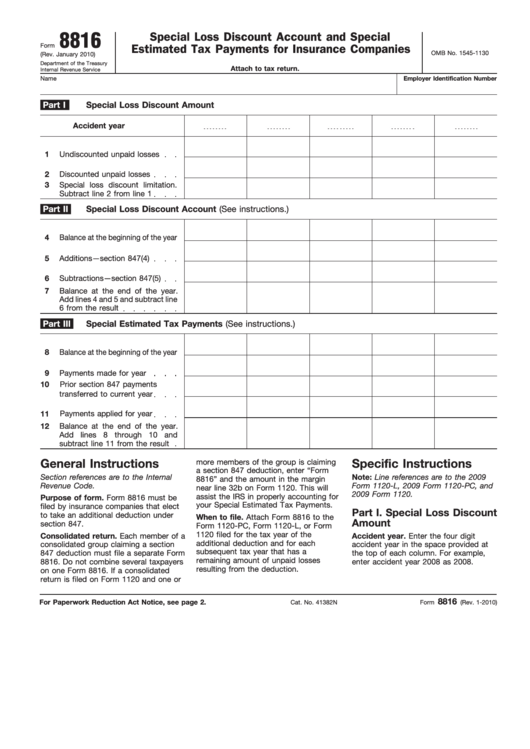

8816

Special Loss Discount Account and Special

Form

Estimated Tax Payments for Insurance Companies

OMB No. 1545-1130

(Rev. January 2010)

Department of the Treasury

Attach to tax return.

Internal Revenue Service

Name

Employer Identification Number

Part I

Special Loss Discount Amount

Accident year

1

Undiscounted unpaid losses

2

Discounted unpaid losses

3

Special loss discount limitation.

Subtract line 2 from line 1

Part II

Special Loss Discount Account (See instructions.)

4

Balance at the beginning of the year

5

Additions—section 847(4)

6

Subtractions—section 847(5)

7

Balance at the end of the year.

Add lines 4 and 5 and subtract line

6 from the result

Part III

Special Estimated Tax Payments (See instructions.)

8

Balance at the beginning of the year

9

Payments made for year

10

Prior section 847 payments

transferred to current year

11

Payments applied for year

12

Balance at the end of the year.

Add lines 8 through 10 and

subtract line 11 from the result

more members of the group is claiming

General Instructions

Specific Instructions

a section 847 deduction, enter “Form

Section references are to the Internal

Note: Line references are to the 2009

8816” and the amount in the margin

Revenue Code.

Form 1120-L, 2009 Form 1120-PC, and

near line 32b on Form 1120. This will

2009 Form 1120.

assist the IRS in properly accounting for

Purpose of form. Form 8816 must be

your Special Estimated Tax Payments.

filed by insurance companies that elect

Part I. Special Loss Discount

to take an additional deduction under

When to file. Attach Form 8816 to the

Amount

section 847.

Form 1120-PC, Form 1120-L, or Form

1120 filed for the tax year of the

Consolidated return. Each member of a

Accident year. Enter the four digit

additional deduction and for each

consolidated group claiming a section

accident year in the space provided at

subsequent tax year that has a

847 deduction must file a separate Form

the top of each column. For example,

remaining amount of unpaid losses

8816. Do not combine several taxpayers

enter accident year 2008 as 2008.

resulting from the deduction.

on one Form 8816. If a consolidated

return is filed on Form 1120 and one or

8816

For Paperwork Reduction Act Notice, see page 2.

Cat. No. 41382N

Form

(Rev. 1-2010)

1

1 2

2