Form Dtf-4.2 - Compromise Of Spousal Share Of Liability On Joint Tax Return Page 2

ADVERTISEMENT

Page 2 of 6 DTF-4.2 (2/08)

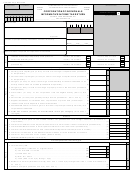

9

Enter the names and addresses of all banks or other financial institutions where you have done business during the past

three years.

Name and address

Name and address

10 Enter your most recent financial information in the columns below. Enter the fair market value of each asset you own directly

or indirectly. Also list your interests in partnerships, S corporations, LLCs, estates, trusts, and other property rights,

including contingent interests and remainders.

Assets

Fair market value

Cash

Cash surrender value of insurance

Real estate

Furniture and fixtures

Automobiles and trucks

Recreational vehicles

Stocks, bonds, and other securities

Jewelry

Business equipment

Individual retirement accounts, 401(k)s, etc.

Other assets

(list below)

Total assets

$

11 Enter the amount owed on the following applicable liabilities.

Liabilities

Amount

Mortgage(s)

Real estate taxes owed

Judgments

Federal income tax owed

Loans from relatives

Loans from others

Credit card debt

Other liabilities

(list below)

Total liabilities

$

12 Real estate

(attach copy of indenture, mortgage, and deed for each)

Fair market

Balance due

Overdue taxes,

Address(es) and description(s) of real property

Cost

value

on mortgage

penalties, interest

Totals

$

$

$

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6