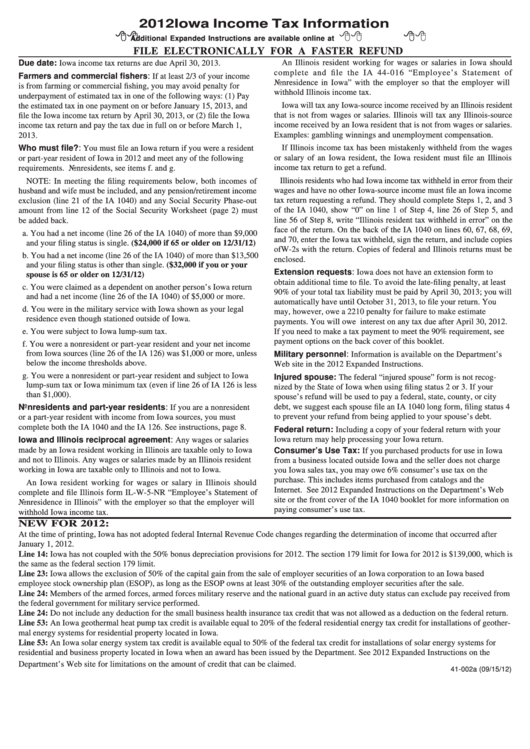

Iowa Income Tax Information - 2012

ADVERTISEMENT

2012 Iowa Income Tax Information

Additional Expanded Instructions are available online at

FILE ELECTRONICALLY FOR A FASTER REFUND

An Illinois resident working for wages or salaries in Iowa should

Due date: Iowa income tax returns are due April 30, 2013.

complete and file the IA 44-016 “Employee’s Statement of

Farmers and commercial fishers: If at least 2/3 of your income

Nonresidence in Iowa” with the employer so that the employer will

is from farming or commercial fishing, you may avoid penalty for

withhold Illinois income tax.

underpayment of estimated tax in one of the following ways: (1) Pay

Iowa will tax any Iowa-source income received by an Illinois resident

the estimated tax in one payment on or before January 15, 2013, and

that is not from wages or salaries. Illinois will tax any Illinois-source

file the Iowa income tax return by April 30, 2013, or (2) file the Iowa

income received by an Iowa resident that is not from wages or salaries.

income tax return and pay the tax due in full on or before March 1,

Examples: gambling winnings and unemployment compensation.

2013.

If Illinois income tax has been mistakenly withheld from the wages

Who must file?: You must file an Iowa return if you were a resident

or salary of an Iowa resident, the Iowa resident must file an Illinois

or part-year resident of Iowa in 2012 and meet any of the following

income tax return to get a refund.

requirements. Nonresidents, see items f. and g.

Illinois residents who had Iowa income tax withheld in error from their

NOTE: In meeting the filing requirements below, both incomes of

wages and have no other Iowa-source income must file an Iowa income

husband and wife must be included, and any pension/retirement income

tax return requesting a refund. They should complete Steps 1, 2, and 3

exclusion (line 21 of the IA 1040) and any Social Security Phase-out

of the IA 1040, show “0” on line 1 of Step 4, line 26 of Step 5, and

amount from line 12 of the Social Security Worksheet (page 2) must

line 56 of Step 8, write “Illinois resident tax withheld in error” on the

be added back.

face of the return. On the back of the IA 1040 on lines 60, 67, 68, 69,

a. You had a net income (line 26 of the IA 1040) of more than $9,000

and 70, enter the Iowa tax withheld, sign the return, and include copies

and your filing status is single. ($24,000 if 65 or older on 12/31/12)

of W-2s with the return. Copies of federal and Illinois returns must be

b. You had a net income (line 26 of the IA 1040) of more than $13,500

enclosed.

and your filing status is other than single. ($32,000 if you or your

Extension requests: Iowa does not have an extension form to

spouse is 65 or older on 12/31/12)

obtain additional time to file. To avoid the late-filing penalty, at least

c. You were claimed as a dependent on another person’s Iowa return

90% of your total tax liability must be paid by April 30, 2013; you will

and had a net income (line 26 of the IA 1040) of $5,000 or more.

automatically have until October 31, 2013, to file your return. You

d. You were in the military service with Iowa shown as your legal

may, however, owe a 2210 penalty for failure to make estimate

residence even though stationed outside of Iowa.

payments. You will owe interest on any tax due after April 30, 2012.

e. You were subject to Iowa lump-sum tax.

If you need to make a tax payment to meet the 90% requirement, see

payment options on the back cover of this booklet.

f. You were a nonresident or part-year resident and your net income

from Iowa sources (line 26 of the IA 126) was $1,000 or more, unless

Military personnel: Information is available on the Department’s

below the income thresholds above.

Web site in the 2012 Expanded Instructions.

g. You were a nonresident or part-year resident and subject to Iowa

Injured spouse: The federal “injured spouse” form is not recog-

lump-sum tax or Iowa minimum tax (even if line 26 of IA 126 is less

nized by the State of Iowa when using filing status 2 or 3. If your

than $1,000).

spouse’s refund will be used to pay a federal, state, county, or city

debt, we suggest each spouse file an IA 1040 long form, filing status 4

Nonresidents and part-year residents: If you are a nonresident

to prevent your refund from being applied to your spouse’s debt.

or a part-year resident with income from Iowa sources, you must

complete both the IA 1040 and the IA 126. See instructions, page 8.

Federal return: Including a copy of your federal return with your

Iowa and Illinois reciprocal agreement: Any wages or salaries

Iowa return may help processing your Iowa return.

made by an Iowa resident working in Illinois are taxable only to Iowa

Consumer’s Use Tax: If you purchased products for use in Iowa

and not to Illinois. Any wages or salaries made by an Illinois resident

from a business located outside Iowa and the seller does not charge

working in Iowa are taxable only to Illinois and not to Iowa.

you Iowa sales tax, you may owe 6% consumer’s use tax on the

purchase. This includes items purchased from catalogs and the

An Iowa resident working for wages or salary in Illinois should

Internet. See 2012 Expanded Instructions on the Department’s Web

complete and file Illinois form IL-W-5-NR “Employee’s Statement of

site or the front cover of the IA 1040 booklet for more information on

Nonresidence in Illinois” with the employer so that the employer will

paying consumer’s use tax.

withhold Iowa income tax.

NEW FOR 2012:

At the time of printing, Iowa has not adopted federal Internal Revenue Code changes regarding the determination of income that occurred after

January 1, 2012.

Line 14: Iowa has not coupled with the 50% bonus depreciation provisions for 2012. The section 179 limit for Iowa for 2012 is $139,000, which is

the same as the federal section 179 limit.

Line 23: Iowa allows the exclusion of 50% of the capital gain from the sale of employer securities of an Iowa corporation to an Iowa based

employee stock ownership plan (ESOP), as long as the ESOP owns at least 30% of the outstanding employer securities after the sale.

Line 24: Members of the armed forces, armed forces military reserve and the national guard in an active duty status can exclude pay received from

the federal government for military service performed.

Line 24: Do not include any deduction for the small business health insurance tax credit that was not allowed as a deduction on the federal return.

Line 53: An Iowa geothermal heat pump tax credit is available equal to 20% of the federal residential energy tax credit for installations of geother-

mal energy systems for residential property located in Iowa.

Line 53: An Iowa solar energy system tax credit is available equal to 50% of the federal tax credit for installations of solar energy systems for

residential and business property located in Iowa when an award has been issued by the Department. See 2012 Expanded Instructions on the

Department’s Web site for limitations on the amount of credit that can be claimed.

41-002a (09/15/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11