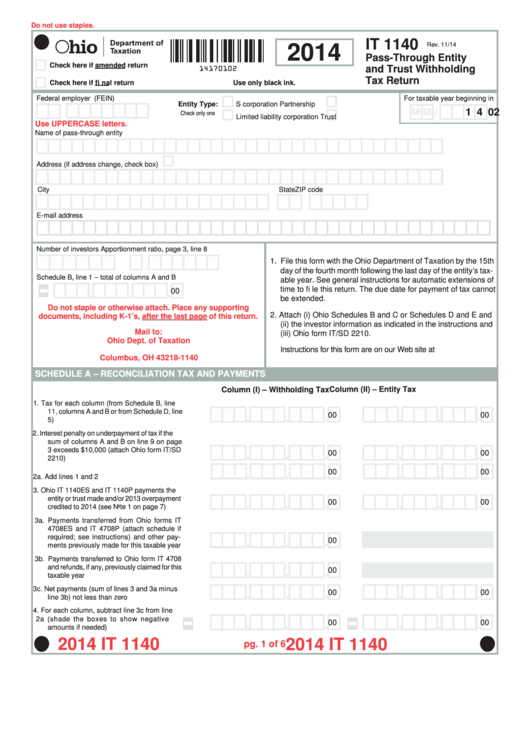

Form It 1140 - Pass-Through Entity And Trust Withholding Tax Return - 2014

ADVERTISEMENT

Do not use staples.

IT 1140

Rev. 11/14

2014

Pass-Through Entity

Check here if amended return

14170102

and Trust Withholding

Tax Return

Check here if fi nal return

Use only black ink.

Federal employer I.D. no. (FEIN)

For taxable year beginning in

S corporation

Partnership

Entity Type:

/

M M

2

0

1 4

Check only one

Limited liability corporation

Trust

Use UPPERCASE letters.

Name of pass-through entity

Address (if address change, check box)

City

State

ZIP code

E-mail address

Number of investors

Apportionment ratio, page 3, line 8

1. File this form with the Ohio Department of Taxation by the 15th

.

day of the fourth month following the last day of the entity’s tax-

Schedule B, line 1 – total of columns A and B

able year. See general instructions for automatic extensions of

time to fi le this return. The due date for payment of tax cannot

,

,

.

00

be extended.

Do not staple or otherwise attach. Place any supporting

2. Attach (i) Ohio Schedules B and C or Schedules D and E and

documents, including K-1’s, after the last page of this return.

(ii) the investor information as indicated in the instructions and

Mail to:

(iii) Ohio form IT/SD 2210.

Ohio Dept. of Taxation

P.O. Box 181140

Instructions for this form are on our Web site at tax.ohio.gov.

Columbus, OH 43218-1140

SCHEDULE A – RECONCILIATION TAX AND PAYMENTS

Column (II) – Entity Tax

Column (I) – Withholding Tax

1. Tax for each column (from Schedule B, line

11, columns A and B or from Schedule D, line

,

,

.

00

,

,

.

00

5)

............................................................................ 1.

2. Interest penalty on underpayment of tax if the

sum of columns A and B on line 9 on page

3 exceeds $10,000 (attach Ohio form IT/SD

00

00

,

,

.

,

,

.

2210)

...................................................................... 2.

00

00

,

,

.

,

,

.

2a. Add lines 1 and 2

................................................. 2a.

3. Ohio IT 1140ES and IT 1140P payments the

entity or trust made and/or 2013 overpayment

00

00

,

,

.

,

,

.

credited to 2014 (see Note 1 on page 7)

........... 3.

3a. Payments transferred from Ohio forms IT

4708ES and IT 4708P (attach schedule if

required; see instructions) and other pay-

00

,

,

.

ments previously made for this taxable year

........ 3a.

3b. Payments transferred to Ohio form IT 4708

and refunds, if any, previously claimed for this

00

,

,

.

taxable year

.......................................................... 3b.

3c. Net payments (sum of lines 3 and 3a minus

,

,

.

00

,

,

.

00

line 3b) not less than zero

.....................................3c.

4. For each column, subtract line 3c from line

2a (shade the boxes to show negative

00

00

,

,

.

,

,

.

amounts if needed)

......................................

... 4.

2014 IT 1140

2014 IT 1140

pg. 1 of 6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7