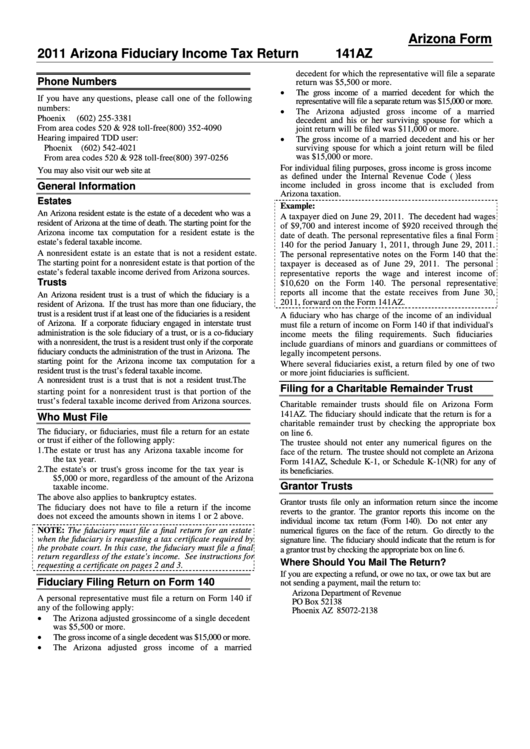

Arizona Form 141az - Arizona Fiduciary Income Tax Return - 2011

ADVERTISEMENT

Arizona Form

2011 Arizona Fiduciary Income Tax Return

141AZ

decedent for which the representative will file a separate

Phone Numbers

return was $5,500 or more.

•

The gross income of a married decedent for which the

If you have any questions, please call one of the following

representative will file a separate return was $15,000 or more.

numbers:

•

The Arizona adjusted gross income of a married

Phoenix

(602) 255-3381

decedent and his or her surviving spouse for which a

From area codes 520 & 928 toll-free

(800) 352-4090

joint return will be filed was $11,000 or more.

•

Hearing impaired TDD user:

The gross income of a married decedent and his or her

Phoenix

(602) 542-4021

surviving spouse for which a joint return will be filed

was $15,000 or more.

From area codes 520 & 928 toll-free

(800) 397-0256

For individual filing purposes, gross income is gross income

You may also visit our web site at

as defined under the Internal Revenue Code (I.R.C.) less

General Information

income included in gross income that is excluded from

Arizona taxation.

Estates

Example:

An Arizona resident estate is the estate of a decedent who was a

A taxpayer died on June 29, 2011. The decedent had wages

resident of Arizona at the time of death. The starting point for the

of $9,700 and interest income of $920 received through the

Arizona income tax computation for a resident estate is the

date of death. The personal representative files a final Form

estate’s federal taxable income.

140 for the period January 1, 2011, through June 29, 2011.

A nonresident estate is an estate that is not a resident estate.

The personal representative notes on the Form 140 that the

The starting point for a nonresident estate is that portion of the

taxpayer is deceased as of June 29, 2011. The personal

estate’s federal taxable income derived from Arizona sources.

representative reports the wage and interest income of

Trusts

$10,620 on the Form 140. The personal representative

reports all income that the estate receives from June 30,

An Arizona resident trust is a trust of which the fiduciary is a

2011, forward on the Form 141AZ.

resident of Arizona. If the trust has more than one fiduciary, the

trust is a resident trust if at least one of the fiduciaries is a resident

A fiduciary who has charge of the income of an individual

of Arizona. If a corporate fiduciary engaged in interstate trust

must file a return of income on Form 140 if that individual's

administration is the sole fiduciary of a trust, or is a co-fiduciary

income meets the filing requirements. Such fiduciaries

with a nonresident, the trust is a resident trust only if the corporate

include guardians of minors and guardians or committees of

fiduciary conducts the administration of the trust in Arizona. The

legally incompetent persons.

starting point for the Arizona income tax computation for a

Where several fiduciaries exist, a return filed by one of two

resident trust is the trust’s federal taxable income.

or more joint fiduciaries is sufficient.

A nonresident trust is a trust that is not a resident trust. The

Filing for a Charitable Remainder Trust

starting point for a nonresident trust is that portion of the

trust’s federal taxable income derived from Arizona sources.

Charitable remainder trusts should file on Arizona Form

141AZ. The fiduciary should indicate that the return is for a

Who Must File

charitable remainder trust by checking the appropriate box

The fiduciary, or fiduciaries, must file a return for an estate

on line 6.

or trust if either of the following apply:

The trustee should not enter any numerical figures on the

1.

The estate or trust has any Arizona taxable income for

face of the return. The trustee should not complete an Arizona

the tax year.

Form 141AZ, Schedule K-1, or Schedule K-1(NR) for any of

2.

The estate's or trust's gross income for the tax year is

its beneficiaries.

$5,000 or more, regardless of the amount of the Arizona

Grantor Trusts

taxable income.

The above also applies to bankruptcy estates.

Grantor trusts file only an information return since the income

The fiduciary does not have to file a return if the income

reverts to the grantor. The grantor reports this income on the

does not exceed the amounts shown in items 1 or 2 above.

individual income tax return (Form 140). Do not enter any

NOTE: The fiduciary must file a final return for an estate

numerical figures on the face of the return. Go directly to the

when the fiduciary is requesting a tax certificate required by

signature line. The fiduciary should indicate that the return is for

the probate court. In this case, the fiduciary must file a final

a grantor trust by checking the appropriate box on line 6.

return regardless of the estate's income. See instructions for

Where Should You Mail The Return?

requesting a certificate on pages 2 and 3.

If you are expecting a refund, or owe no tax, or owe tax but are

Fiduciary Filing Return on Form 140

not sending a payment, mail the return to:

Arizona Department of Revenue

A personal representative must file a return on Form 140 if

PO Box 52138

any of the following apply:

Phoenix AZ 85072-2138

•

The Arizona adjusted gross income of a single decedent

was $5,500 or more.

•

The gross income of a single decedent was $15,000 or more.

•

The Arizona adjusted gross income of a married

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12