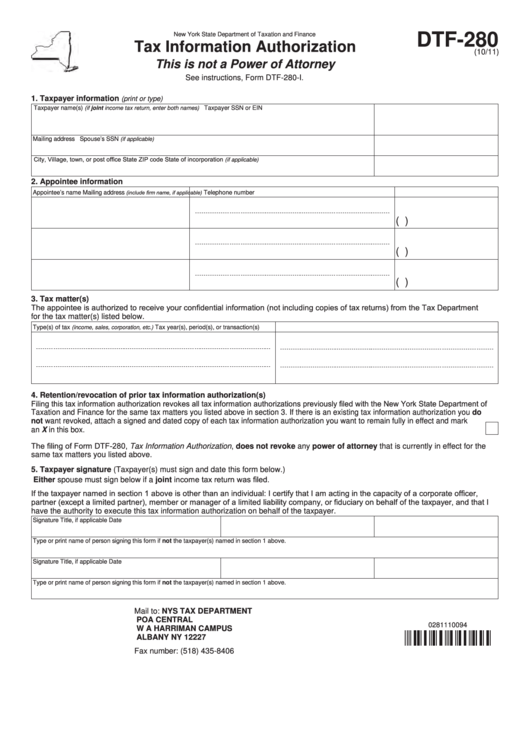

New York State Department of Taxation and Finance

DTF-280

Tax Information Authorization

(10/11)

This is not a Power of Attorney

See instructions, Form DTF-280-I.

1. Taxpayer information

(print or type)

Taxpayer name(s)

(if joint income tax return, enter both names)

Taxpayer SSN or EIN

Mailing address

Spouse’s SSN

(if applicable)

City, Village, town, or post office

State

ZIP code

State of incorporation

(if applicable)

2. Appointee information

(include firm name, if applicable)

Appointee’s name

Mailing address

Telephone number

(

)

(

)

(

)

3. Tax matter(s)

The appointee is authorized to receive your confidential information (not including copies of tax returns) from the Tax Department

for the tax matter(s) listed below.

Type(s) of tax

Tax year(s), period(s), or transaction(s)

(income, sales, corporation, etc.)

4. Retention/revocation of prior tax information authorization(s)

Filing this tax information authorization revokes all tax information authorizations previously filed with the New York State Department of

Taxation and Finance for the same tax matters you listed above in section 3. If there is an existing tax information authorization you do

not want revoked, attach a signed and dated copy of each tax information authorization you want to remain fully in effect and mark

an X in this box. ......................................................................................................................................................................................

The filing of Form DTF-280, Tax Information Authorization, does not revoke any power of attorney that is currently in effect for the

same tax matters you listed above.

5. Taxpayer signature (Taxpayer(s) must sign and date this form below.)

Either spouse must sign below if a joint income tax return was filed.

If the taxpayer named in section 1 above is other than an individual: I certify that I am acting in the capacity of a corporate officer,

partner (except a limited partner), member or manager of a limited liability company, or fiduciary on behalf of the taxpayer, and that I

have the authority to execute this tax information authorization on behalf of the taxpayer.

Signature

Title, if applicable

Date

Type or print name of person signing this form if not the taxpayer(s) named in section 1 above.

Signature

Title, if applicable

Date

Type or print name of person signing this form if not the taxpayer(s) named in section 1 above.

Mail to: NYS TAX DEPARTMENT

POA CENTRAL

0281110094

W A HARRIMAN CAMPUS

ALBANY NY 12227

Fax number: (518) 435-8406

1

1