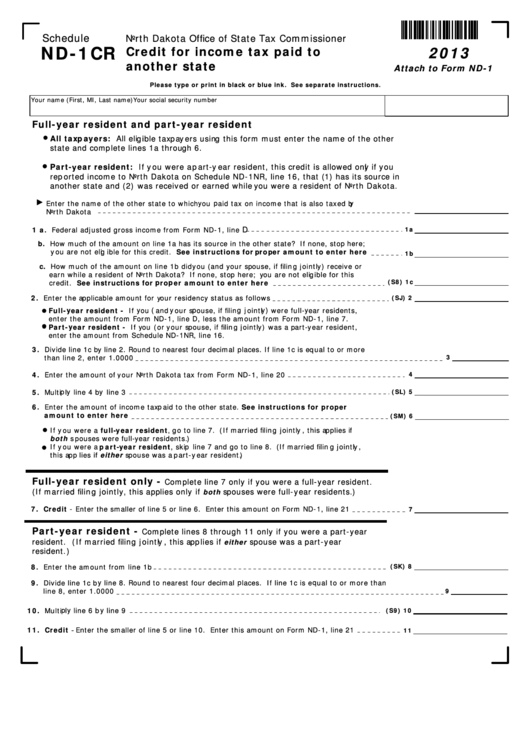

Schedule

North Dakota Office of State Tax Commissioner

ND-1CR

Credit for income tax paid to

2013

another state

Attach to Form ND-1

Please type or print in black or blue ink. See separate instructions.

Your name (First, MI, Last name)

Your social security number

Full-year resident and part-year resident

All taxpayers: All eligible taxpayers using this form must enter the name of the other

state and complete lines 1a through 6.

Part-year resident: If you were a part-year resident, this credit is allowed only if you

reported income to North Dakota on Schedule ND-1NR, line 16, that (1) has its source in

another state and (2) was received or earned while you were a resident of North Dakota.

Enter the name of the other state to which you paid tax on income that is also taxed by

North Dakota

D

1 a. Federal adjusted gross income from Form ND-1, line

1a

b. How much of the amount on line 1a has its source in the other state? If none, stop here;

you are not eligible for this credit. See instructions for proper amount to enter here

1b

c. How much of the amount on line 1b did you (and your spouse, if filing jointly) receive or

earn while a resident of North Dakota? If none, stop here; you are not eligible for this

credit. See instructions for proper amount to enter here

(S8) 1c

2. Enter the applicable amount for your residency status as follows

(SJ) 2

Full-year resident - If you (and your spouse, if filing jointly) were full-year residents,

enter the amount from Form ND-1, line D, less the amount from Form ND-1, line 7.

Part-year resident - If you (or your spouse, if filing jointly) was a part-year resident,

enter the amount from Schedule ND-1NR, line 16.

3. Divide line 1c by line 2. Round to nearest four decimal places. If line 1c is equal to or more

than line 2, enter 1.0000

3

4. Enter the amount of your North Dakota tax from Form ND-1, line 20

4

5. Multiply line 4 by line 3

(SL) 5

6. Enter the amount of income tax paid to the other state. See instructions for proper

amount to enter here

(SM) 6

If you were a full-year resident, go to line 7. (If married filing jointly, this applies if

both spouses were full-year residents.)

If you were a part-year resident, skip line 7 and go to line 8. (If married filing jointly,

this applies if either spouse was a part-year resident.)

Full-year resident only -

Complete line 7 only if you were a full-year resident.

(If married filing jointly, this applies only if

spouses were full-year residents.)

both

7. Credit - Enter the smaller of line 5 or line 6. Enter this amount on Form ND-1, line 21

7

Part-year resident -

Complete lines 8 through 11 only if you were a part-year

resident. (If married filing jointly, this applies if

spouse was a part-year

either

resident.)

8. Enter the amount from line 1b

(SK) 8

9. Divide line 1c by line 8. Round to nearest four decimal places. If line 1c is equal to or more than

line 8, enter 1.0000

9

10. Multiply line 6 by line 9

(S9) 10

11. Credit

Enter the smaller of line 5 or line 10. Enter this amount on Form ND-1, line 21

11

-

1

1 2

2