Form Bi-472 Instructions - S Corporation Schedule

ADVERTISEMENT

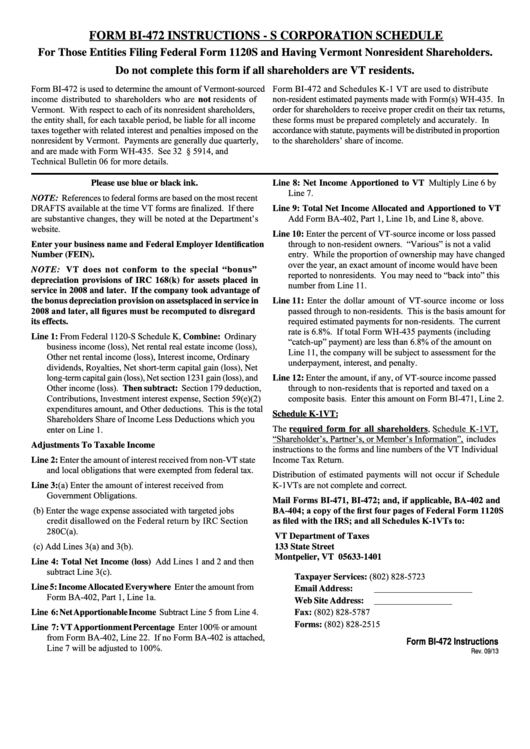

FORM BI-472 INSTRUCTIONS - S CORPORATION SCHEDULE

For Those Entities Filing Federal Form 1120S and Having Vermont Nonresident Shareholders.

Do not complete this form if all shareholders are VT residents.

Form BI-472 is used to determine the amount of Vermont-sourced

Form BI-472 and Schedules K-1 VT are used to distribute

non-resident estimated payments made with Form(s) WH-435. In

income distributed to shareholders who are not residents of

Vermont. With respect to each of its nonresident shareholders,

order for shareholders to receive proper credit on their tax returns,

the entity shall, for each taxable period, be liable for all income

these forms must be prepared completely and accurately. In

taxes together with related interest and penalties imposed on the

accordance with statute, payments will be distributed in proportion

nonresident by Vermont. Payments are generally due quarterly,

to the shareholders’ share of income.

and are made with Form WH-435. See 32 V.S.A. § 5914, and

Technical Bulletin 06 for more details.

Line 8: Net Income Apportioned to VT Multiply Line 6 by

Please use blue or black ink.

Line 7.

NOTE: References to federal forms are based on the most recent

DRAFTS available at the time VT forms are finalized. If there

Line 9: Total Net Income Allocated and Apportioned to VT

Add Form BA-402, Part 1, Line 1b, and Line 8, above.

are substantive changes, they will be noted at the Department’s

website.

Line 10: Enter the percent of VT-source income or loss passed

Enter your business name and Federal Employer Identification

through to non-resident owners. “Various” is not a valid

entry. While the proportion of ownership may have changed

Number (FEIN).

over the year, an exact amount of income would have been

NOTE: VT does not conform to the special “bonus”

reported to nonresidents. You may need to “back into” this

depreciation provisions of IRC 168(k) for assets placed in

number from Line 11.

service in 2008 and later. If the company took advantage of

the bonus depreciation provision on assetsplaced in service in

Line 11: Enter the dollar amount of VT-source income or loss

2008 and later, all figures must be recomputed to disregard

passed through to non-residents. This is the basis amount for

required estimated payments for non-residents. The current

its effects.

rate is 6.8%. If total Form WH-435 payments (including

Line 1: From Federal 1120-S Schedule K, Combine: Ordinary

“catch-up” payment) are less than 6.8% of the amount on

business income (loss), Net rental real estate income (loss),

Line 11, the company will be subject to assessment for the

Other net rental income (loss), Interest income, Ordinary

underpayment, interest, and penalty.

dividends, Royalties, Net short-term capital gain (loss), Net

long-term capital gain (loss), Net section 1231 gain (loss), and

Line 12: Enter the amount, if any, of VT-source income passed

Other income (loss). Then subtract: Section 179 deduction,

through to non-residents that is reported and taxed on a

Contributions, Investment interest expense, Section 59(e)(2)

composite basis. Enter this amount on Form BI-471, Line 2.

expenditures amount, and Other deductions. This is the total

Schedule K-1VT:

Shareholders Share of Income Less Deductions which you

enter on Line 1.

The required form for all shareholders, Schedule K-1VT,

“Shareholder’s, Partner’s, or Member’s Information”, includes

Adjustments To Taxable Income

instructions to the forms and line numbers of the VT Individual

Income Tax Return.

Line 2: Enter the amount of interest received from non-VT state

and local obligations that were exempted from federal tax.

Distribution of estimated payments will not occur if Schedule

Line 3: (a) Enter the amount of interest received from U.S.

K-1VTs are not complete and correct.

Government Obligations.

Mail Forms BI-471, BI-472; and, if applicable, BA-402 and

(b) Enter the wage expense associated with targeted jobs

BA-404; a copy of the first four pages of Federal Form 1120S

credit disallowed on the Federal return by IRC Section

as filed with the IRS; and all Schedules K-1VTs to:

280C(a).

VT Department of Taxes

(c) Add Lines 3(a) and 3(b).

133 State Street

Montpelier, VT 05633-1401

Line 4: Total Net Income (loss) Add Lines 1 and 2 and then

subtract Line 3(c).

Taxpayer Services: (802) 828-5723

Line 5: Income Allocated Everywhere Enter the amount from

Email Address:

tax-corpincome@state.vt.us

Form BA-402, Part 1, Line 1a.

Web Site Address:

Line 6: Net Apportionable Income Subtract Line 5 from Line 4.

(802) 828-5787

Fax:

(802) 828-2515

Forms:

Line 7: VT Apportionment Percentage Enter 100% or amount

from Form BA-402, Line 22. If no Form BA-402 is attached,

Form BI-472 Instructions

Line 7 will be adjusted to 100%.

Rev. 09/13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1