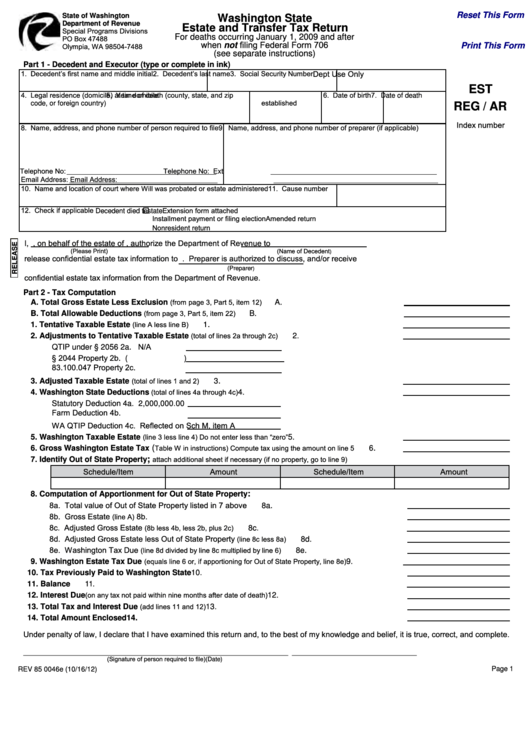

Reset This Form

State of Washington

Washington State

Department of Revenue

Estate and Transfer Tax Return

Special Programs Divisions

For deaths occurring January 1, 2009 and after

PO Box 47488

when not filing Federal Form 706

Olympia, WA 98504-7488

Print This Form

(see separate instructions)

Part 1 - Decedent and Executor (type or complete in ink)

Dept Use Only

1. Decedent’s first name and middle initial

2. Decedent’s last name

3. Social Security Number

EST

4. Legal residence (domicile) at time of death (county, state, and zip

5. Year domicile

6. Date of birth

7. Date of death

established

code, or foreign country)

REG / AR

Index number

8. Name, address, and phone number of person required to file

9. Name, address, and phone number of preparer (if applicable)

Telephone No:

Telephone No:

Ext

Email Address:

Email Address:

10. Name and location of court where Will was probated or estate administered

11. Cause number

12. Check if applicable

Extension form attached

Decedent died testate

Installment payment or filing election

Amended return

Nonresident return

, on behalf of the estate of

, authorize the Department of Revenue to

I,

(Name of Decedent

(Please Print)

)

release confidential estate tax information to

. Preparer is authorized to discuss, and/or receive

(Preparer

)

confidential estate tax information from the Department of Revenue.

Part 2 - Tax Computation

(from page 3, Part 5, item 12)

A.

Total Gross Estate Less Exclusion

...................................................

A.

(from page 3, Part 5, item 22)

B.

Total Allowable Deductions

................................................................

B.

(line A less line B)

............................................................................

.

1.

Tentative Taxable Estate

1

(total of lines 2a through 2c)

2.

Adjustments to Tentative Taxable Estate

............................................

2.

N/A

QTIP under § 2056

2a.

§ 2044 Property

2b. (

)

83.100.047 Property

2c.

(total of lines 1 and 2)

.......................................................................

.

3.

Adjusted Taxable Estate

3

(total of lines 4a through 4c)

.......................................................

4.

Washington State Deductions

4.

Statutory Deduction

4a. 2,000,000.00

Farm Deduction

4b.

WA QTIP Deduction

4c. Reflected on Sch M, item A

(line 3 less line 4) Do not enter less than “zero”

...................................

5.

Washington Taxable Estate

5.

Table W in instructions) Compute tax using the amount on line 5

(

........

.

6.

Gross Washington Estate Tax

6

attach additional sheet if necessary (if no property, go to line 9)

;

7.

Identify Out of State Property

Schedule/Item

Amount

Schedule/Item

Amount

:

8.

Computation of Apportionment for Out of State Property

8a. Total value of Out of State Property listed in 7 above ......................................................

8a.

8b. Gross Estate

8b.

(line A)

.........................................................................................................

8c. Adjusted Gross Estate

(8b less 4b, less 2b, plus 2c)

............................................................

8c.

8d. Adjusted Gross Estate less Out of State Property

(line 8c less 8a)

....................................

8d.

8e. Washington Tax Due

(line 8d divided by line 8c multiplied by line 6)

.......................................

8e.

(equals line 6 or, if apportioning for Out of State Property, line 8e)

...........

9.

Washington Estate Tax Due

9.

...........................................................................

10.

Tax Previously Paid to Washington State

10.

.............................................................................................................................

11.

Balance

11.

(on any tax not paid within nine months after date of death)

...........................................

12.

Interest Due

12.

(add lines 11 and 12)

......................................................................

13.

Total Tax and Interest Due

13.

......................................................................................................

14.

Total Amount Enclosed

14.

Under penalty of law, I declare that I have examined this return and, to the best of my knowledge and belief, it is true, correct, and complete.

____________________________________________________________________

________________________________

(Signature of person required to file)

(Date)

Page 1

REV 85 0046e (10/16/12)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20