GO DIRECTLY TO FORM

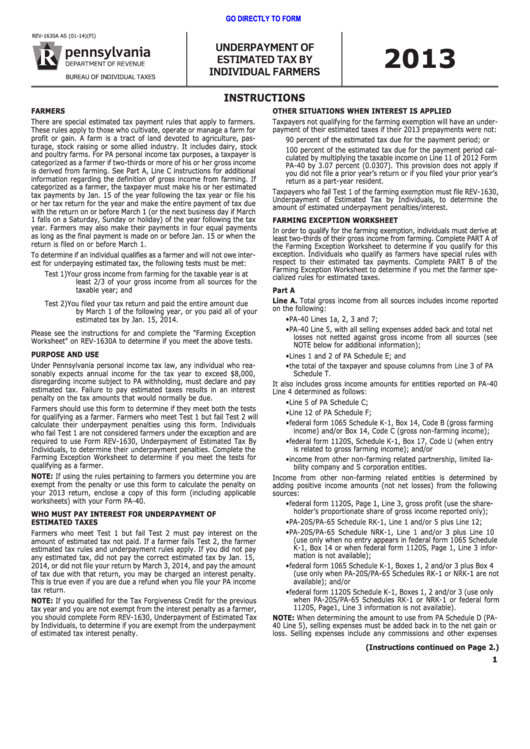

REV-1630A AS (01-14)(FI)

UNDERPAYMENT OF

2013

ESTIMATED TAX BY

INDIVIDUAL FARMERS

BUREAU OF INDIVIDUAL TAXES

INSTRUCTIONS

FARMERS

OTHER SITUATIONS WHEN INTEREST IS APPLIED

Taxpayers not qualifying for the farming exemption will have an under-

There are special estimated tax payment rules that apply to farmers.

payment of their estimated taxes if their 2013 prepayments were not:

These rules apply to those who cultivate, operate or manage a farm for

profit or gain. A farm is a tract of land devoted to agriculture, pas-

90 percent of the estimated tax due for the payment period; or

turage, stock raising or some allied industry. It includes dairy, stock

100 percent of the estimated tax due for the payment period cal-

and poultry farms. For PA personal income tax purposes, a taxpayer is

culated by multiplying the taxable income on Line 11 of 2012 Form

categorized as a farmer if two-thirds or more of his or her gross income

PA-40 by 3.07 percent (0.0307). This provision does not apply if

is derived from farming. See Part A, Line C instructions for additional

you did not file a prior year’s return or if you filed your prior year’s

information regarding the definition of gross income from farming. If

return as a part-year resident.

categorized as a farmer, the taxpayer must make his or her estimated

Taxpayers who fail Test 1 of the farming exemption must file REV-1630,

tax payments by Jan. 15 of the year following the tax year or file his

Underpayment of Estimated Tax by Individuals, to determine the

or her tax return for the year and make the entire payment of tax due

amount of estimated underpayment penalties/interest.

with the return on or before March 1 (or the next business day if March

1 falls on a Saturday, Sunday or holiday) of the year following the tax

FARMING EXCEPTION WORKSHEET

year. Farmers may also make their payments in four equal payments

In order to qualify for the farming exemption, individuals must derive at

as long as the final payment is made on or before Jan. 15 or when the

least two-thirds of their gross income from farming. Complete PART A of

return is filed on or before March 1.

the Farming Exception Worksheet to determine if you qualify for this

exception. Individuals who qualify as farmers have special rules with

To determine if an individual qualifies as a farmer and will not owe inter-

respect to their estimated tax payments. Complete PART B of the

est for underpaying estimated tax, the following tests must be met:

Farming Exception Worksheet to determine if you met the farmer spe-

Test 1)

Your gross income from farming for the taxable year is at

cialized rules for estimated taxes.

least 2/3 of your gross income from all sources for the

taxable year; and

Part A

Line A. Total gross income from all sources includes income reported

Test 2)

You filed your tax return and paid the entire amount due

on the following:

by March 1 of the following year, or you paid all of your

• PA-40 Lines 1a, 2, 3 and 7;

estimated tax by Jan. 15, 2014.

• PA-40 Line 5, with all selling expenses added back and total net

Please see the instructions for and complete the "Farming Exception

losses not netted against gross income from all sources (see

Worksheet" on REV-1630A to determine if you meet the above tests.

NOTE below for additional information);

PURPOSE AND USE

• Lines 1 and 2 of PA Schedule E; and

Under Pennsylvania personal income tax law, any individual who rea-

• the total of the taxpayer and spouse columns from Line 3 of PA

sonably expects annual income for the tax year to exceed $8,000,

Schedule T.

disregarding income subject to PA withholding, must declare and pay

It also includes gross income amounts for entities reported on PA-40

estimated tax. Failure to pay estimated taxes results in an interest

Line 4 determined as follows:

penalty on the tax amounts that would normally be due.

• Line 5 of PA Schedule C;

Farmers should use this form to determine if they meet both the tests

• Line 12 of PA Schedule F;

for qualifying as a farmer. Farmers who meet Test 1 but fail Test 2 will

• federal form 1065 Schedule K-1, Box 14, Code B (gross farming

calculate their underpayment penalties using this form. Individuals

income) and/or Box 14, Code C (gross non-farming income);

who fail Test 1 are not considered farmers under the exception and are

required to use Form REV-1630, Underpayment of Estimated Tax By

• federal form 1120S, Schedule K-1, Box 17, Code U (when entry

is related to gross farming income); and/or

Individuals, to determine their underpayment penalties. Complete the

Farming Exception Worksheet to determine if you meet the tests for

• income from other non-farming related partnership, limited lia-

qualifying as a farmer.

bility company and S corporation entities.

NOTE: If using the rules pertaining to farmers you determine you are

Income from other non-farming related entities is determined by

exempt from the penalty or use this form to calculate the penalty on

adding positive income amounts (not net losses) from the following

your 2013 return, enclose a copy of this form (including applicable

sources:

worksheets) with your Form PA-40.

• federal form 1120S, Page 1, Line 3, gross profit (use the share-

holder’s proportionate share of gross income reported only);

WHO MUST PAY INTEREST FOR UNDERPAYMENT OF

• PA-20S/PA-65 Schedule RK-1, Line 1 and/or 5 plus Line 12;

ESTIMATED TAXES

• PA-20S/PA-65 Schedule NRK-1, Line 1 and/or 3 plus Line 10

Farmers who meet Test 1 but fail Test 2 must pay interest on the

(use only when no entry appears in federal form 1065 Schedule

amount of estimated tax not paid. If a farmer fails Test 2, the farmer

K-1, Box 14 or when federal form 1120S, Page 1, Line 3 infor-

estimated tax rules and underpayment rules apply. If you did not pay

mation is not available);

any estimated tax, did not pay the correct estimated tax by Jan. 15,

2014, or did not file your return by March 3, 2014, and pay the amount

• federal form 1065 Schedule K-1, Boxes 1, 2 and/or 3 plus Box 4

of tax due with that return, you may be charged an interest penalty.

(use only when PA-20S/PA-65 Schedules RK-1 or NRK-1 are not

available); and/or

This is true even if you are due a refund when you file your PA income

tax return.

• federal form 1120S Schedule K-1, Boxes 1, 2 and/or 3 (use only

when PA-20S/PA-65 Schedules RK-1 or NRK-1 or federal form

NOTE: If you qualified for the Tax Forgiveness Credit for the previous

1120S, Page1, Line 3 information is not available).

tax year and you are not exempt from the interest penalty as a farmer,

you should complete Form REV-1630, Underpayment of Estimated Tax

NOTE: When determining the amount to use from PA Schedule D (PA-

by Individuals, to determine if you are exempt from the underpayment

40 Line 5), selling expenses must be added back in to the net gain or

of estimated tax interest penalty.

loss. Selling expenses include any commissions and other expenses

(Instructions continued on Page 2.)

1

1

1 2

2 3

3 4

4