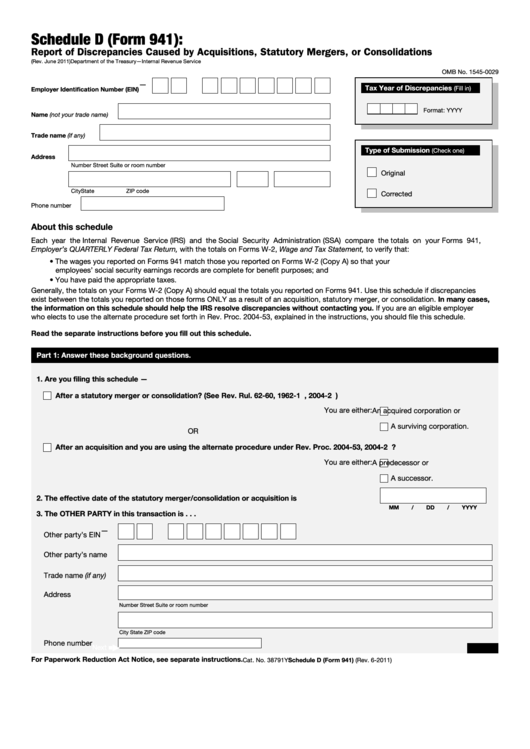

Schedule D (Form 941):

Report of Discrepancies Caused by Acquisitions, Statutory Mergers, or Consolidations

(Rev. June 2011)

Department of the Treasury—Internal Revenue Service

OMB No. 1545-0029

—

Tax Year of Discrepancies

(Fill in)

Employer Identification Number (EIN)

Format: YYYY

Name (not your trade name)

Trade name (if any)

Type of Submission

(Check one)

Address

Number

Street

Suite or room number

Original

City

State

ZIP code

Corrected

Phone number

About this schedule

Each year the Internal Revenue Service (IRS) and the Social Security Administration (SSA) compare the totals on your Forms 941,

Employer’s QUARTERLY Federal Tax Return, with the totals on Forms W-2, Wage and Tax Statement, to verify that:

• The wages you reported on Forms 941 match those you reported on Forms W-2 (Copy A) so that your

employees’ social security earnings records are complete for benefit purposes; and

• You have paid the appropriate taxes.

Generally, the totals on your Forms W-2 (Copy A) should equal the totals you reported on Forms 941. Use this schedule if discrepancies

exist between the totals you reported on those forms ONLY as a result of an acquisition, statutory merger, or consolidation. In many cases,

the information on this schedule should help the IRS resolve discrepancies without contacting you. If you are an eligible employer

who elects to use the alternate procedure set forth in Rev. Proc. 2004-53, explained in the instructions, you should file this schedule.

Read the separate instructions before you fill out this schedule.

Part 1: Answer these background questions.

1. Are you filing this schedule —

After a statutory merger or consolidation? (See Rev. Rul. 62-60, 1962-1 C.B. 186 and Rev. Proc. 2004-53, 2004-2 C.B. 320.)

You are either:

An acquired corporation or

A surviving corporation.

OR

After an acquisition and you are using the alternate procedure under Rev. Proc. 2004-53, 2004-2 C.B. 320?

You are either:

A predecessor or

A successor.

2. The effective date of the statutory merger/consolidation or acquisition is

. . . . . . . . .

MM

/

DD

/

YYYY

3. The OTHER PARTY in this transaction is . . .

—

Other party’s EIN

Other party’s name

Trade name (if any)

Address

Number

Street

Suite or room number

City

State

ZIP code

Phone number

Next

▶

■

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 38791Y

Schedule D (Form 941) (Rev. 6-2011)

1

1 2

2