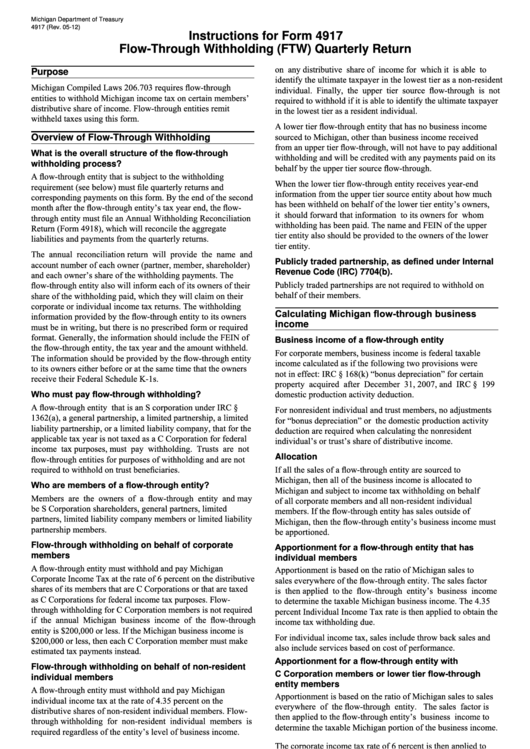

Instructions For Form 4917 - Flow-Through Withholding (Ftw) Quarterly Return

ADVERTISEMENT

Michigan Department of Treasury

4917 (Rev. 05-12)

Instructions for Form 4917

Flow-Through Withholding (FTW) Quarterly Return

on any distributive share of income for which it is able to

Purpose

identify the ultimate taxpayer in the lowest tier as a non-resident

Michigan Compiled Laws 206.703 requires flow-through

individual. Finally, the upper tier source flow-through is not

entities to withhold Michigan income tax on certain members’

required to withhold if it is able to identify the ultimate taxpayer

distributive share of income. Flow-through entities remit

in the lowest tier as a resident individual.

withheld taxes using this form.

A lower tier flow-through entity that has no business income

sourced to Michigan, other than business income received

Overview of Flow-Through Withholding

from an upper tier flow-through, will not have to pay additional

What is the overall structure of the flow-through

withholding and will be credited with any payments paid on its

withholding process?

behalf by the upper tier source flow-through.

A flow-through entity that is subject to the withholding

When the lower tier flow-through entity receives year-end

requirement (see below) must file quarterly returns and

information from the upper tier source entity about how much

corresponding payments on this form. By the end of the second

has been withheld on behalf of the lower tier entity’s owners,

month after the flow-through entity’s tax year end, the flow-

it should forward that information to its owners for whom

through entity must file an Annual Withholding Reconciliation

withholding has been paid. The name and FEIN of the upper

Return (Form 4918), which will reconcile the aggregate

tier entity also should be provided to the owners of the lower

liabilities and payments from the quarterly returns.

tier entity.

The annual reconciliation return will provide the name and

Publicly traded partnership, as defined under Internal

account number of each owner (partner, member, shareholder)

Revenue Code (IRC) 7704(b).

and each owner’s share of the withholding payments. The

Publicly traded partnerships are not required to withhold on

flow-through entity also will inform each of its owners of their

behalf of their members.

share of the withholding paid, which they will claim on their

corporate or individual income tax returns. The withholding

Calculating Michigan flow-through business

information provided by the flow-through entity to its owners

income

must be in writing, but there is no prescribed form or required

format. Generally, the information should include the FEIN of

Business income of a flow-through entity

the flow-through entity, the tax year and the amount withheld.

For corporate members, business income is federal taxable

The information should be provided by the flow-through entity

income calculated as if the following two provisions were

to its owners either before or at the same time that the owners

not in effect: IRC § 168(k) “bonus depreciation” for certain

receive their Federal Schedule K-1s.

property acquired after December 31, 2007, and IRC § 199

Who must pay flow-through withholding?

domestic production activity deduction.

A flow-through entity that is an S corporation under IRC §

For nonresident individual and trust members, no adjustments

1362(a), a general partnership, a limited partnership, a limited

for “bonus depreciation” or the domestic production activity

liability partnership, or a limited liability company, that for the

deduction are required when calculating the nonresident

applicable tax year is not taxed as a C Corporation for federal

individual’s or trust’s share of distributive income.

income tax purposes, must pay withholding. Trusts are not

flow-through entities for purposes of withholding and are not

Allocation

required to withhold on trust beneficiaries.

If all the sales of a flow-through entity are sourced to

Michigan, then all of the business income is allocated to

Who are members of a flow-through entity?

Michigan and subject to income tax withholding on behalf

Members are the owners of a flow-through entity and may

of all corporate members and all non-resident individual

be S Corporation shareholders, general partners, limited

members. If the flow-through entity has sales outside of

partners, limited liability company members or limited liability

Michigan, then the flow-through entity’s business income must

partnership members.

be apportioned.

Flow-through withholding on behalf of corporate

Apportionment for a flow-through entity that has

members

individual members

A flow-through entity must withhold and pay Michigan

Apportionment is based on the ratio of Michigan sales to

Corporate Income Tax at the rate of 6 percent on the distributive

sales everywhere of the flow-through entity. The sales factor

shares of its members that are C Corporations or that are taxed

is then applied to the flow-through entity’s business income

as C Corporations for federal income tax purposes. Flow-

to determine the taxable Michigan business income. The 4.35

through withholding for C Corporation members is not required

percent Individual Income Tax rate is then applied to obtain the

if the annual Michigan business income of the flow-through

income tax withholding due.

entity is $200,000 or less. If the Michigan business income is

For individual income tax, sales include throw back sales and

$200,000 or less, then each C Corporation member must make

also include services based on cost of performance.

estimated tax payments instead.

Apportionment for a flow-through entity with

Flow-through withholding on behalf of non-resident

C Corporation members or lower tier flow-through

individual members

entity members

A flow-through entity must withhold and pay Michigan

Apportionment is based on the ratio of Michigan sales to sales

individual income tax at the rate of 4.35 percent on the

everywhere of the flow-through entity. The sales factor is

distributive shares of non-resident individual members. Flow-

then applied to the flow-through entity’s business income to

through withholding for non-resident individual members is

determine the taxable Michigan portion of the business income.

required regardless of the entity’s level of business income.

The corporate income tax rate of 6 percent is then applied to

obtain the income tax withholding due unless the lowest tier

Flow-through withholding on behalf of other

flow-through entities (tiered structures)

member is known to be resident individual (no withholding) or

a non-resident individual (4.35 percent).

In general, if a flow-through entity (upper tier source flow-

through) has members that are other flow-through entities

Due Dates of Flow-Through Withholding

(lower tier members), then the upper tier source flow-through

Quarterly Return

must withhold on the distributive share of each lower tier

member at the corporate income tax rate of 6 percent. However,

Flow-though entities that are on a calendar year basis must

withhold and file quarterly by April 15, July 15, October 15,

the upper tier source flow-through may withhold at the

individual income tax rate of 4.35 percent, instead of 6 percent,

and January 15. Flow-through entities that are not on a calendar

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2