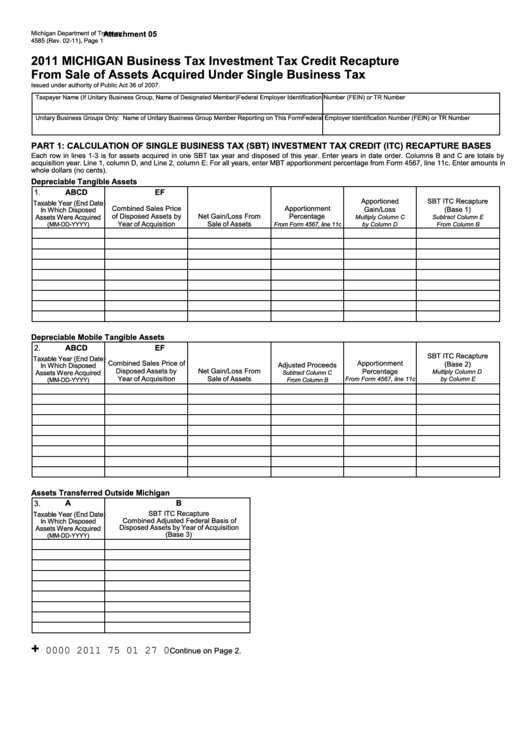

Form 4585 - Business Tax Investment Tax Credit Recapture From Sale Of Assets Acquired Under Single Business Tax - 2011

ADVERTISEMENT

Attachment 05

Michigan Department of Treasury

4585 (Rev. 02-11), Page 1

2011 MICHIGAN Business Tax Investment Tax Credit Recapture

From Sale of Assets Acquired Under Single Business Tax

Issued under authority of Public Act 36 of 2007.

Taxpayer Name (If Unitary Business Group, Name of Designated Member)

Federal Employer Identification Number (FEIN) or TR Number

Unitary Business Groups Only: Name of Unitary Business Group Member Reporting on This Form

Federal Employer Identification Number (FEIN) or TR Number

PART 1: CALCULATION OF SINGLE BUSINESS TAX (SBT) INVESTMENT TAX CREDIT (ITC) RECAPTURE BASES

Each row in lines 1-3 is for assets acquired in one SBT tax year and disposed of this year. Enter years in date order. Columns B and C are totals by

acquisition year. Line 1, column D, and Line 2, column E: For all years, enter MBT apportionment percentage from Form 4567, line 11c. Enter amounts in

whole dollars (no cents).

Depreciable Tangible Assets

1.

A

B

C

D

E

F

Apportioned

SBT ITC Recapture

Taxable Year (End Date)

Combined Sales Price

Apportionment

Gain/Loss

(Base 1)

In Which Disposed

of Disposed Assets by

Net Gain/Loss From

Percentage

Assets Were Acquired

Multiply Column C

Subtract Column E

Year of Acquisition

Sale of Assets

(MM-DD-YYYY)

From Form 4567, line 11c

by Column D

From Column B

Depreciable Mobile Tangible Assets

2.

A

B

C

D

E

F

SBT ITC Recapture

Taxable Year (End Date)

Combined Sales Price of

Apportionment

(Base 2)

Adjusted Proceeds

In Which Disposed

Disposed Assets by

Net Gain/Loss From

Percentage

Assets Were Acquired

Multiply Column D

Subtract Column C

Year of Acquisition

Sale of Assets

From Form 4567, line 11c

by Column E

(MM-DD-YYYY)

From Column B

Assets Transferred Outside Michigan

A

B

3.

SBT ITC Recapture

Taxable Year (End Date)

Combined Adjusted Federal Basis of

In Which Disposed

Disposed Assets by Year of Acquisition

Assets Were Acquired

(Base 3)

(MM-DD-YYYY)

+

0000 2011 75 01 27 0

Continue on Page 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6