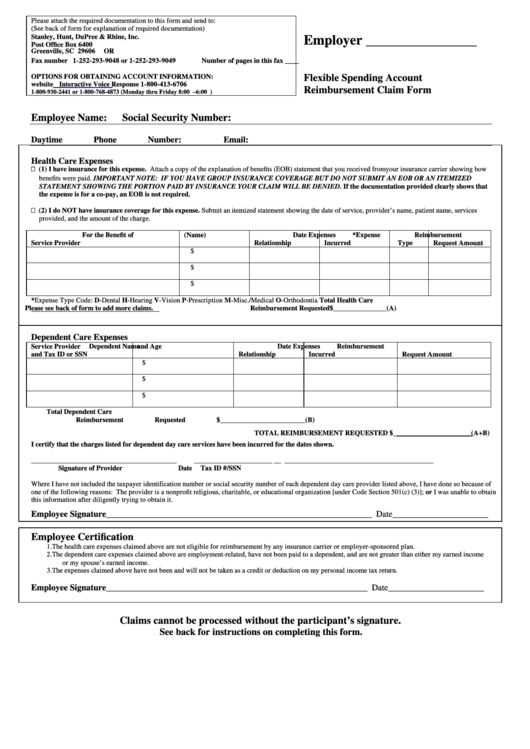

Flexible Spending Account Reimbursement Claim Form

ADVERTISEMENT

Please attach the required documentation to this form and send to:

(See back of form for explanation of required documentation)

Stanley, Hunt, DuPree & Rhine, Inc.

Employer ________________

Post Office Box 6400

Greenville, SC 29606

OR

Fax number 1-252-293-9048 or 1-252-293-9049

Number of pages in this fax _____

OPTIONS FOR OBTAINING ACCOUNT INFORMATION:

Flexible Spending Account

website

Interactive Voice Response 1-800-413-6706

Reimbursement Claim Form

1-800-930-2441 or 1-800-768-4873 (Monday thru Friday 8:00 a.m.–6:00 p.m. ET)

Employee Name:

Social Security Number:

Daytime Phone Number:

Email:

Health Care Expenses

(1) I have insurance for this expense. Attach a copy of the explanation of benefits (EOB) statement that you received from your insurance carrier showing how

benefits were paid. IMPORTANT NOTE: IF YOU HAVE GROUP INSURANCE COVERAGE BUT DO NOT SUBMIT AN EOB OR AN ITEMIZED

STATEMENT SHOWING THE PORTION PAID BY INSURANCE YOUR CLAIM WILL BE DENIED. If the documentation provided clearly shows that

the expense is for a co-pay, an EOB is not required.

(2) I do NOT have insurance coverage for this expense. Submit an itemized statement showing the date of service, provider’s name, patient name, services

provided, and the amount of the charge.

For the Benefit of

Date Expenses

*Expense

Reimbursement

Service Provider

(Name)

Relationship

Incurred

Type

Request Amount

$

$

$

*Expense Type Code: D-Dental H-Hearing V-Vision P-Prescription M-Misc./Medical O-Orthodontia

Total Health Care

Please see back of form to add more claims.

Reimbursement Requested $_______________(A)

Dependent Care Expenses

Service Provider

Dependent Name

Date Expenses

Reimbursement

and Tax ID or SSN

and Age

Relationship

Incurred

Request Amount

$

$

$

Total Dependent Care

Reimbursement Requested $________________________(B)

TOTAL REIMBURSEMENT REQUESTED $______________________(A+B)

I certify that the charges listed for dependent day care services have been incurred for the dates shown.

_________________________________________

______________________ __

__________________________________________

Signature of Provider

Date

Tax ID #/SSN

Where I have not included the taxpayer identification number or social security number of each dependent day care provider listed above, I have done so because of

one of the following reasons: The provider is a nonprofit religious, charitable, or educational organization [under Code Section 501(c) (3)]; or I was unable to obtain

this information after diligently trying to obtain it.

Employee Signature_____________________________________________________________ Date______________________

Employee Certification

1.

The health care expenses claimed above are not eligible for reimbursement by any insurance carrier or employer-sponsored plan.

2.

The dependent care expenses claimed above are employment-related, have not been paid to a dependent, and are not greater than either my earned income

or my spouse’s earned income.

3.

The expenses claimed above have not been and will not be taken as a credit or deduction on my personal income tax return.

Employee Signature____________________________________________________________ Date______________________

Claims cannot be processed without the participant’s signature.

See back for instructions on completing this form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2