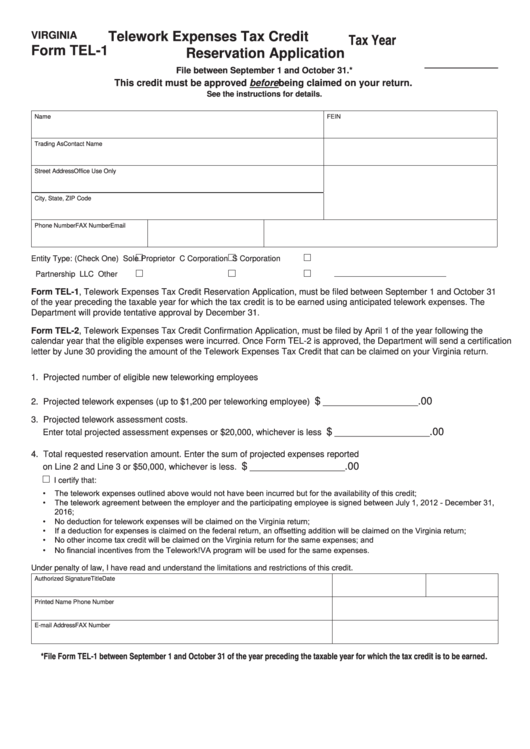

VIRGINIA

Telework Expenses Tax Credit

Tax Year

Form TEL-1

Reservation Application

___________

File between September 1 and October 31.*

This credit must be approved before being claimed on your return.

See the instructions for details.

Name

FEIN

Trading As

Contact Name

Street Address

Office Use Only

City, State, ZIP Code

Phone Number

FAX Number

Email

Entity Type: (Check One)

Sole Proprietor

C Corporation

S Corporation

Partnership

LLC

Other

Form TEL-1, Telework Expenses Tax Credit Reservation Application, must be filed between September 1 and October 31

of the year preceding the taxable year for which the tax credit is to be earned using anticipated telework expenses. The

Department will provide tentative approval by December 31.

Form TEL-2, Telework Expenses Tax Credit Confirmation Application, must be filed by April 1 of the year following the

calendar year that the eligible expenses were incurred. Once Form TEL-2 is approved, the Department will send a certification

letter by June 30 providing the amount of the Telework Expenses Tax Credit that can be claimed on your Virginia return.

1. Projected number of eligible new teleworking employees ............................................... ________________________

$

.00

2. Projected telework expenses (up to $1,200 per teleworking employee) .........................

____________________

3. Projected telework assessment costs.

$

.00

Enter total projected assessment expenses or $20,000, whichever is less ....................

____________________

4. Total requested reservation amount. Enter the sum of projected expenses reported

$

.00

on Line 2 and Line 3 or $50,000, whichever is less. ........................................................

____________________

I certify that:

• The telework expenses outlined above would not have been incurred but for the availability of this credit;

• The telework agreement between the employer and the participating employee is signed between July 1, 2012 - December 31,

2016;

• No deduction for telework expenses will be claimed on the Virginia return;

• If a deduction for expenses is claimed on the federal return, an offsetting addition will be claimed on the Virginia return;

• No other income tax credit will be claimed on the Virginia return for the same expenses; and

• No financial incentives from the Telework!VA program will be used for the same expenses.

Under penalty of law, I have read and understand the limitations and restrictions of this credit.

Authorized Signature

Title

Date

Printed Name

Phone Number

E-mail Address

FAX Number

*File Form TEL-1 between September 1 and October 31 of the year preceding the taxable year for which the tax credit is to be earned.

1

1 2

2 3

3