part III, line 7.

00

13

Enter the amount of available carryover from Part IV, line 11, column (d) ........................................... 13

14

Total Available Credit: Add line 12 and line 13, and enter the total here and also on

00

Form 301, Part I, line 21 ......................................................................................................................... 14

ADOR 10371 (12)

Print Form

1

1