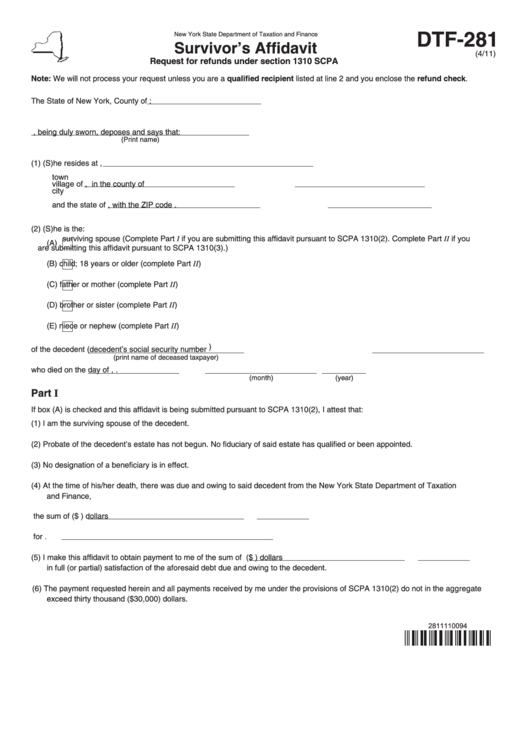

Form Dtf-281 - Survivor'S Affidavit Request For Refunds Under Section 1310 Scpa

ADVERTISEMENT

DTF-281

New York State Department of Taxation and Finance

Survivor’s Affidavit

(4/11)

Request for refunds under section 1310 SCPA

Note: We will not process your request unless you are a qualified recipient listed at line 2 and you enclose the refund check.

The State of New York, County of

:

, being duly sworn, deposes and says that:

(Print name)

(1) (S)he resides at

,

town

village of

, in the county of

city

and the state of

, with the ZIP code

.

(2) (S)he is the:

surviving spouse (Complete Part I if you are submitting this affidavit pursuant to SCPA 1310(2). Complete Part II if you

(A)

are submitting this affidavit pursuant to SCPA 1310(3).)

(B)

child; 18 years or older (complete Part II)

(C)

father or mother (complete Part II)

(D)

brother or sister (complete Part II)

(E)

niece or nephew (complete Part II)

)

of the decedent

(decedent’s social security number

(print name of deceased taxpayer)

who died on the

day of

,

.

(month)

(year)

Part I

If box (A) is checked and this affidavit is being submitted pursuant to SCPA 1310(2), I attest that:

(1) I am the surviving spouse of the decedent.

(2) Probate of the decedent’s estate has not begun. No fiduciary of said estate has qualified or been appointed.

(3) No designation of a beneficiary is in effect.

(4) At the time of his/her death, there was due and owing to said decedent from the New York State Department of Taxation

and Finance,

the sum of

($

) dollars

for

.

(5) I make this affidavit to obtain payment to me of the sum of

($

) dollars

in full (or partial) satisfaction of the aforesaid debt due and owing to the decedent.

(6) The payment requested herein and all payments received by me under the provisions of SCPA 1310(2) do not in the aggregate

exceed thirty thousand ($30,000) dollars.

2811110094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2