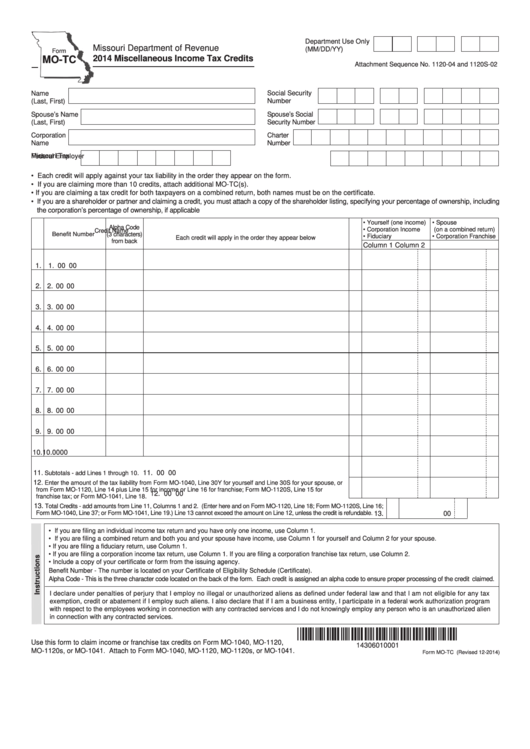

Reset Form

Print Form

Department Use Only

Missouri Department of Revenue

(MM/DD/YY)

Form

2014 Miscellaneous Income Tax Credits

MO-TC

Attachment Sequence No. 1120-04 and 1120S-02

Social Security

Name

Number

(Last, First)

Spouse’s Social

Spouse’s Name

Security Number

(Last, First)

Corporation

Charter

Name

Number

Missouri Tax

Federal Employer

I.D. Number

I.D. Number

• Each credit will apply against your tax liability in the order they appear on the form.

• If you are claiming more than 10 credits, attach additional MO-TC(s).

• If you are claiming a tax credit for both taxpayers on a combined return, both names must be on the certificate.

• If you are a shareholder or partner and claiming a credit, you must attach a copy of the shareholder listing, specifying your percentage of ownership, including

the corporation’s percentage of ownership, if applicable

• Yourself (one income)

• Spouse

Alpha Code

• Corporation Income

(on a combined return)

Credit Name

Benefit Number

(3 characters)

• Fiduciary

• Corporation Franchise

Each credit will apply in the order they appear below

from back

Column 1

Column 2

1.

1.

00

00

2.

2.

00

00

3.

3.

00

00

4.

4.

00

00

5.

5.

00

00

6.

6.

00

00

7.

7.

00

00

8.

8.

00

00

9.

9.

00

00

10.

10.

00

00

11.

11.

00

00

Subtotals - add Lines 1 through 10

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12.

Enter the amount of the tax liability from Form MO-1040, Line 30Y for yourself and Line 30S for your spouse, or

from Form MO-1120, Line 14 plus Line 15 for income or Line 16 for franchise; Form MO-1120S, Line 15 for

12.

00

00

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

franchise tax; or Form MO-1041, Line 18.

13.

Total Credits - add amounts from Line 11, Columns 1 and 2. (Enter here and on Form MO-1120, Line 18; Form MO-1120S, Line 16;

Form MO-1040, Line 37; or Form MO-1041, Line 19.) Line 13 cannot exceed the amount on Line 12, unless the credit is refundable.

13.

00

• If you are filing an individual income tax return and you have only one income, use Column 1.

• If you are filing a combined return and both you and your spouse have income, use Column 1 for yourself and Column 2 for your spouse.

• If you are filing a fiduciary return, use Column 1.

• If you are filing a corporation income tax return, use Column 1. If you are filing a corporation franchise tax return, use Column 2.

• Include a copy of your certificate or form from the issuing agency.

Benefit Number - The number is located on your Certificate of Eligibility Schedule (Certificate).

Alpha Code - This is the three character code located on the back of the form. Each credit is assigned an alpha code to ensure proper processing of the credit claimed.

I declare under penalties of perjury that I employ no illegal or unauthorized aliens as defined under federal law and that I am not eligible for any tax

exemption, credit or abatement if I employ such aliens. I also declare that if I am a business entity, I participate in a federal work authorization program

with respect to the employees working in connection with any contracted services and I do not knowingly employ any person who is an unauthorized alien

in connection with any contracted services.

*14306010001*

Use this form to claim income or franchise tax credits on Form MO-1040, MO-1120,

14306010001

MO-1120s, or MO-1041. Attach to Form MO-1040, MO-1120, MO-1120s, or MO-1041.

Form MO-TC (Revised 12-2014)

1

1 2

2