Form 4583 - Michigan Business Tax Simplified Return - 2011

ADVERTISEMENT

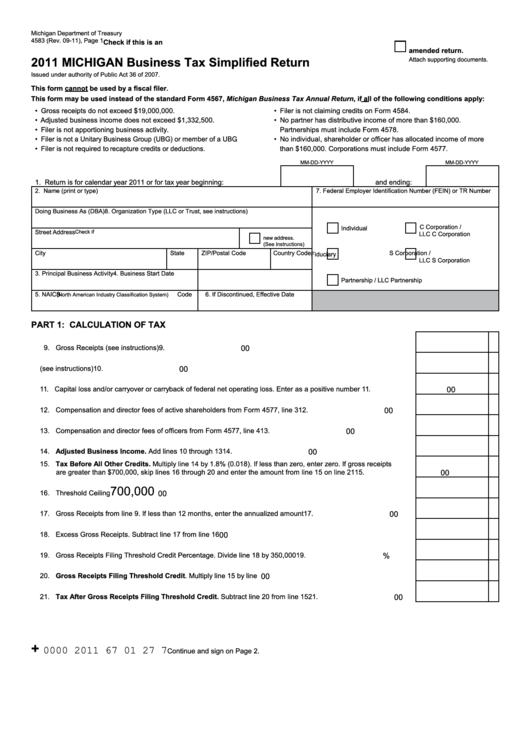

Michigan Department of Treasury

4583 (Rev. 09-11), Page 1

Check if this is an

amended return.

2011 MICHIGAN Business Tax Simplified Return

Attach supporting documents.

Issued under authority of Public Act 36 of 2007.

This form cannot be used by a fiscal filer.

This form may be used instead of the standard Form 4567, Michigan Business Tax Annual Return, if all of the following conditions apply:

• Gross receipts do not exceed $19,000,000.

• Filer is not claiming credits on Form 4584.

• Adjusted business income does not exceed $1,332,500.

• No partner has distributive income of more than $160,000.

• Filer is not apportioning business activity.

Partnerships must include Form 4578.

• Filer is not a Unitary Business Group (UBG) or member of a UBG.

• No individual, shareholder or officer has allocated income of more

• Filer is not required to recapture credits or deductions.

than $160,000. Corporations must include Form 4577.

MM-DD-YYYY

MM-DD-YYYY

1. Return is for calendar year 2011 or for tax year beginning:

and ending:

2. Name (print or type)

7. Federal Employer Identification Number (FEIN) or TR Number

Doing Business As (DBA)

8. Organization Type (LLC or Trust, see instructions)

C Corporation /

Individual

Street Address

Check if

LLC C Corporation

new address.

(See instructions)

City

State

ZIP/Postal Code

Country Code

S Corporation /

Fiduciary

LLC S Corporation

3. Principal Business Activity

4. Business Start Date

Partnership / LLC Partnership

5. NAICS

Code

6. If Discontinued, Effective Date

(North American Industry Classification System)

PART 1: CAlCulATIoN of TAx

9. Gross Receipts (see instructions)...........................................................................................................................

9.

00

10. Business Income (see instructions) ........................................................................................................................

10.

00

11. Capital loss and/or carryover or carryback of federal net operating loss. Enter as a positive number ..................

11.

00

12. Compensation and director fees of active shareholders from Form 4577, line 3 ...................................................

12.

00

13. Compensation and director fees of officers from Form 4577, line 4 .......................................................................

13.

00

14. Adjusted Business Income. Add lines 10 through 13 ..........................................................................................

14.

00

15. Tax Before All other Credits. Multiply line 14 by 1.8% (0.018). If less than zero, enter zero. If gross receipts

are greater than $700,000, skip lines 16 through 20 and enter the amount from line 15 on line 21 ......................

15.

00

700,000

16. Threshold Ceiling....................................................................................................................................................

16.

00

17. Gross Receipts from line 9. If less than 12 months, enter the annualized amount ................................................

17.

00

18. Excess Gross Receipts. Subtract line 17 from line 16............................................................................................

18.

00

19. Gross Receipts Filing Threshold Credit Percentage. Divide line 18 by 350,000 ....................................................

19.

%

20. Gross Receipts filing Threshold Credit. Multiply line 15 by line 19...................................................................

20.

00

21. Tax After Gross Receipts filing Threshold Credit. Subtract line 20 from line 15 ..............................................

21.

00

+

0000 2011 67 01 27 7

Continue and sign on Page 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2