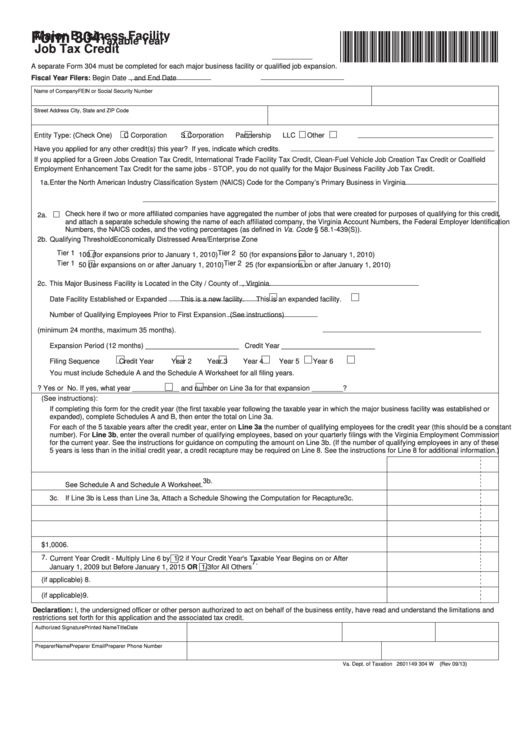

Major Business Facility

*VA0304113888*

Form 304

Taxable Year

Job Tax Credit

A separate Form 304 must be completed for each major business facility or qualified job expansion.

Fiscal Year Filers: Begin Date

, and End Date

Name of Company

FEIN or Social Security Number

Street Address

City, State and ZIP Code

Entity Type: (Check One)

C Corporation

S Corporation

Partnership

LLC

Other

Have you applied for any other credit(s) this year? If yes, indicate which credits.

If you applied for a Green Jobs Creation Tax Credit, International Trade Facility Tax Credit, Clean-Fuel Vehicle Job Creation Tax Credit or Coalfield

.

Employment Enhancement Tax Credit for the same jobs - STOP, you do not qualify for the Major Business Facility Job Tax Credit

1a.Enter the North American Industry Classification System (NAICS) Code for the Company’s Primary Business in Virginia

1b. Enter the Industry Description

Check here if two or more affiliated companies have aggregated the number of jobs that were created for purposes of qualifying for this credit,

2a.

and attach a separate schedule showing the name of each affiliated company, the Virginia Account Numbers, the Federal Employer Identification

Numbers, the NAICS codes, and the voting percentages (as defined in Va. Code § 58.1-439(S)).

2b. Qualifying Threshold

Economically Distressed Area/Enterprise Zone

Tier 1

Tier 2

100 (for expansions prior to January 1, 2010)

50 (for expansions prior to January 1, 2010)

Tier 1

Tier 2

50 (for expansions on or after January 1, 2010)

25 (for expansions on or after January 1, 2010)

2c. This Major Business Facility is Located in the City / County of

, Virginia.

Date Facility Established or Expanded

This is a new facility.

This is an expanded facility.

Number of Qualifying Employees Prior to First Expansion

(See instructions)

2d. Date Range from Which the Credit is Based (minimum 24 months, maximum 35 months)

.

Expansion Period (12 months) ________________________ Credit Year ________________________

Filing Sequence

Credit Year

Year 2

Year 3

Year 4

Year 5

Year 6

You must include Schedule A and the Schedule A Worksheet for all filing years.

2e. Have you had an expansion before?

Yes or

No. If yes, what year ____________ and number on Line 3a for that expansion ________?

3. Number of Qualifying Employees (See instructions):

If completing this form for the credit year (the first taxable year following the taxable year in which the major business facility was established or

expanded), complete Schedules A and B, then enter the total on Line 3a.

For each of the 5 taxable years after the credit year, enter on Line 3a the number of qualifying employees for the credit year (this should be a constant

number). For Line 3b, enter the overall number of qualifying employees, based on your quarterly filings with the Virginia Employment Commission

for the current year. See the instructions for guidance on computing the amount on Line 3b. (If the number of qualifying employees in any of these

5 years is less than in the initial credit year, a credit recapture may be required on Line 8. See the instructions for Line 8 for additional information.)

3a. Number of Qualifying Employees in the Credit Year

3a.

3b. Overall Number of Qualifying Employees in the Current Year for This Expansion

3b.

See Schedule A and Schedule A Worksheet.

3c.

If Line 3b is Less than Line 3a, Attach a Schedule Showing the Computation for Recapture

3c.

4. Threshold Amount - Enter the Amount from 2b

4.

5. Number of Credit Year Qualifying Employees - Subtract Line 4 from Line 3a

5.

6. Total Credit Allowed for this Major Business Facility or Expansion - Multiply Line 5 by $1,000

6.

7. Current Year Credit - Multiply Line 6 by

1/2 if Your Credit Year's Taxable Year Begins on or After

7.

January 1, 2009 but Before January 1, 2015 or

1/3 for All Others

8. Credit to Be Recaptured This Year (if applicable)

8.

9. Adjusted Credit - Subtract Line 8 from Line 7 (if applicable)

9.

Declaration: I, the undersigned officer or other person authorized to act on behalf of the business entity, have read and understand the limitations and

restrictions set forth for this application and the associated tax credit.

Authorized Signature

Printed Name

Title

Date

Preparer Name

Preparer Email

Preparer Phone Number

Va. Dept. of Taxation 2601149 304 W

(Rev 09/13)

1

1 2

2 3

3 4

4 5

5 6

6 7

7