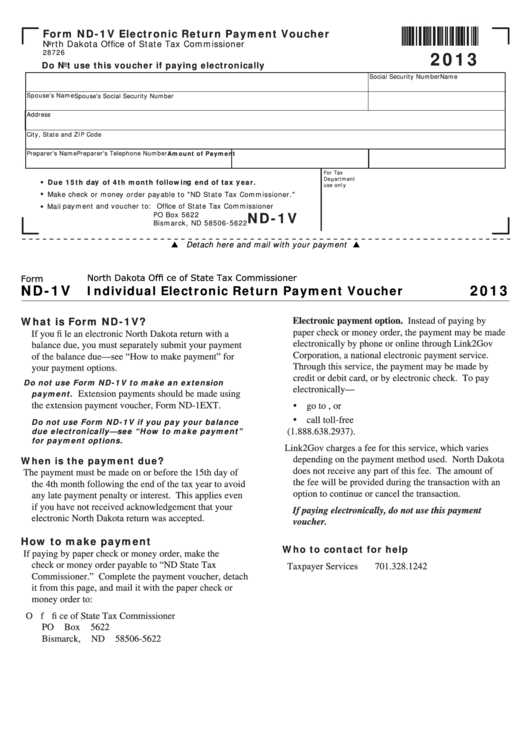

Form ND-1V Electronic Return Payment Voucher

North Dakota Office of State Tax Commissioner

28726

2013

Do Not use this voucher if paying electronically

Name

Social Security Number

Spouse's Name

Spouse's Social Security Number

Address

City, State and ZIP Code

Preparer's Name

Preparer's Telephone Number

Amount of Payment

For Tax

Department

Due 15th day of 4th month following end of tax year.

•

use only

Make check or money order payable to "ND State Tax Commissioner."

•

Mail payment and voucher to: Office of State Tax Commissioner

•

ND-1V

PO Box 5622

Bismarck, ND 58506-5622

Detach here and mail with your payment

North Dakota Offi ce of State Tax Commissioner

Form

ND-1V

2013

Individual Electronic Return Payment Voucher

What is Form ND-1V?

Electronic payment option. Instead of paying by

paper check or money order, the payment may be made

If you fi le an electronic North Dakota return with a

electronically by phone or online through Link2Gov

balance due, you must separately submit your payment

Corporation, a national electronic payment service.

of the balance due—see “How to make payment” for

Through this service, the payment may be made by

your payment options.

credit or debit card, or by electronic check. To pay

Do not use Form ND-1V to make an extension

electronically—

payment.

Extension payments should be made using

go to , or

the extension payment voucher, Form ND-1EXT.

call toll-free 1.888.ND.TAXES

Do not use Form ND-1V if you pay your balance

due electronically—see “How to make payment”

(1.888.638.2937).

for payment options.

Link2Gov charges a fee for this service, which varies

When is the payment due?

depending on the payment method used. North Dakota

does not receive any part of this fee. The amount of

The payment must be made on or before the 15th day of

the fee will be provided during the transaction with an

the 4th month following the end of the tax year to avoid

option to continue or cancel the transaction.

any late payment penalty or interest. This applies even

if you have not received acknowledgement that your

If paying electronically, do not use this payment

electronic North Dakota return was accepted.

voucher.

How to make payment

Who to contact for help

If paying by paper check or money order, make the

check or money order payable to “ND State Tax

Taxpayer Services

701.328.1242

Commissioner.” Complete the payment voucher, detach

it from this page, and mail it with the paper check or

money order to:

Offi ce of State Tax Commissioner

PO Box 5622

Bismarck, ND 58506-5622

1

1