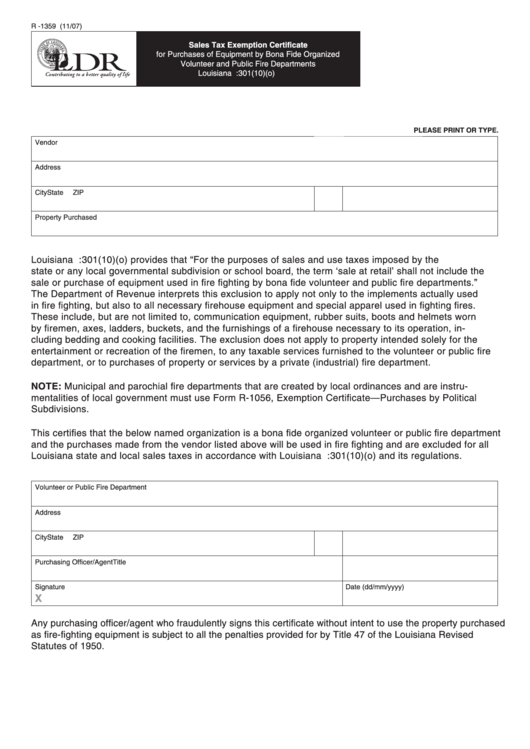

R -1359 (11/07)

Sales Tax Exemption Certificate

for Purchases of Equipment by Bona Fide Organized

Volunteer and Public Fire Departments

Louisiana R.S. 47:301(10)(o)

PLEASE PRINT OR TYPE.

Vendor

Address

City

State

ZIP

Property Purchased

Louisiana R.S. 47:301(10)(o) provides that “For the purposes of sales and use taxes imposed by the

state or any local governmental subdivision or school board, the term ‘sale at retail’ shall not include the

sale or purchase of equipment used in fire fighting by bona fide volunteer and public fire departments.”

The Department of Revenue interprets this exclusion to apply not only to the implements actually used

in fire fighting, but also to all necessary firehouse equipment and special apparel used in fighting fires.

These include, but are not limited to, communication equipment, rubber suits, boots and helmets worn

by firemen, axes, ladders, buckets, and the furnishings of a firehouse necessary to its operation, in-

cluding bedding and cooking facilities. The exclusion does not apply to property intended solely for the

entertainment or recreation of the firemen, to any taxable services furnished to the volunteer or public fire

department, or to purchases of property or services by a private (industrial) fire department.

NOTE: Municipal and parochial fire departments that are created by local ordinances and are instru-

mentalities of local government must use Form R-1056, Exemption Certificate—Purchases by Political

Subdivisions.

This certifies that the below named organization is a bona fide organized volunteer or public fire department

and the purchases made from the vendor listed above will be used in fire fighting and are excluded for all

Louisiana state and local sales taxes in accordance with Louisiana R.S. 47:301(10)(o) and its regulations.

Volunteer or Public Fire Department

Address

City

State

ZIP

Purchasing Officer/Agent

Title

Signature

Date (dd/mm/yyyy)

X

Any purchasing officer/agent who fraudulently signs this certificate without intent to use the property purchased

as fire-fighting equipment is subject to all the penalties provided for by Title 47 of the Louisiana Revised

Statutes of 1950.

1

1