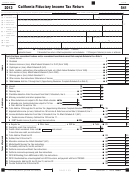

35 Overpaid tax. Subtract line 28 from line 33 from Side 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

35

00

00

36 Amount of line 35 to be credited to 2014 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

36

00

37 Amount of overpaid tax available this year. Subtract line 36 from line 35 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

37

00

38 Use tax. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

38

00

39 Total voluntary contributions from line 61 below . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .39

.

,

,

00

40 Refund or No Amount Due. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

.

,

,

00

41 Amount Due. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

41

42 Underpayment of estimated tax. Check the box:

FTB 5805 attached

FTB 5805F attached . . . . . . . . . . . . . . . . .

42

00

Code

Amount

Code

Amount

Alzheimer’s Disease/Related Disorders Fund . . . . . . . . . . . . . . 401

00

Municipal Shelter Spay-Neuter Fund. . . . . . 412

00

CA Fund for Senior Citizens . . . . . . . . . . . . . . . . . . . . . . . . . . . 402

00

CA Cancer Research Fund. . . . . . . . . . . . . . 413

00

00

00

Rare and Endangered Species Preservation Program . . . . . . . . 403

Child Victims of Human Trafficking Fund . . 419

State Children’s Trust Fund for the Prevention of Child Abuse . 404

00

CA YMCA Youth and Government Fund . . . 420

00

CA Breast Cancer Research Fund . . . . . . . . . . . . . . . . . . . . . . . 405

00

CA Youth Leadership Fund . . . . . . . . . . . . . 421

00

CA Firefighters’ Memorial Fund. . . . . . . . . . . . . . . . . . . . . . . . . 406

00

School Supplies for Homeless Children Fund . 422

00

Emergency Food For Families Fund . . . . . . . . . . . . . . . . . . . . . 407

00

Protect Our Coast and Oceans Fund . . . . . . 424

00

CA Peace Officer Memorial Foundation Fund. . . . . . . . . . . . . . . . 408

00

Keep Arts in Schools Fund . . . . . . . . . . . . . 425

00

CA Sea Otter Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 410

00

American Red Cross, California Chapters Fund . 426

00

00

61 Total voluntary contributions. Add line 401 through line 426. Enter here and on line 39, above . . . . . . . . . . . . . . . . . . .

61

Schedule A Charitable Deduction. Do not complete for a simple trust or a pooled income fund. See instructions.

00

1 a Amounts paid for charitable purposes from gross income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a

00

b Amounts permanently set aside for charitable purposes from gross income. See instructions .

1b

00

c Total. Add line 1a and line 1b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1c

00

2 Tax-exempt income allocable to charitable contributions. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

00

3 Subtract line 2 from line 1c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

00

4 Capital gains for the tax year allocated to corpus and paid or permanently set aside for charitable purposes . . . . . . . . . . . . . . . . 4

00

5 Charitable Deduction. Add line 3 and line 4. Enter here and on Side 1, line 13. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Other Information.

1 Date trust was created or, if an estate, date of decedent’s death:

5

Did the estate or trust receive tax-exempt income?. . . . . . . . . . Yes No

(mm/dd/yyyy)

a

If “Yes,” attach computation of the allocation of expenses.

b Name of Grantor(s) of Trust ____________________________________

6

Is this tax return for a short taxable year? . . . . . . . . . . . . . . . . . Yes No

(attach an additional sheet if necessary)

7

Has the estate or trust included a Reportable Transaction,

2 a If an estate, was decedent a California resident? . . . . . . . . . Yes No

or Listed Transaction within this tax return? . . . . . . . . . . . . . . . Yes No

b Was decedent married at date of death? . . . . . . . . . . . . . . . Yes No

If “Yes,” complete and attach federal Form 8886.

c If “Yes,” enter surviving spouse’s/RDP’s social security number (or ITIN)

8

Does this trust have a beneficial interest in a trust or is it

and name: __________________________________________________

a grantor of another trust? Attach schedule of trusts

3 If an estate, enter fair market value (FMV) of:

and federal IDs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

a Decedent’s assets at date of death . . . . . . . . . . . . . . . . . ______________

9

During the year did the estate or trust defer any income

b Assets located in California . . . . . . . . . . . . . . . . . . . . . . ______________

from the disposition of assets? . . . . . . . . . . . . . . . . . . . . . .

Yes No

c Assets located outside California . . . . . . . . . . . . . . . . . . ______________

Note: Income of final year is taxable to beneficiaries.

4 If this is the final tax return of an estate, enter date of

court order, if applicable, authorizing the final distribution . . ______________

Under penalties of perjury, I declare that I have examined this tax return, including accompanying schedules and statements, and to the best of my knowledge and belief, it

is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Here

Date

Signature of trustee or officer representing fiduciary

Preparer’s signature

Date

Check if self-

PTIN

employed

Paid

FEIN

Preparer’s

Firm’s name (or yours,

Use Only

if self-employed) and

Telephone

address.

(

)

May the FTB discuss this tax return with the preparer shown above (see instructions)? . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Side 2 Form 541

2013

C1

3162133

1

1 2

2 3

3