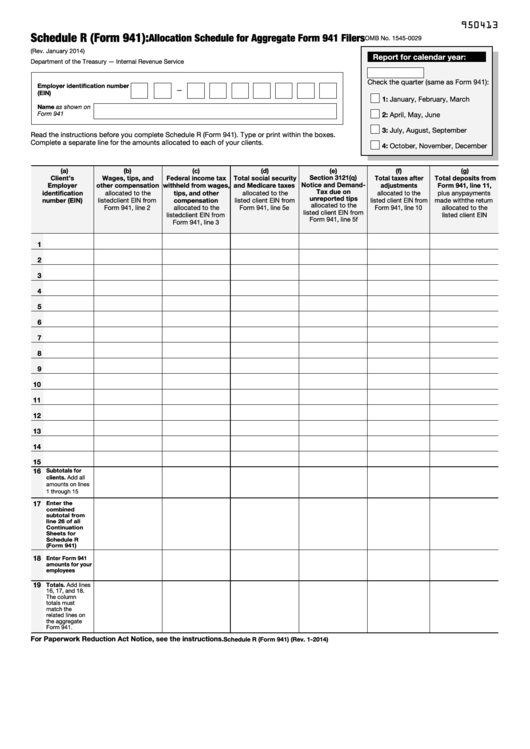

950413

Schedule R (Form 941):

Allocation Schedule for Aggregate Form 941 Filers

OMB No. 1545-0029

(Rev. January 2014)

Report for calendar year:

Department of the Treasury — Internal Revenue Service

Check the quarter (same as Form 941):

Employer identification number

—

(EIN)

1: January, February, March

Name as shown on

Form 941

2: April, May, June

3: July, August, September

Read the instructions before you complete Schedule R (Form 941). Type or print within the boxes.

Complete a separate line for the amounts allocated to each of your clients.

4: October, November, December

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Section 3121(q)

Client’s

Wages, tips, and

Federal income tax

Total social security

Total taxes after

Total deposits from

Notice and Demand-

Employer

other compensation

withheld from wages,

and Medicare taxes

adjustments

Form 941, line 11,

Tax due on

identification

tips, and other

allocated to the

allocated to the

allocated to the

plus any payments

unreported tips

number (EIN)

listed client EIN from

compensation

listed client EIN from

listed client EIN from

made with the return

allocated to the

Form 941, line 2

allocated to the

Form 941, line 5e

Form 941, line 10

allocated to the

listed client EIN from

listed client EIN from

listed client EIN

Form 941, line 5f

Form 941, line 3

.

.

.

.

.

.

1

.

.

.

.

.

.

2

.

.

.

.

.

.

3

.

.

.

.

.

.

4

.

.

.

.

.

.

5

.

.

.

.

.

.

6

.

.

.

.

.

.

7

.

.

.

.

.

.

8

.

.

.

.

.

.

9

.

.

.

.

.

.

10

.

.

.

.

.

.

11

.

.

.

.

.

.

12

.

.

.

.

.

.

13

.

.

.

.

.

.

14

.

.

.

.

.

.

15

16

Subtotals for

clients. Add all

amounts on lines

.

.

.

.

.

.

1 through 15

17

Enter the

combined

subtotal from

line 26 of all

Continuation

Sheets for

Schedule R

.

.

.

.

.

.

(Form 941)

18

Enter Form 941

amounts for your

employees

.

.

.

.

.

.

19

Totals. Add lines

16, 17, and 18.

The column

totals must

match the

related lines on

the aggregate

.

.

.

.

.

.

Form 941.

For Paperwork Reduction Act Notice, see the instructions.

IRS.gov/form941

Cat. No. 49301K

Schedule R (Form 941) (Rev. 1-2014)

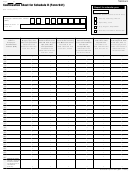

1

1 2

2 3

3