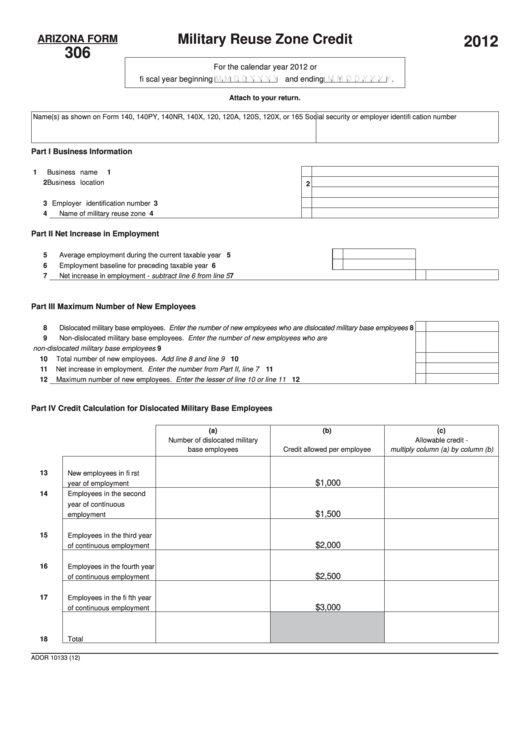

Military Reuse Zone Credit

ARIZONA FORM

2012

306

For the calendar year 2012 or

M M D D Y Y Y Y

M M D D Y Y Y Y

fi scal year beginning

and ending

.

Attach to your return.

Name(s) as shown on Form 140, 140PY, 140NR, 140X, 120, 120A, 120S, 120X, or 165

Social security or employer identifi cation number

Part I

Business Information

1 Business name .....................................................................................................

1

2 Business location ..................................................................................................

2

3 Employer identifi cation number ............................................................................

3

4 Name of military reuse zone .................................................................................

4

Part II

Net Increase in Employment

5 Average employment during the current taxable year ..........................................................

5

6 Employment baseline for preceding taxable year .................................................................

6

7 Net increase in employment - subtract line 6 from line 5 ..................................................................................................

7

Part III Maximum Number of New Employees

8 Dislocated military base employees. Enter the number of new employees who are dislocated military base employees ......

8

9 Non-dislocated military base employees. Enter the number of new employees who are

non-dislocated military base employees ...........................................................................................................................

9

10 Total number of new employees. Add line 8 and line 9 ................................................................................................... 10

11 Net increase in employment. Enter the number from Part II, line 7 ................................................................................. 11

12 Maximum number of new employees. Enter the lesser of line 10 or line 11 .................................................................... 12

Part IV Credit Calculation for Dislocated Military Base Employees

(a)

(b)

(c)

Number of dislocated military

Allowable credit -

base employees

Credit allowed per employee

multiply column (a) by column (b)

13

New employees in fi rst

$1,000

year of employment

14

Employees in the second

year of continuous

$1,500

employment

15

Employees in the third year

$2,000

of continuous employment

16

Employees in the fourth year

$2,500

of continuous employment

17

Employees in the fi fth year

$3,000

of continuous employment

18

Total

ADOR 10133 (12)

1

1 2

2 3

3 4

4 5

5 6

6 7

7