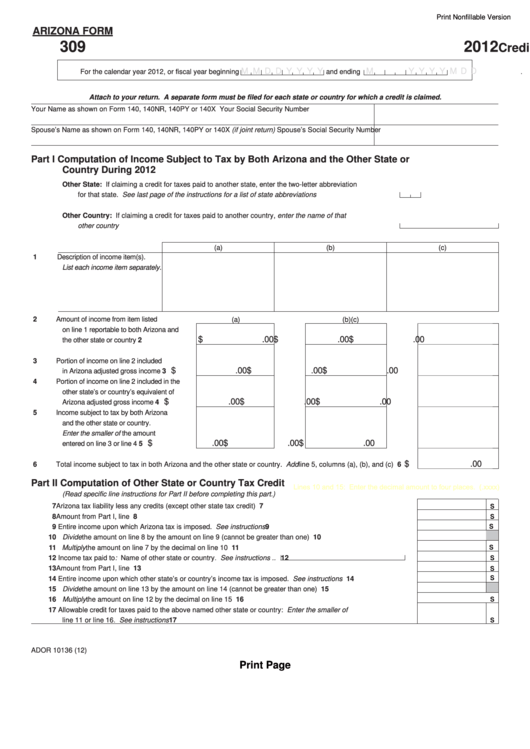

Print Nonfillable Version

ARIZONA FORM

309

2012

Credit for Taxes Paid to Another State or Country

M M D D Y Y Y Y

M

M D D

Y Y Y Y

For the calendar year 2012, or fiscal year beginning

and ending

.

Attach to your return. A separate form must be filed for each state or country for which a credit is claimed.

Your Name as shown on Form 140, 140NR, 140PY or 140X

Your Social Security Number

Spouse’s Name as shown on Form 140, 140NR, 140PY or 140X (if joint return)

Spouse’s Social Security Number

Part I Computation of Income Subject to Tax by Both Arizona and the Other State or

Country During 2012

Other State: If claiming a credit for taxes paid to another state, enter the two-letter abbreviation

for that state. See last page of the instructions for a list of state abbreviations .........................................

Other Country: If claiming a credit for taxes paid to another country, enter the name of that

other country ...............................................................................................................................................

(a)

(b)

(c)

1 Description of income item(s).

List each income item separately.

2 Amount of income from item listed

(a)

(b)

(c)

on line 1 reportable to both Arizona and

$

.00

$

.00

$

.00

the other state or country ...........................2

3 Portion of income on line 2 included

$

.00

$

.00

$

.00

in Arizona adjusted gross income ..............3

4 Portion of income on line 2 included in the

other state’s or country’s equivalent of

$

.00

$

.00

$

.00

Arizona adjusted gross income ..................4

5 Income subject to tax by both Arizona

and the other state or country.

Enter the smaller of the amount

$

.00

$

.00

$

.00

entered on line 3 or line 4 ..........................5

$

.00

6 Total income subject to tax in both Arizona and the other state or country. Add line 5, columns (a), (b), and (c) .... 6

Part II Computation of Other State or Country Tax Credit

Lines 10 and 15: Enter the decimal amount to four places. (.xxxx)

(Read specific line instructions for Part II before completing this part.)

s

7 Arizona tax liability less any credits (except other state tax credit) ..........................................................................

7

s

8 Amount from Part I, line 6.........................................................................................................................................

8

s

9 Entire income upon which Arizona tax is imposed. See instructions.......................................................................

9

10 Divide the amount on line 8 by the amount on line 9 (cannot be greater than one) ................................................. 10

s

11 Multiply the amount on line 7 by the decimal on line 10 ........................................................................................... 11

s

12 Income tax paid to: Name of other state or country. See instructions ..

12

s

13 Amount from Part I, line 6......................................................................................................................................... 13

s

14 Entire income upon which other state’s or country’s income tax is imposed. See instructions ............................... 14

15 Divide the amount on line 13 by the amount on line 14 (cannot be greater than one) ............................................. 15

s

16 Multiply the amount on line 12 by the decimal on line 15 ......................................................................................... 16

17 Allowable credit for taxes paid to the above named other state or country: Enter the smaller of

s

line 11 or line 16. See instructions ........................................................................................................................... 17

ADOR 10136 (12)

Print Page

1

1 2

2 3

3 4

4