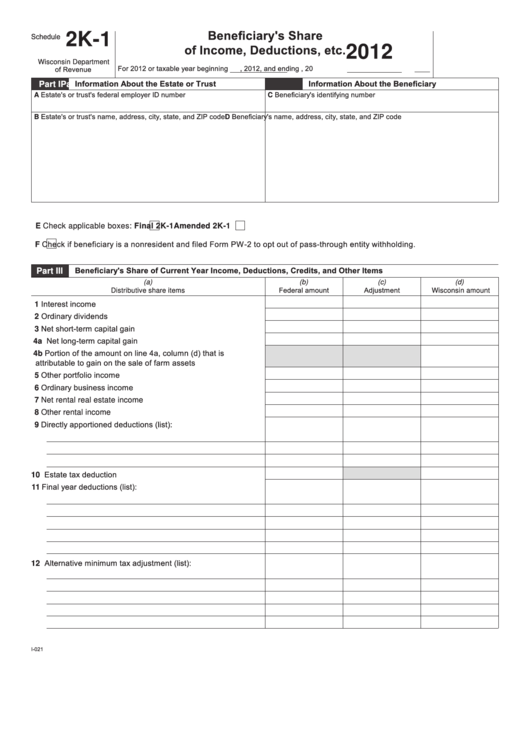

Beneficiary's Share

2K-1

Schedule

of Income, Deductions, etc.

2012

Wisconsin Department

For 2012 or taxable year beginning

, 2012, and ending

, 20

of Revenue

Information About the Estate or Trust

Information About the Beneficiary

Part I

Part II

A Estate's or trust's federal employer ID number

C Beneficiary's identifying number

B Estate's or trust's name, address, city, state, and ZIP code

D Beneficiary's name, address, city, state, and ZIP code

E Check applicable boxes:

Final 2K-1

Amended 2K-1

Check if beneficiary is a nonresident and filed Form PW-2 to opt out of pass-through entity withholding.

F

Beneficiary's Share of Current Year Income, Deductions, Credits, and Other Items

Part III

(a)

(b)

(c)

(d)

Federal amount

Adjustment

Distributive share items

Wisconsin amount

1 Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Ordinary dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Net short-term capital gain . . . . . . . . . . . . . . . . . . . . . . . . . . .

4a Net long-term capital gain . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4b Portion of the amount on line 4a, column (d) that is

attributable to gain on the sale of farm assets . . . . . . . . . . . . .

5 Other portfolio income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Ordinary business income . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Net rental real estate income . . . . . . . . . . . . . . . . . . . . . . . . .

8 Other rental income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 Directly apportioned deductions (list):

10 Estate tax deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11 Final year deductions (list):

12 Alternative minimum tax adjustment (list):

I-021

1

1 2

2