Form Cbt-150 - Statement Of Estimated Tax Vouchers For Corporations - 2012

ADVERTISEMENT

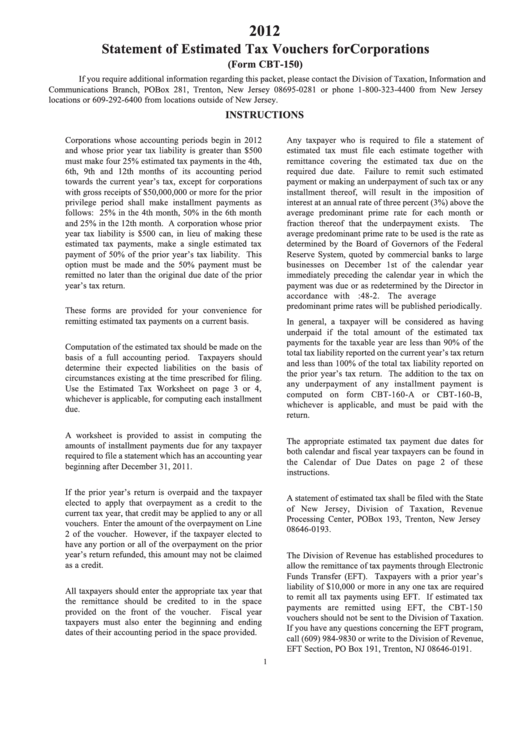

2012

Statement of Estimated Tax Vouchers for Corporations

(Form CBT-150)

If you require additional information regarding this packet, please contact the Division of Taxation, Information and

Communications Branch, PO Box 281, Trenton, New Jersey 08695-0281 or phone 1-800-323-4400 from New Jersey

locations or 609-292-6400 from locations outside of New Jersey.

INSTRUCTIONS

1. Who must file -

7. Underpayment of estimated tax -

Corporations whose accounting periods begin in 2012

Any taxpayer who is required to file a statement of

and whose prior year tax liability is greater than $500

estimated tax must file each estimate together with

must make four 25% estimated tax payments in the 4th,

remittance covering the estimated tax due on the

6th, 9th and 12th months of its accounting period

required due date.

Failure to remit such estimated

towards the current year’s tax, except for corporations

payment or making an underpayment of such tax or any

with gross receipts of $50,000,000 or more for the prior

installment thereof, will result in the imposition of

privilege period shall make installment payments as

interest at an annual rate of three percent (3%) above the

follows: 25% in the 4th month, 50% in the 6th month

average predominant prime rate for each month or

and 25% in the 12th month. A corporation whose prior

fraction thereof that the underpayment exists.

The

year tax liability is $500 can, in lieu of making these

average predominant prime rate to be used is the rate as

estimated tax payments, make a single estimated tax

determined by the Board of Governors of the Federal

payment of 50% of the prior year’s tax liability. This

Reserve System, quoted by commercial banks to large

option must be made and the 50% payment must be

businesses on December 1st of the calendar year

remitted no later than the original due date of the prior

immediately preceding the calendar year in which the

year’s tax return.

payment was due or as redetermined by the Director in

accordance with N.J.S.A. 54:48-2.

The average

2. Purpose -

predominant prime rates will be published periodically.

These forms are provided for your convenience for

remitting estimated tax payments on a current basis.

In general, a taxpayer will be considered as having

underpaid if the total amount of the estimated tax

3. How to determine your estimated tax -

payments for the taxable year are less than 90% of the

Computation of the estimated tax should be made on the

total tax liability reported on the current year’s tax return

basis of a full accounting period. Taxpayers should

and less than 100% of the total tax liability reported on

determine their expected liabilities on the basis of

the prior year’s tax return. The addition to the tax on

circumstances existing at the time prescribed for filing.

any underpayment of any installment payment is

Use the Estimated Tax Worksheet on page 3 or 4,

computed on form CBT-160-A or CBT-160-B,

whichever is applicable, for computing each installment

whichever is applicable, and must be paid with the

due.

return.

4. Estimated tax worksheet -

8. When to file -

A worksheet is provided to assist in computing the

The appropriate estimated tax payment due dates for

amounts of installment payments due for any taxpayer

both calendar and fiscal year taxpayers can be found in

required to file a statement which has an accounting year

the Calendar of Due Dates on page 2 of these

beginning after December 31, 2011.

instructions.

5. Overpayment credit from CBT-100 or CBT-100S -

9. Where to file -

If the prior year’s return is overpaid and the taxpayer

A statement of estimated tax shall be filed with the State

elected to apply that overpayment as a credit to the

of New Jersey, Division of Taxation, Revenue

current tax year, that credit may be applied to any or all

Processing Center, PO Box 193, Trenton, New Jersey

vouchers. Enter the amount of the overpayment on Line

08646-0193.

2 of the voucher. However, if the taxpayer elected to

have any portion or all of the overpayment on the prior

10. Electronic Funds Transfers -

year’s return refunded, this amount may not be claimed

The Division of Revenue has established procedures to

as a credit.

allow the remittance of tax payments through Electronic

Funds Transfer (EFT). Taxpayers with a prior year’s

6. Calendar year and fiscal year taxpayers -

liability of $10,000 or more in any one tax are required

All taxpayers should enter the appropriate tax year that

to remit all tax payments using EFT. If estimated tax

the remittance should be credited to in the space

payments are remitted using EFT, the CBT-150

provided on the front of the voucher.

Fiscal year

vouchers should not be sent to the Division of Taxation.

taxpayers must also enter the beginning and ending

If you have any questions concerning the EFT program,

dates of their accounting period in the space provided.

call (609) 984-9830 or write to the Division of Revenue,

EFT Section, PO Box 191, Trenton, NJ 08646-0191.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4