Arizona Form 141az Es - Estate Or Trust Estimated Income Tax Payment Instructions - 2011

ADVERTISEMENT

2011 Estate or Trust Estimated

Arizona Form

Income Tax Payment Instructions

141AZ ES

Method 3: You may file an Arizona Estimated Tax Payment

Phone Numbers

Form 141AZ ES with a single, lump-sum payment before

January 17, 2012. The payment should reflect your

If you have questions, please call one of the following numbers:

estimated end-of-tax-year liability.

Phoenix

(602) 255-3381

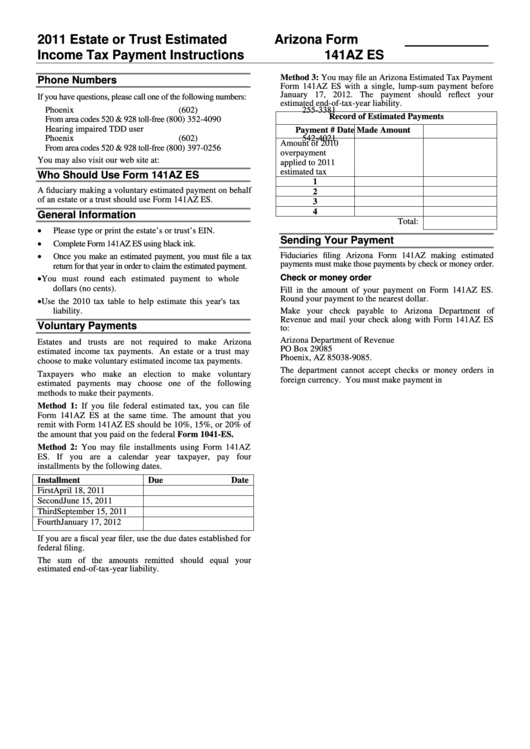

Record of Estimated Payments

From area codes 520 & 928 toll-free

(800) 352-4090

Hearing impaired TDD user

Payment #

Date Made

Amount

Phoenix

(602) 542-4021

Amount of 2010

From area codes 520 & 928 toll-free

(800) 397-0256

overpayment

You may also visit our web site at:

applied to 2011

estimated tax

Who Should Use Form 141AZ ES

1

A fiduciary making a voluntary estimated payment on behalf

2

of an estate or a trust should use Form 141AZ ES.

3

4

General Information

Total:

Please type or print the estate’s or trust’s EIN.

Sending Your Payment

Complete Form 141AZ ES using black ink.

Fiduciaries filing Arizona Form 141AZ making estimated

Once you make an estimated payment, you must file a tax

payments must make those payments by check or money order.

return for that year in order to claim the estimated payment.

Check or money order

You must round each estimated payment to whole

dollars (no cents).

Fill in the amount of your payment on Form 141AZ ES.

Round your payment to the nearest dollar.

Use the 2010 tax table to help estimate this year's tax

Make your check payable to Arizona Department of

liability.

Revenue and mail your check along with Form 141AZ ES

Voluntary Payments

to:

Arizona Department of Revenue

Estates and trusts are not required to make Arizona

PO Box 29085

estimated income tax payments. An estate or a trust may

Phoenix, AZ 85038-9085.

choose to make voluntary estimated income tax payments.

The department cannot accept checks or money orders in

Taxpayers who make an election to make voluntary

foreign currency. You must make payment in U.S. dollars.

estimated payments may choose one of the following

methods to make their payments.

Method 1: If you file federal estimated tax, you can file

Form 141AZ ES at the same time. The amount that you

remit with Form 141AZ ES should be 10%, 15%, or 20% of

the amount that you paid on the federal Form 1041-ES.

Method 2: You may file installments using Form 141AZ

ES. If you are a calendar year taxpayer, pay four

installments by the following dates.

Installment

Due Date

First

April 18, 2011

Second

June 15, 2011

Third

September 15, 2011

Fourth

January 17, 2012

If you are a fiscal year filer, use the due dates established for

federal filing.

The sum of the amounts remitted should equal your

estimated end-of-tax-year liability.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1