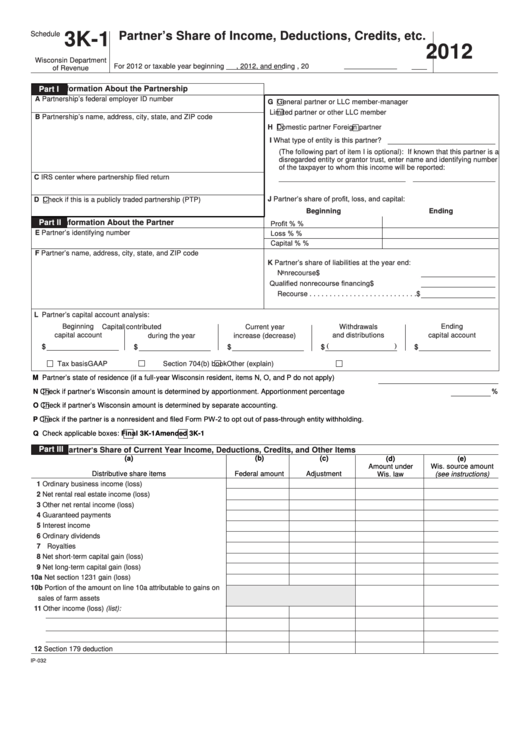

Schedule

3K-1

Partner’s Share of Income, Deductions, Credits, etc.

2012

Wisconsin Department

For 2012 or taxable year beginning

, 2012, and ending

, 20

of Revenue

Information About the Partnership

Part I

A Partnership’s federal employer ID number

G

General partner or LLC member-manager

Limited partner or other LLC member

B Partnership’s name, address, city, state, and ZIP code

H

Domestic partner

Foreign partner

I

What type of entity is this partner?

(The following part of item I is optional): If known that this partner is a

disregarded entity or grantor trust, enter name and identifying number

of the taxpayer to whom this income will be reported:

C IRS center where partnership filed return

J Partner’s share of profit, loss, and capital:

D

Check if this is a publicly traded partnership (PTP)

Beginning

Ending

Profit

%

%

Part II

Information About the Partner

Loss

%

%

E Partner’s identifying number

%

%

Capital

F Partner’s name, address, city, state, and ZIP code

K Partner’s share of liabilities at the year end:

Nonrecourse . . . . . . . . . . . . . . . . . . . . . . . .$

Qualified nonrecourse financing . . . . . . . . . .$

Recourse . . . . . . . . . . . . . . . . . . . . . . . . . . .$

L Partner’s capital account analysis:

Beginning

Withdrawals

Ending

Capital contributed

Current year

capital account

capital account

during the year

increase (decrease)

and distributions

(

)

$

$

$

$

$

Tax basis

GAAP

Section 704(b) book

Other (explain)

M Partner’s state of residence (if a full-year Wisconsin resident, items N, O, and P do not apply) . . . . . . . . .

%

N

Check if partner’s Wisconsin amount is determined by apportionment . Apportionment percentage . . . . . . . . . . . . . . . . . . . . . .

O

Check if partner’s Wisconsin amount is determined by separate accounting .

Check if the partner is a nonresident and filed Form PW-2 to opt out of pass-through entity withholding.

P

Q Check applicable boxes:

Final 3K-1

Amended 3K-1

Part III

Partner

s Share of Current Year Income, Deductions, Credits, and Other Items

’

(a)

(b)

(c)

(d)

(e)

Amount under

Wis . source amount

Distributive share items

Federal amount

Adjustment

Wis . law

(see instructions)

1 Ordinary business income (loss) . . . . . . . . . . . . . . . . . . .

2 Net rental real estate income (loss) . . . . . . . . . . . . . . . . .

3 Other net rental income (loss) . . . . . . . . . . . . . . . . . . . . .

4 Guaranteed payments . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Ordinary dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Net short-term capital gain (loss) . . . . . . . . . . . . . . . . . . .

9 Net long-term capital gain (loss) . . . . . . . . . . . . . . . . . . . .

10a Net section 1231 gain (loss) . . . . . . . . . . . . . . . . . . . . . . .

10b Portion of the amount on line 10a attributable to gains on

sales of farm assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11 Other income (loss) (list):

12 Section 179 deduction . . . . . . . . . . . . . . . . . . . . . . . . . . .

IP-032

1

1 2

2