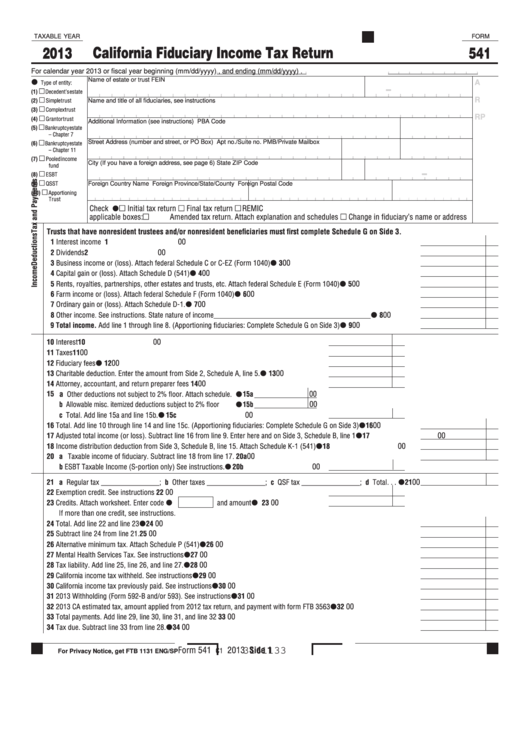

TAXABLE YEAR

FORM

California Fiduciary Income Tax Return

2013

541

For calendar year 2013 or fiscal year beginning (mm/dd/yyyy)

, and ending (mm/dd/yyyy)

.

Name of estate or trust

FEIN

Type of entity:

A

(1)

Decedent’s estate

(2)

Simple trust

R

Name and title of all fiduciaries, see instructions

(3)

Complex trust

RP

(4)

Grantor trust

Additional Information (see instructions)

PBA Code

(5)

Bankruptcy estate

– Chapter 7

Street Address (number and street, or PO Box)

Apt no./Suite no.

PMB/Private Mailbox

(6)

Bankruptcy estate

– Chapter 11

(7)

Pooled income

City (If you have a foreign address, see page 6)

State

ZIP Code

fund

(8)

ESBT

(9)

QSST

Foreign Country Name

Foreign Province/State/County

Foreign Postal Code

(10)

Apportioning

Trust

Initial tax return Final tax return REMIC

Check

applicable boxes:

Amended tax return. Attach explanation and schedules Change in fiduciary’s name or address

Trusts that have nonresident trustees and/or nonresident beneficiaries must first complete Schedule G on Side 3.

1 Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

00

00

2 Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

00

3 Business income or (loss). Attach federal Schedule C or C-EZ (Form 1040). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Capital gain or (loss). Attach Schedule D (541). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

00

5 Rents, royalties, partnerships, other estates and trusts, etc. Attach federal Schedule E (Form 1040) . . . . . . . . . . . . . . . .

5

00

6 Farm income or (loss). Attach federal Schedule F (Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7 Ordinary gain or (loss). Attach Schedule D-1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8 Other income. See instructions. State nature of income___________________________________________ . . . . . . .

8

00

9 Total income. Add line 1 through line 8. (Apportioning fiduciaries: Complete Schedule G on Side 3) . . . . . . . . . . . . . . .

9

00

10 Interest. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

00

11 Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Fiduciary fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

00

00

13 Charitable deduction. Enter the amount from Side 2, Schedule A, line 5.. . . . . . . . . . . .

13

00

14 Attorney, accountant, and return preparer fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

a

00

15

Other deductions not subject to 2% floor. Attach schedule.

1 5a

00

b Allowable misc. itemized deductions subject to 2% floor . . . .

1 5b

00

c Total. Add line 15a and line 15b.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 5c

00

16 Total. Add line 10 through line 14 and line 15c. (Apportioning fiduciaries: Complete Schedule G on Side 3) . . . . . . . . .

16

00

17 Adjusted total income (or loss). Subtract line 16 from line 9. Enter here and on Side 3, Schedule B, line 1 . . . . . . . . . .

17

00

18 Income distribution deduction from Side 3, Schedule B, line 15. Attach Schedule K-1 (541) . . . . . . . . . . . . . . . . . . . . .

18

00

20 a Taxable income of fiduciary. Subtract line 18 from line 17.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20a

b ESBT Taxable Income (S-portion only) See instructions. . . . . . . . . . . . . . . . . . . . .

2 0b

00

00

21 a Regular tax ________________; b Other taxes ________________; c QSF tax ________________; d Total . . .

21

22 Exemption credit. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

00

00

23 Credits. Attach worksheet. Enter code

and amount . . . . . . . . . . . . . . .

23

If more than one credit, see instructions.

00

24 Total. Add line 22 and line 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

00

25 Subtract line 24 from line 21.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

00

26 Alternative minimum tax. Attach Schedule P (541) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

00

27 Mental Health Services Tax. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

00

28 Tax liability. Add line 25, line 26, and line 27. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

00

29 California income tax withheld. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

00

30 California income tax previously paid. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30

31 2013 Withholding (Form 592-B and/or 593). See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31

00

00

32 2013 CA estimated tax, amount applied from 2012 tax return, and payment with form FTB 3563. . . . . . . . . . . . . . . . . .

32

00

33 Total payments. Add line 29, line 30, line 31, and line 32. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

00

34 Tax due. Subtract line 33 from line 28.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

34

Form 541

2013 Side 1

C1

3161133

For Privacy Notice, get FTB 1131 ENG/SP

1

1 2

2 3

3