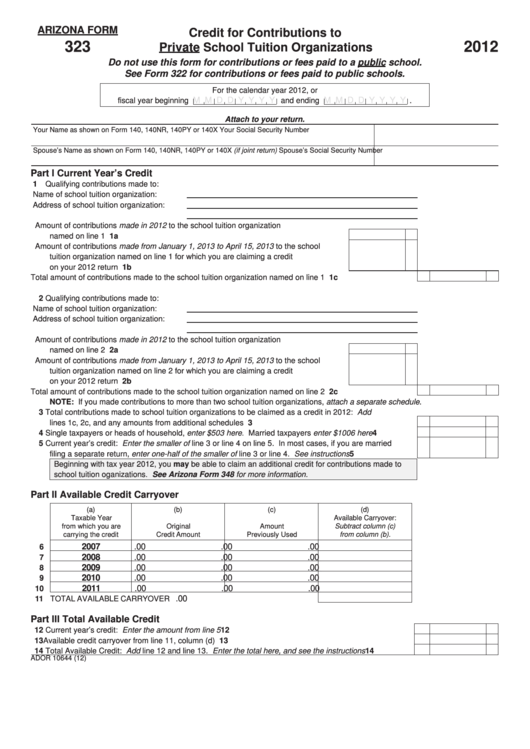

ARIZONA FORM

Credit for Contributions to

323

2012

Private School Tuition Organizations

Do not use this form for contributions or fees paid to a public school.

See Form 322 for contributions or fees paid to public schools.

For the calendar year 2012, or

M M D D Y Y Y Y

M M D D Y Y Y Y

fiscal year beginning

and ending

.

Attach to your return.

Your Name as shown on Form 140, 140NR, 140PY or 140X

Your Social Security Number

Spouse’s Name as shown on Form 140, 140NR, 140PY or 140X (if joint return)

Spouse’s Social Security Number

Part I

Current Year’s Credit

1 Qualifying contributions made to:

Name of school tuition organization:

Address of school tuition organization:

Amount of contributions made in 2012 to the school tuition organization

named on line 1 .......................................................................................................... 1a

Amount of contributions made from January 1, 2013 to April 15, 2013 to the school

tuition organization named on line 1 for which you are claiming a credit

on your 2012 return .................................................................................................... 1b

Total amount of contributions made to the school tuition organization named on line 1 ...............................

1c

2 Qualifying contributions made to:

Name of school tuition organization:

Address of school tuition organization:

Amount of contributions made in 2012 to the school tuition organization

named on line 2 .......................................................................................................... 2a

Amount of contributions made from January 1, 2013 to April 15, 2013 to the school

tuition organization named on line 2 for which you are claiming a credit

on your 2012 return .................................................................................................... 2b

Total amount of contributions made to the school tuition organization named on line 2 ...............................

2c

NOTE: If you made contributions to more than two school tuition organizations, attach a separate schedule.

3 Total contributions made to school tuition organizations to be claimed as a credit in 2012: Add

lines 1c, 2c, and any amounts from additional schedules ............................................................................

3

4 Single taxpayers or heads of household, enter $503 here. Married taxpayers enter $1006 here ...............

4

5 Current year’s credit: Enter the smaller of line 3 or line 4 on line 5. In most cases, if you are married

filing a separate return, enter one-half of the smaller of line 3 or line 4. See instructions ...........................

5

Beginning with tax year 2012, you may be able to claim an additional credit for contributions made to

school tuition oganizations. See Arizona Form 348 for more information.

Part II

Available Credit Carryover

(a)

(b)

(c)

(d)

Taxable Year

Available Carryover:

from which you are

Original

Amount

Subtract column (c)

carrying the credit

Credit Amount

Previously Used

from column (b).

2007

.00

.00

.00

6

2008

.00

.00

.00

7

2009

.00

.00

.00

8

2010

.00

.00

.00

9

2011

.00

.00

.00

10

.00

11 TOTAL AVAILABLE CARRYOVER .................................................................

Part III Total Available Credit

12 Current year’s credit: Enter the amount from line 5 ..................................................................................... 12

13 Available credit carryover from line 11, column (d) ....................................................................................... 13

14 Total Available Credit: Add line 12 and line 13. Enter the total here, and see the instructions ................... 14

ADOR 10644 (12)

1

1