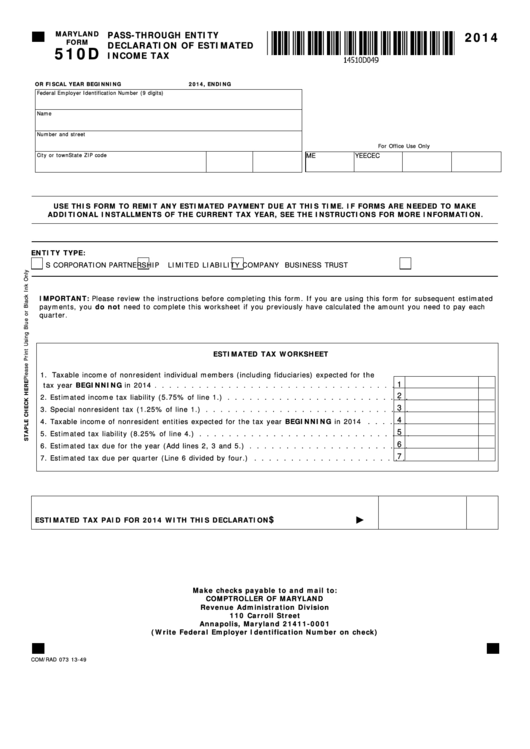

MARYLAND

PASS-THROUGH ENTITY

2014

FORM

DECLARATION OF ESTIMATED

510D

INCOME TAX

OR FISCAL YEAR BEGINNING

2014, ENDING

Federal Employer Identification Number (9 digits)

Name

Number and street

For Office Use Only

City or town

State

ZIP code

ME

YE

EC

EC

USE THIS FORM TO REMIT ANY ESTIMATED PAYMENT DUE AT THIS TIME . IF FORMS ARE NEEDED TO MAKE

ADDITIONAL INSTALLMENTS OF THE CURRENT TAX YEAR, SEE THE INSTRUCTIONS FOR MORE INFORMATION .

ENTITY TYPE:

S CORPORATION

PARTNERSHIP

LIMITED LIABILITY COMPANY

BUSINESS TRUST

IMPORTANT: Please review the instructions before completing this form. If you are using this form for subsequent estimated

payments, you do not need to complete this worksheet if you previously have calculated the amount you need to pay each

quarter.

ESTIMATED TAX WORKSHEET

1. Taxable income of nonresident individual members (including fiduciaries) expected for the

1

tax year BEGINNING in 2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2. Estimated income tax liability (5.75% of line 1.) . . . . . . . . . . . . . . . . . . . . . . . . .

3

3. Special nonresident tax (1.25% of line 1.) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4. Taxable income of nonresident entities expected for the tax year BEGINNING in 2014 . . . . . .

5

5. Estimated tax liability (8.25% of line 4.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6. Estimated tax due for the year (Add lines 2, 3 and 5.) . . . . . . . . . . . . . . . . . . . . . .

7

7. Estimated tax due per quarter (Line 6 divided by four.) . . . . . . . . . . . . . . . . . . . . .

$

ESTIMATED TAX PAID FOR 2014 WITH THIS DECLARATION . . . . . . . . . . . . . . . . . .

Make checks payable to and mail to:

COMPTROLLER OF MARYLAND

Revenue Administration Division

110 Carroll Street

Annapolis, Maryland 21411-0001

(Write Federal Employer Identification Number on check)

COM/RAD 073

13-49

1

1 2

2