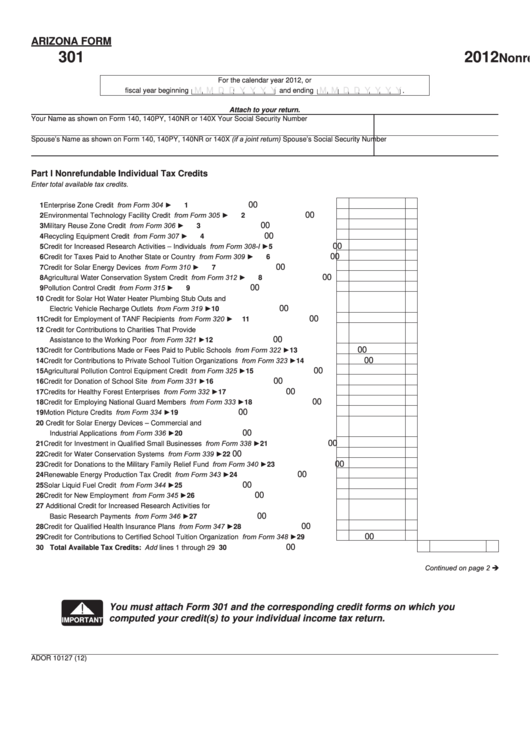

ARIZONA FORM

301

2012

Nonrefundable Individual Tax Credits and Recapture

For the calendar year 2012, or

M M D D Y Y Y Y

M M D D Y Y Y Y

fiscal year beginning

and ending

.

Attach to your return.

Your Name as shown on Form 140, 140PY, 140NR or 140X

Your Social Security Number

Spouse’s Name as shown on Form 140, 140PY, 140NR or 140X (if a joint return)

Spouse’s Social Security Number

Part I

Nonrefundable Individual Tax Credits

Enter total available tax credits.

1 Enterprise Zone Credit .................................................................................from Form 304 ►

00

1

2 Environmental Technology Facility Credit ....................................................from Form 305 ►

00

2

3 Military Reuse Zone Credit ..........................................................................from Form 306 ►

00

3

4 Recycling Equipment Credit ........................................................................from Form 307 ►

00

4

5 Credit for Increased Research Activities – Individuals ...............................from Form 308-I ►

00

5

6 Credit for Taxes Paid to Another State or Country .......................................from Form 309 ►

00

6

7 Credit for Solar Energy Devices ..................................................................from Form 310 ►

00

7

8 Agricultural Water Conservation System Credit ...........................................from Form 312 ►

00

8

9 Pollution Control Credit ................................................................................from Form 315 ►

00

9

10 Credit for Solar Hot Water Heater Plumbing Stub Outs and

Electric Vehicle Recharge Outlets ...............................................................from Form 319 ►

00

10

11 Credit for Employment of TANF Recipients .................................................from Form 320 ►

00

11

12 Credit for Contributions to Charities That Provide

Assistance to the Working Poor ...................................................................from Form 321 ►

00

12

13 Credit for Contributions Made or Fees Paid to Public Schools ....................from Form 322 ►

00

13

14 Credit for Contributions to Private School Tuition Organizations .................from Form 323 ►

00

14

15 Agricultural Pollution Control Equipment Credit ...........................................from Form 325 ►

00

15

16 Credit for Donation of School Site ...............................................................from Form 331 ►

00

16

17 Credits for Healthy Forest Enterprises .........................................................from Form 332 ►

00

17

18 Credit for Employing National Guard Members ...........................................from Form 333 ►

00

18

19 Motion Picture Credits .................................................................................from Form 334 ►

00

19

20 Credit for Solar Energy Devices – Commercial and

Industrial Applications ..................................................................................from Form 336 ►

00

20

21 Credit for Investment in Qualified Small Businesses ...................................from Form 338 ►

00

21

22 Credit for Water Conservation Systems .......................................................from Form 339 ►

00

22

23 Credit for Donations to the Military Family Relief Fund ...............................from Form 340 ►

00

23

24 Renewable Energy Production Tax Credit ...................................................from Form 343 ►

00

24

25 Solar Liquid Fuel Credit ...............................................................................from Form 344 ►

00

25

26 Credit for New Employment .........................................................................from Form 345 ►

00

26

27 Additional Credit for Increased Research Activities for

Basic Research Payments ...........................................................................from Form 346 ►

00

27

28 Credit for Qualified Health Insurance Plans .................................................from Form 347 ►

00

28

29 Credit for Contributions to Certified School Tuition Organization ................from Form 348 ►

00

29

30 Total Available Tax Credits: Add lines 1 through 29 ...................................................................................................

00

30

Continued on page 2

You must attach Form 301 and the corresponding credit forms on which you

!

computed your credit(s) to your individual income tax return.

IMPORTANT

ADOR 10127 (12)

1

1 2

2