Form VA-6H Household Employer’s Annual Summary of Virginia Income Tax Withheld

Electronic Filing Mandate: All employers must file all returns and make

Questions: If you have any questions about this return, call (804) 367-

all payments electronically using eForms, Business iFile or ACH Credit.

8037, use Live Chat on the Department’s website or write the Virginia

Employers must also file Forms W-2 and 1099 electronically. See www.

Department of Taxation, PO Box 1115, Richmond, Virginia 23218-

tax.virginia.gov for information on these electronic filing options.

1115.

Worksheet: Complete this worksheet and transfer line entries to the

If you are unable to file and pay electronically, you may request a

corresponding line numbers on Form VA-6H below. Retain the worksheet

temporary waiver. A waiver form is available for download on the

for your records.

Department’s website. The request must provide your business name,

Virginia tax account number, contact person, phone number, mailing

Lines 1 - 4: Enter the total quarterly wages in Column B and the total

address, the reason for the request, and the date when you will be able

quarterly Virginia income tax withheld in Column C.

to file and pay electronically. Fax your request to (804) 367-3015.

Line 5: Enter the total of Virginia income tax withheld in Lines 1C

General: Certain employers of household service employees may elect to

through 4C.

file and pay the Virginia income tax withheld from their employees’ salaries

Line 6: Enter the amount of payments submitted during the period in

on an annual basis at the same time that they submit the employees’

Column C.

Forms W-2 for the year. The employment must consist exclusively of

domestic service in the private home of the employer.

Line 7: Enter the net amount due in Column C.

To register for this annual filing option, go to the Department’s website

Line 8: Enter the total number of Form W-2 statements (state copy) sent

at and use iReg or complete and file Form R-1H,

with this return in Column C.

which is also available on the Department’s website.

C. Virginia Tax

A. Quarter

B. Total Wages

All household employers are required to electronically file an annual Form

Withheld

VA-6H, Household Employer’s Annual Summary of Virginia Income Tax

1. First Quarter

(January - March)

Withheld. In addition, all employers are required to electronically submit

2. Second Quarter

the equivalent of the state copy of the Forms W-2 and 1099 that were

(April - June)

provided to each employee.

3. Third Quarter

Filing Procedure: File Form VA-6H and Form W-2 by February 28 of

(July - September)

the year following the calendar year in which taxes were withheld from

4. Fourth Quarter

(October - December)

employees. File and pay electronically using eForms or iFile at

virginia.gov. A return must be filed even if no tax is due. If you file the

5. Total Virginia Income Tax Withheld Add Lines 1C through 4C

return and/or pay the tax after the due date, a penalty will be assessed.

The penalty is 6% of the tax due for each month or fraction of a month,

6. Payments (if any) Made During Period

not to exceed 30%. For late filing and payment, interest is assessed at

7. Net Amount Due - Line 5 minus Line 6. If you overpaid, fill in the

the rate established in § 6621 of the Internal Revenue Code, plus 2%.

refund box on Line 7C of Form VA-6H.

8. Total Number of Statements - Enter the total number of

If your bank does not honor any payment to the Department, the

Form W-2 statements associated with this return

Department may impose a penalty of $35 as authorized by Va. Code

§ 2.2-614.1. This penalty is in addition to other penalties such as the

Preparation of Return: Transfer the entries from the worksheet above

penalty for late payment of a tax.

to the corresponding line numbers on the Form VA-6H.

Change of Address/No Longer Employ Household Staff: If you

Declaration and Signature: Be sure to sign and date the return.

change your address or no longer employ household staff, use Business

Make checks payable to VA Department of Taxation. Mail return

iFile at .

and payment to Virginia Department of Taxation, PO Box 27264,

Richmond, Virginia 23261-7264.

File and pay online at . It’s fast, easy and secure. Plus it’s free!

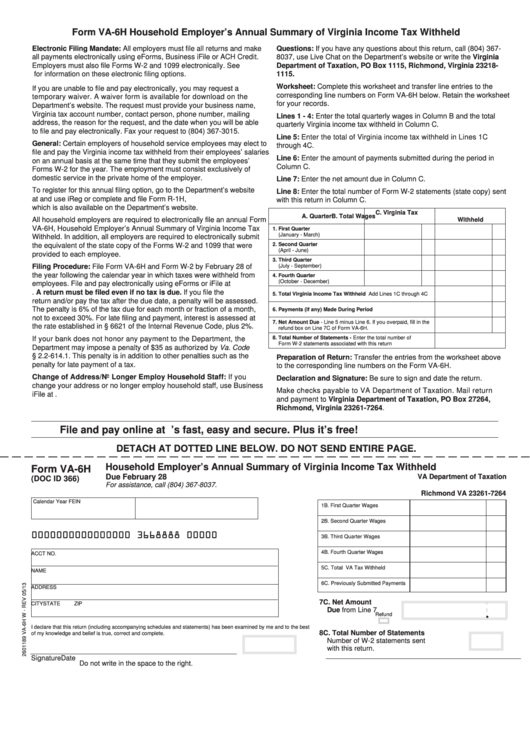

DETACH AT DOTTED LINE BELOW. DO NOT SEND ENTIRE PAGE.

Household Employer’s Annual Summary of Virginia Income Tax Withheld

Form VA-6H

Due February 28

VA Department of Taxation

(DOC ID 366)

For assistance, call (804) 367-8037.

P.O. Box 27264

Richmond VA 23261-7264

Calendar Year

FEIN

1B. First Quarter Wages

2B. Second Quarter Wages

0000000000000000 3668888 00000

3B. Third Quarter Wages

4B. Fourth Quarter Wages

ACCT NO.

5C. Total VA Tax Withheld

NAME

6C. Previously Submitted Payments

ADDRESS

7C. Net Amount

CITY

STATE

ZIP

Due from Line 7

.

Refund

I declare that this return (including accompanying schedules and statements) has been examined by me and to the best

8C. Total Number of Statements

of my knowledge and belief is true, correct and complete.

Number of W-2 statements sent

with this return.

Signature

Date

Do not write in the space to the right.

1

1