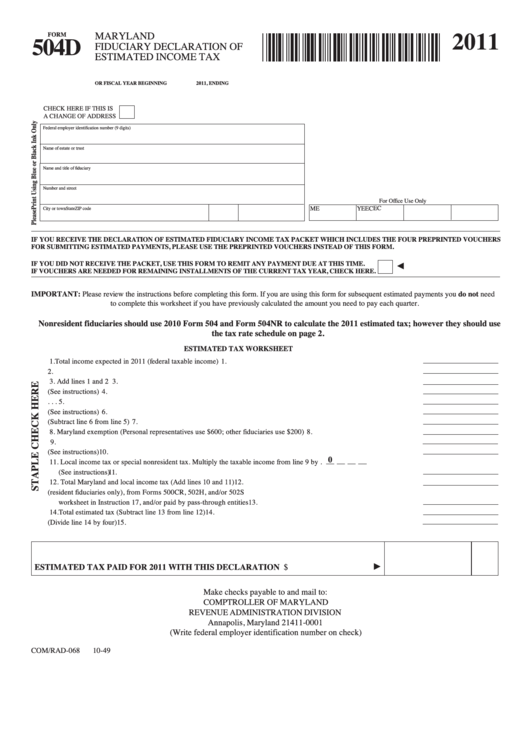

2011

504D

MARYLAND

FORM

FIDUCIARY DECLARATION OF

ESTIMATED INCOME TAX

11504D049

OR FISCAL YEAR BEGINNING

2011, ENDING

CHECK HERE IF THIS IS

A CHANGE OF ADDRESS

Federal employer identification number (9 digits)

Name of estate or trust

Name and title of fiduciary

Number and street

For Office Use Only

EC

ME

YE

EC

City or town

State

ZIP code

IF YOU RECEIVE THE DECLARATION OF ESTIMATED FIDUCIARY INCOME TAX PACKET WHICH INCLUDES THE FOUR PREPRINTED VOUCHERS

FOR SUBMITTING ESTIMATED PAYMENTS, PLEASE USE THE PREPRINTED VOUCHERS INSTEAD OF THIS FORM.

IF YOU DID NOT RECEIVE THE PACKET, USE THIS FORM TO REMIT ANY PAYMENT DUE AT THIS TIME.

IF VOUCHERS ARE NEEDED FOR REMAINING INSTALLMENTS OF THE CURRENT TAX YEAR, CHECK HERE.

IMPORTANT: Please review the instructions before completing this form. If you are using this form for subsequent estimated payments you do not need

to complete this worksheet if you have previously calculated the amount you need to pay each quarter.

Nonresident fiduciaries should use 2010 Form 504 and Form 504NR to calculate the 2011 estimated tax; however they should use

the tax rate schedule on page 2.

ESTIMATED TAX WORKSHEET

1. Total income expected in 2011 (federal taxable income) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

2. Federal exemption amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

3. Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

4. Net modifications (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

5. Line 3 above plus or minus line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

6. Nonresident beneficiary deduction (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

7. Balance (Subtract line 6 from line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

8. Maryland exemption (Personal representatives use $600; other fiduciaries use $200). . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

9. Maryland net taxable income of fiduciary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

10. Maryland income tax (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.

0

11. Local income tax or special nonresident tax. Multiply the taxable income from line 9 by .

(See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

12. Total Maryland and local income tax (Add lines 10 and 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

13. Credit for income tax paid to another state (resident fiduciaries only), from Forms 500CR, 502H, and/or 502S

worksheet in Instruction 17, and/or paid by pass-through entities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

14. Total estimated tax (Subtract line 13 from line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.

15. Amount to be submitted with each declaration (Divide line 14 by four) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.

ESTIMATED TAX PAID FOR 2011 WITH THIS DECLARATION . . . . . . . . . . . . . . . . . . . . .

$

Make checks payable to and mail to:

COMPTROLLER OF MARYLAND

REVENUE ADMINISTRATION DIVISION

Annapolis, Maryland 21411-0001

(Write federal employer identification number on check)

COM/RAD-068

10-49

1

1 2

2