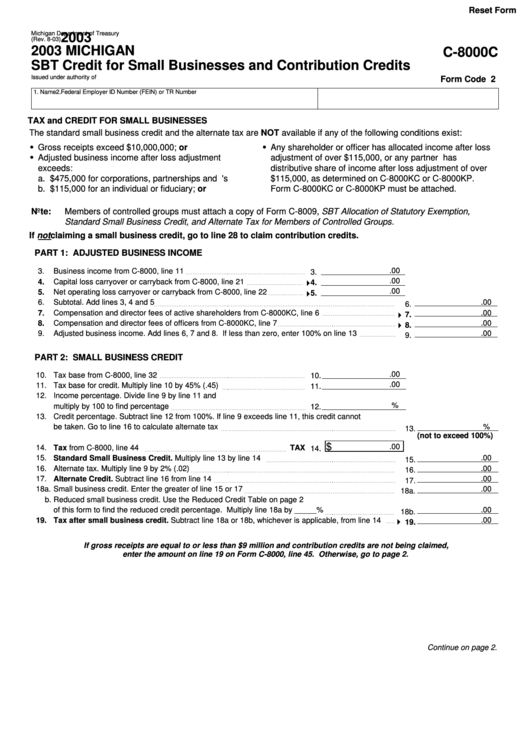

Reset Form

Michigan Department of Treasury

2003

(Rev. 8-03)

2003 MICHIGAN

C-8000C

SBT Credit for Small Businesses and Contribution Credits

Issued under authority of P.A. 228 of 1975. See instruction booklet for filing guidelines.

Form Code 2

1. Name

2. Federal Employer ID Number (FEIN) or TR Number

TAX and CREDIT FOR SMALL BUSINESSES

The standard small business credit and the alternate tax are NOT available if any of the following conditions exist:

Gross receipts exceed $10,000,000; or

Any shareholder or officer has allocated income after loss

=

=

Adjusted business income after loss adjustment

adjustment of over $115,000, or any partner has

=

exceeds:

distributive share of income after loss adjustment of over

a. $475,000 for corporations, partnerships and L.L.C.'s

$115,000, as determined on C-8000KC or C-8000KP.

b. $115,000 for an individual or fiduciary; or

Form C-8000KC or C-8000KP must be attached.

Note:

Members of controlled groups must attach a copy of Form C-8009, SBT Allocation of Statutory Exemption,

Standard Small Business Credit, and Alternate Tax for Members of Controlled Groups.

If not claiming a small business credit, go to line 28 to claim contribution credits.

PART 1: ADJUSTED BUSINESS INCOME

.00

3.

Business income from C-8000, line 11

3.

.00

4.

Capital loss carryover or carryback from C-8000, line 21

4

4.

.00

5.

Net operating loss carryover or carryback from C-8000, line 22

4

5.

6.

Subtotal. Add lines 3, 4 and 5

.00

6.

7.

Compensation and director fees of active shareholders from C-8000KC, line 6

.00

4

7.

8.

Compensation and director fees of officers from C-8000KC, line 7

.00

4

8.

9.

Adjusted business income. Add lines 6, 7 and 8. If less than zero, enter 100% on line 13

.00

9.

PART 2: SMALL BUSINESS CREDIT

.00

10.

Tax base from C-8000, line 32

10.

.00

11.

Tax base for credit. Multiply line 10 by 45% (.45)

11.

12.

Income percentage. Divide line 9 by line 11 and

%

multiply by 100 to find percentage

12.

13.

Credit percentage. Subtract line 12 from 100%. If line 9 exceeds line 11, this credit cannot

be taken. Go to line 16 to calculate alternate tax

%

13.

(not to exceed 100%)

$

.00

14.

Tax from C-8000, line 44

TAX

14.

15.

Standard Small Business Credit. Multiply line 13 by line 14

.00

15.

16.

Alternate tax. Multiply line 9 by 2% (.02)

.00

16.

17.

Alternate Credit. Subtract line 16 from line 14

.00

17.

18a.

Small business credit. Enter the greater of line 15 or 17

.00

18a.

b.

Reduced small business credit. Use the Reduced Credit Table on page 2

of this form to find the reduced credit percentage. Multiply line 18a by _____%

.00

18b.

19.

Tax after small business credit. Subtract line 18a or 18b, whichever is applicable, from line 14

4

.00

19.

If gross receipts are equal to or less than $9 million and contribution credits are not being claimed,

enter the amount on line 19 on Form C-8000, line 45. Otherwise, go to page 2.

Continue on page 2.

1

1 2

2