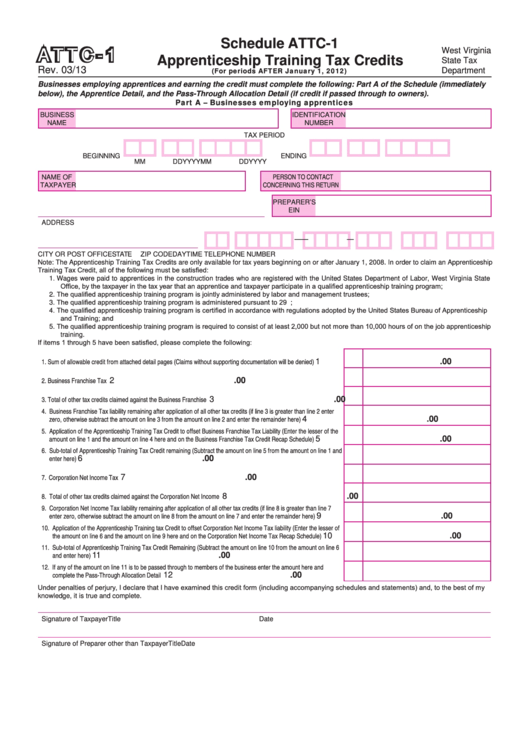

Schedule ATTC-1

West Virginia

A T T C - 1

Apprenticeship Training Tax Credits

State Tax

Rev. 03/13

(For periods aFter January 1, 2012)

Department

Businesses employing apprentices and earning the credit must complete the following: Part A of the Schedule (immediately

below), the Apprentice Detail, and the Pass-Through Allocation Detail (if credit if passed through to owners).

Part a – Businesses employing apprentices

BuSineSS

iDenTifiCATion

nAme

numBeR

TAx PeRioD

Beginning

enDing

mm

DD

YYYY

mm

DD

YYYY

Person to contact

nAme of

concerning this return

TAxPAYeR

PRePAReR’S

ein

ADDReSS

—

—

—

CiTY oR PoST offiCe

STATe

ZiP CoDe

DAYTime TelePhone numBeR

note: The Apprenticeship Training Tax Credits are only available for tax years beginning on or after January 1, 2008. in order to claim an Apprenticeship

Training Tax Credit, all of the following must be satisfied:

1. Wages were paid to apprentices in the construction trades who are registered with the united States Department of labor, West Virginia State

Office, by the taxpayer in the tax year that an apprentice and taxpayer participate in a qualified apprenticeship training program;

2. The qualified apprenticeship training program is jointly administered by labor and management trustees;

3. The qualified apprenticeship training program is administered pursuant to 29 U.S.C. Section 50;

4. The qualified apprenticeship training program is certified in accordance with regulations adopted by the United States Bureau of Apprenticeship

and Training; and

5. The qualified apprenticeship training program is required to consist of at least 2,000 but not more than 10,000 hours of on the job apprenticeship

training.

If items 1 through 5 have been satisfied, please complete the following:

1. sum of allowable credit from attached detail pages (claims without supporting documentation will be denied)...................

1

.00

2. Business Franchise tax liability..............................................................................................................................................

2

.00

3. total of other tax credits claimed against the Business Franchise tax..................................................................................

3

.00

4. Business Franchise tax liability remaining after application of all other tax credits (if line 3 is greater than line 2 enter

zero, otherwise subtract the amount on line 3 from the amount on line 2 and enter the remainder here)............................

4

.00

5. application of the apprenticeship training tax credit to offset Business Franchise tax Liability (enter the lesser of the

5

amount on line 1 and the amount on line 4 here and on the Business Franchise tax credit recap schedule)...................

.00

6. sub-total of apprenticeship training tax credit remaining (subtract the amount on line 5 from the amount on line 1 and

enter here).............................................................................................................................................................................

6

.00

7. corporation net income tax Liability......................................................................................................................................

7

.00

8. total of other tax credits claimed against the corporation net income tax..........................................................................

8

.00

9. corporation net income tax liability remaining after application of all other tax credits (if line 8 is greater than line 7

9

enter zero, otherwise subtract the amount on line 8 from the amount on line 7 and enter the remainder here)...................

.00

10. application of the apprenticeship training tax credit to offset corporation net income tax liability (enter the lesser of

the amount on line 6 and the amount on line 9 here and on the corporation net income tax recap schedule)..............

10

.00

11. sub-total of apprenticeship training tax credit remaining (subtract the amount on line 10 from the amount on line 6

and enter here)...................................................................................................................................................................

11

.00

12. if any of the amount on line 11 is to be passed through to members of the business enter the amount here and

complete the Pass-through allocation Detail schedule......................................................................................................

12

.00

Under penalties of perjury, I declare that I have examined this credit form (including accompanying schedules and statements) and, to the best of my

knowledge, it is true and complete.

Signature of Taxpayer

Title

Date

Signature of Preparer other than Taxpayer

Title

Date

1

1 2

2 3

3 4

4