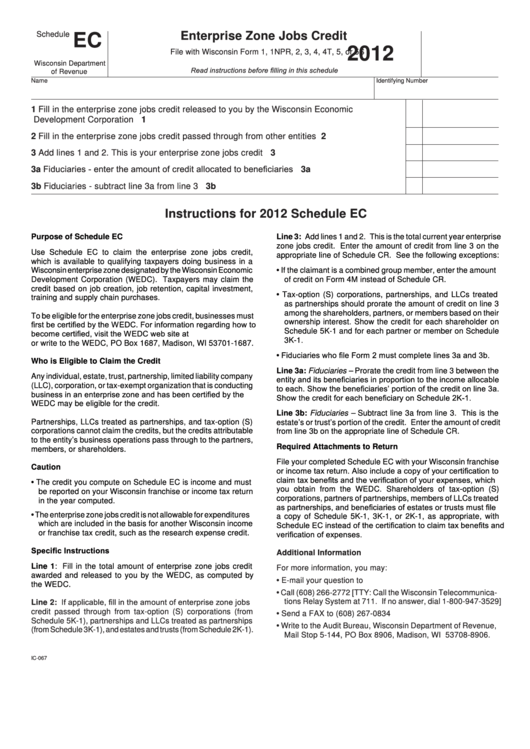

Schedule

Enterprise Zone Jobs Credit

EC

2012

File with Wisconsin Form 1, 1NPR, 2, 3, 4, 4T, 5, or 5S

Wisconsin Department

Read instructions before filling in this schedule

of Revenue

Name

Identifying Number

1

Fill in the enterprise zone jobs credit released to you by the Wisconsin Economic

Development Corporation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2

Fill in the enterprise zone jobs credit passed through from other entities . . . . . . . . . . . . . . .

2

3

Add lines 1 and 2 . This is your enterprise zone jobs credit . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3a Fiduciaries - enter the amount of credit allocated to beneficiaries . . . . . . . . . . . . . . . . . . . .

3a

3b Fiduciaries - subtract line 3a from line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3b

Instructions for 2012 Schedule EC

Purpose of Schedule EC

Line 3: Add lines 1 and 2 . This is the total current year enterprise

zone jobs credit . Enter the amount of credit from line 3 on the

Use Schedule EC to claim the enterprise zone jobs credit,

appropriate line of Schedule CR . See the following exceptions:

which is available to qualifying taxpayers doing business in a

• If the claimant is a combined group member, enter the amount

Wisconsin enterprise zone designated by the Wisconsin Economic

Development Corporation (WEDC) . Taxpayers may claim the

of credit on Form 4M instead of Schedule CR .

credit based on job creation, job retention, capital investment,

• Tax-option (S) corporations, partnerships, and LLCs treated

training and supply chain purchases .

as partnerships should prorate the amount of credit on line 3

among the shareholders, partners, or members based on their

To be eligible for the enterprise zone jobs credit, businesses must

ownership interest . Show the credit for each shareholder on

first be certified by the WEDC. For information regarding how to

Schedule 5K-1 and for each partner or member on Schedule

become certified, visit the WEDC web site at inwisconsin .com

3K-1 .

or write to the WEDC, PO Box 1687, Madison, WI 53701-1687 .

• Fiduciaries who file Form 2 must complete lines 3a and 3b.

Who is Eligible to Claim the Credit

Line 3a: Fiduciaries – Prorate the credit from line 3 between the

Any individual, estate, trust, partnership, limited liability company

entity and its beneficiaries in proportion to the income allocable

(LLC), corporation, or tax-exempt organization that is conducting

to each. Show the beneficiaries’ portion of the credit on line 3a.

business in an enterprise zone and has been certified by the

Show the credit for each beneficiary on Schedule 2K-1.

WEDC may be eligible for the credit .

Line 3b: Fiduciaries – Subtract line 3a from line 3 . This is the

Partnerships, LLCs treated as partnerships, and tax-option (S)

estate’s or trust’s portion of the credit . Enter the amount of credit

corporations cannot claim the credits, but the credits attributable

from line 3b on the appropriate line of Schedule CR .

to the entity’s business operations pass through to the partners,

Required Attachments to Return

members, or shareholders .

File your completed Schedule EC with your Wisconsin franchise

Caution

or income tax return. Also include a copy of your certification to

claim tax benefits and the verification of your expenses, which

• The credit you compute on Schedule EC is income and must

you obtain from the WEDC . Shareholders of tax-option (S)

be reported on your Wisconsin franchise or income tax return

corporations, partners of partnerships, members of LLCs treated

in the year computed .

as partnerships, and beneficiaries of estates or trusts must file

• The enterprise zone jobs credit is not allowable for expenditures

a copy of Schedule 5K-1, 3K-1, or 2K-1, as appropriate, with

Schedule EC instead of the certification to claim tax benefits and

which are included in the basis for another Wisconsin income

verification of expenses.

or franchise tax credit, such as the research expense credit .

Specific Instructions

Additional Information

Line 1: Fill in the total amount of enterprise zone jobs credit

For more information, you may:

awarded and released to you by the WEDC, as computed by

• E-mail your question to

corp@revenue .wi .gov

the WEDC .

• Call (608) 266-2772 [TTY: Call the Wisconsin Telecommunica-

Line 2: If applicable, fill in the amount of enterprise zone jobs

tions Relay System at 711 . If no answer, dial 1-800-947-3529]

credit passed through from tax-option (S) corporations (from

• Send a FAX to (608) 267-0834

Schedule 5K-1), partnerships and LLCs treated as partnerships

• Write to the Audit Bureau, Wisconsin Department of Revenue,

(from Schedule 3K-1), and estates and trusts (from Schedule 2K-1) .

Mail Stop 5-144, PO Box 8906, Madison, WI 53708-8906 .

IC-067

1

1