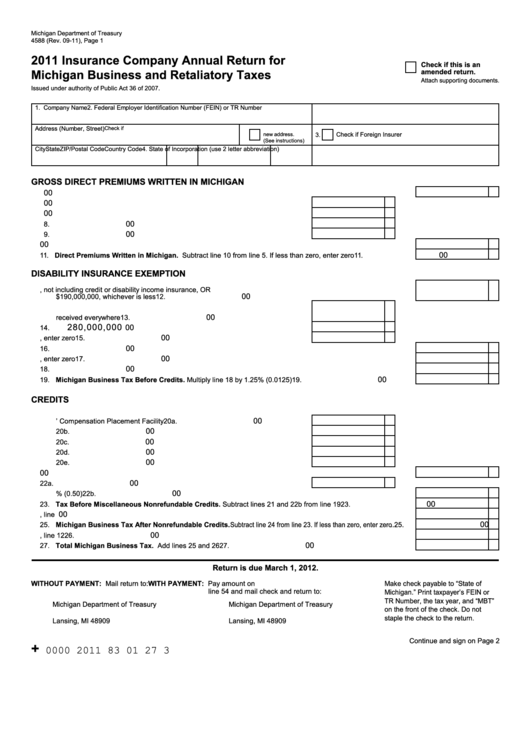

Form 4588 - Insurance Company Annual Return For Michigan Business And Retaliatory Taxes - 2011

ADVERTISEMENT

Michigan Department of Treasury

4588 (Rev. 09-11), Page 1

2011 Insurance Company Annual Return for

Check if this is an

Michigan Business and Retaliatory Taxes

amended return.

Attach supporting documents.

Issued under authority of Public Act 36 of 2007.

1. Company Name

2. Federal Employer Identification Number (FEIN) or TR Number

Address (Number, Street)

Check if

Check if Foreign Insurer

new address.

3.

(See instructions)

City

State

ZIP/Postal Code

Country Code 4. State of Incorporation (use 2 letter abbreviation)

GROSS DIRECT PREMIUMS WRITTEN IN MICHIGAN

00

5. Gross direct premiums written in Michigan.............................................................................................................

5.

00

6. Premiums on policies not taken.......................................................................

6.

00

7. Returned premiums on canceled policies........................................................

7.

00

8. Receipts on sales of annuities .........................................................................

8.

00

9. Receipts on reinsurance assumed ..................................................................

9.

00

10. Add lines 6 through 9..............................................................................................................................................

10.

00

11. Direct Premiums Written in Michigan. Subtract line 10 from line 5. If less than zero, enter zero .....................

11.

DISABILITY INSURANCE EXEMPTION

12. Disability insurance premiums written in Michigan, not including credit or disability income insurance, OR

00

$190,000,000, whichever is less ..........................................................................................................................

12.

13. Gross direct premiums from all lines of insurance carrier services

00

received everywhere ....................................................................................

13.

280,000,000

00

14. Phase out ......................................................................................................

14.

00

15. Subtract line 14 from line 13. If less than zero, enter zero ...........................

15.

00

16. Exemption reduction. Multiply line 15 by 2 .............................................................................................................

16.

00

17. Subtract line 16 from line 12. If less than zero, enter zero .....................................................................................

17.

00

18. Adjusted Tax Base. Subtract line 17 from line 11 ...................................................................................................

18.

00

19. Michigan Business Tax Before Credits. Multiply line 18 by 1.25% (0.0125) ......................................................

19.

CREDITS

20. Enter amounts paid from 1/1/2010 to 12/31/2010 to each of the following

00

a. Michigan Workers’ Compensation Placement Facility ..............................

20a.

00

b. Michigan Basic Property Insurance Association .......................................

20b.

00

c. Michigan Automobile Insurance Placement Facility .................................

20c.

00

d. Property and Casualty Guaranty Association ...........................................

20d.

00

e. Michigan Life and Health Insurance Guaranty Association ......................

20e.

00

21. Add lines 20a through 20e......................................................................................................................................

21.

00

22. a. Michigan Examination Fees .....................................................................

22a.

00

b. Credit. Multiply line 22a by 50% (0.50) .............................................................................................................. 22b.

00

23. Tax Before Miscellaneous Nonrefundable Credits. Subtract lines 21 and 22b from line 19 .............................

23.

00

24. Miscellaneous Nonrefundable Credits from Form 4596, line 30.............................................................................

24.

00

25. Michigan Business Tax After Nonrefundable Credits. Subtract line 24 from line 23. If less than zero, enter zero ..

25.

00

26. Recapture of Certain Business Tax Credits and Deductions from Form 4587, line 12 ...........................................

26.

00

27. Total Michigan Business Tax. Add lines 25 and 26 ............................................................................................

27.

Return is due March 1, 2012.

WITHOUT PAYMENT: Mail return to:

WITH PAYMENT: Pay amount on

Make check payable to “State of

line 54 and mail check and return to:

Michigan.” Print taxpayer’s FEIN or

TR Number, the tax year, and “MBT”

Michigan Department of Treasury

Michigan Department of Treasury

on the front of the check. Do not

P.O. Box 30783

P.O. Box 30113

staple the check to the return.

Lansing, MI 48909

Lansing, MI 48909

Continue and sign on Page 2

+

0000 2011 83 01 27 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2