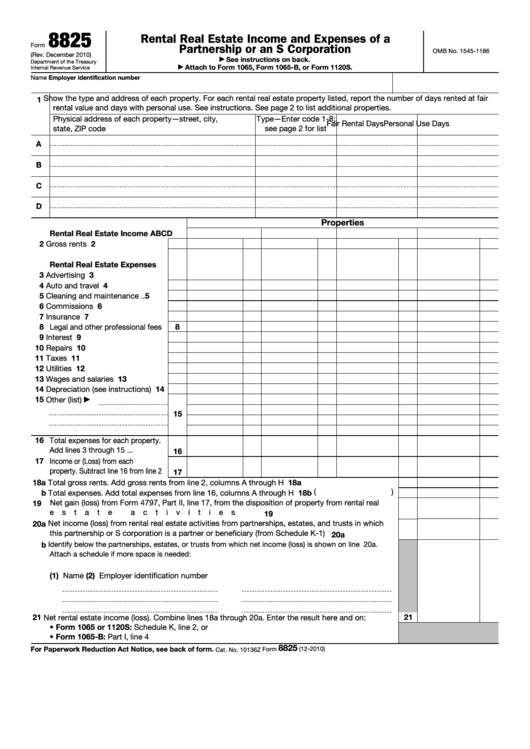

8825

Rental Real Estate Income and Expenses of a

Form

Partnership or an S Corporation

OMB No. 1545-1186

(Rev. December 2010)

See instructions on back.

▶

Department of the Treasury

Attach to Form 1065, Form 1065-B, or Form 1120S.

Internal Revenue Service

▶

Employer identification number

Name

Show the type and address of each property. For each rental real estate property listed, report the number of days rented at fair

1

rental value and days with personal use. See instructions. See page 2 to list additional properties.

Physical

address

of

each

property—street,

city,

Type—Enter code 1-8;

Fair Rental Days

Personal Use Days

state, ZIP code

see page 2 for list

A

B

C

D

Properties

Rental Real Estate Income

A

B

C

D

2 Gross rents .

.

.

.

.

.

.

2

Rental Real Estate Expenses

3 Advertising .

.

.

.

.

.

.

3

4 Auto and travel

4

.

.

.

.

.

5 Cleaning and maintenance .

5

.

6 Commissions .

.

.

.

.

.

6

7 Insurance

.

.

.

.

.

.

.

7

8 Legal and other professional fees

8

9 Interest .

.

.

.

.

.

.

.

9

10 Repairs .

.

.

.

.

.

.

.

10

11 Taxes

11

.

.

.

.

.

.

.

.

12 Utilities .

.

.

.

.

.

.

.

12

13 Wages and salaries .

.

.

.

13

14 Depreciation (see instructions)

14

15 Other (list)

▶

15

16 Total expenses for each property.

Add lines 3 through 15

.

.

.

16

17 Income

or

(Loss)

from

each

property. Subtract line 16 from line 2

17

18a Total gross rents. Add gross rents from line 2, columns A through H .

.

.

.

.

.

.

.

.

.

18a

18b (

)

b Total expenses. Add total expenses from line 16, columns A through H .

.

.

.

.

.

.

.

.

Net gain (loss) from Form 4797, Part II, line 17, from the disposition of property from rental real

19

estate activities

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

19

20a Net income (loss) from rental real estate activities from partnerships, estates, and trusts in which

this partnership or S corporation is a partner or beneficiary (from Schedule K-1) .

.

.

.

.

.

20a

b

Identify below the partnerships, estates, or trusts from which net income (loss) is shown on line 20a.

Attach a schedule if more space is needed:

(1) Name

(2) Employer identification number

21

21

Net rental estate income (loss). Combine lines 18a through 20a. Enter the result here and on:

• Form 1065 or 1120S: Schedule K, line 2, or

• Form 1065-B: Part I, line 4

8825

For Paperwork Reduction Act Notice, see back of form.

Form

(12-2010)

Cat. No. 10136Z

1

1 2

2 3

3