Electronic Payment Options For Quarter-Monthly (Weekly) Withholding Tax Filers

ADVERTISEMENT

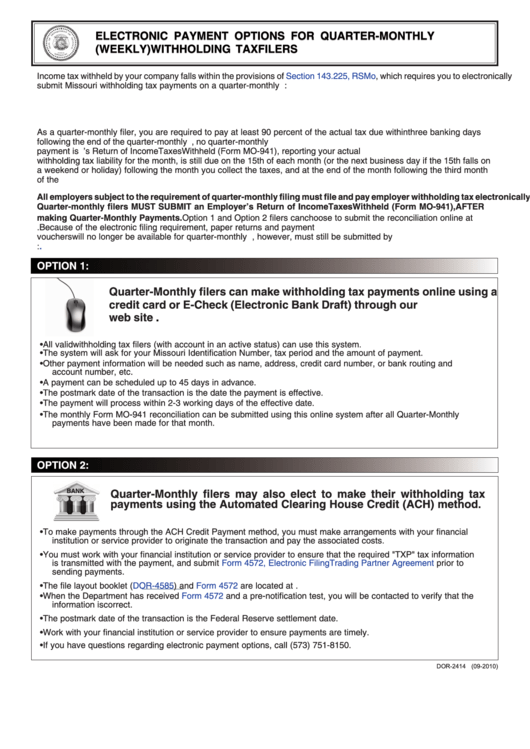

E L E C T RO N I C PAY M E N T O P T I O N S F O R Q UA RT E R - M O N T H LY

E L E C T RO N I C PAY M E N T O P T I O N S F O R Q UA RT E R - M O N T H LY

( W E E K LY ) W I T H H O L D I N G TA X F I L E R S

( W E E K LY ) W I T H H O L D I N G TA X F I L E R S

Income tax withheld by your company falls within the provisions of

Section 143.225,

RSMo, which requires you to electronically

submit Missouri withholding tax payments on a quarter-monthly basis. Quarter-Monthly periods are defined as:

1. The first seven days of the calendar month.

2. The 8th to the 15th day of the calendar month.

3. The 16th to the 22nd day of the calendar month.

4. The 23rd day to the end of the calendar month.

As a quarter-monthly filer, you are required to pay at least 90 percent of the actual tax due within three banking days

following the end of the quarter-monthly period. If there is not a payroll during a quarter-monthly period, no quarter-monthly

payment is necessary. Your monthly Employer’s Return of Income Taxes Withheld (Form MO-941), reporting your actual

withholding tax liability for the month, is still due on the 15th of each month (or the next business day if the 15th falls on

a weekend or holiday) following the month you collect the taxes, and at the end of the month following the third month

of the quarter. Any additional tax due must be paid on or before the due date of the monthly tax return.

All employers subject to the requirement of quarter-monthly filing must file and pay employer withholding tax electronically.

Quarter-monthly filers MUST SUBMIT an Employer’s Return of Income Taxes Withheld (Form MO-941), AFTER

making Quarter-Monthly Payments. Option 1 and Option 2 filers can choose to submit the reconciliation online at

https://dors.mo.gov/tax/whtxonline/LogIn.jsp. Because of the electronic filing requirement, paper returns and payment

vouchers will no longer be available for quarter-monthly filers. Amended returns, however, must still be submitted by

paper. Blank copies of amended returns are available at:

OPTION 1:

Quarter-Monthly filers can make withholding tax payments online using a

credit card or E-Check (Electronic Bank Draft) through our

web site

•

All valid withholding tax filers (with account in an active status) can use this system.

•

The system will ask for your Missouri Identification Number, tax period and the amount of payment.

•

Other payment information will be needed such as name, address, credit card number, or bank routing and

account number, etc.

•

A payment can be scheduled up to 45 days in advance.

•

The postmark date of the transaction is the date the payment is effective.

•

The payment will process within 2-3 working days of the effective date.

•

The monthly Form MO-941 reconciliation can be submitted using this online system after all Quarter-Monthly

payments have been made for that month.

OPTION 2:

BA N K

Quarter-Monthly filers may also elect to make their withholding tax

payments using the Automated Clearing House Credit (ACH) method.

•

To make payments through the ACH Credit Payment method, you must make arrangements with your financial

institution or service provider to originate the transaction and pay the associated costs.

•

You must work with your financial institution or service provider to ensure that the required "TXP" tax information

is transmitted with the payment, and submit

Form 4572, Electronic Filing Trading Partner Agreement

prior to

sending payments.

•

The file layout booklet (DOR-4585) and

Form 4572

are located at

•

When the Department has received

Form 4572

and a pre-notification test, you will be contacted to verify that the

information is correct.

•

The postmark date of the transaction is the Federal Reserve settlement date.

•

Work with your financial institution or service provider to ensure payments are timely.

•

If you have questions regarding electronic payment options, call (573) 751-8150.

DOR-2414 (09-2010)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2