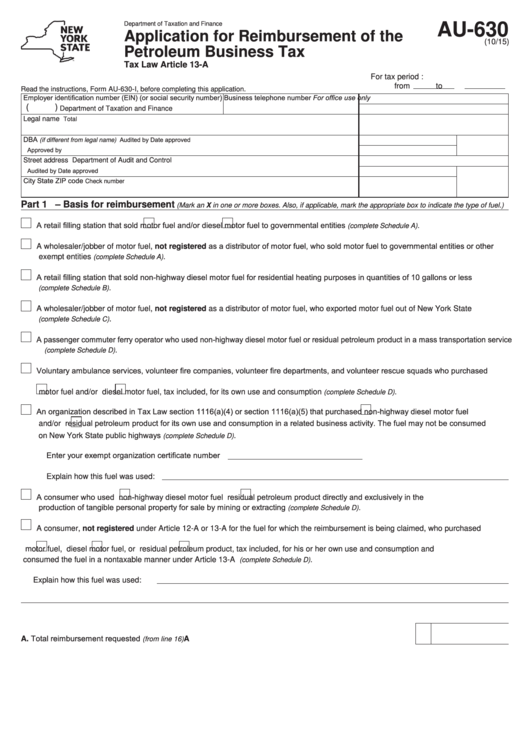

AU-630

Department of Taxation and Finance

Application for Reimbursement of the

(10/15)

Petroleum Business Tax

Tax Law Article 13-A

For tax period :

from

to

Read the instructions, Form AU-630-I, before completing this application.

Employer identification number (EIN) (or social security number) Business telephone number

For office use only

(

)

Department of Taxation and Finance

Legal name

Total

DBA

Audited by

Date approved

(if different from legal name)

Approved by

Street address

Department of Audit and Control

Audited by

Date approved

City

State

ZIP code

Check number

Part 1 – Basis for reimbursement

(Mark an X in one or more boxes. Also, if applicable, mark the appropriate box to indicate the type of fuel.)

A retail filling station that sold

motor fuel and/or

diesel motor fuel to governmental entities

.

(complete Schedule A)

A wholesaler/jobber of motor fuel, not registered as a distributor of motor fuel, who sold motor fuel to governmental entities or other

exempt entities

.

(complete Schedule A)

A retail filling station that sold non-highway diesel motor fuel for residential heating purposes in quantities of 10 gallons or less

.

(complete Schedule B)

A wholesaler/jobber of motor fuel, not registered as a distributor of motor fuel, who exported motor fuel out of New York State

.

(complete Schedule C)

A passenger commuter ferry operator who used non-highway diesel motor fuel or residual petroleum product in a mass transportation service

.

(complete Schedule D)

Voluntary ambulance services, volunteer fire companies, volunteer fire departments, and volunteer rescue squads who purchased

motor fuel and/or

diesel motor fuel, tax included, for its own use and consumption

.

(complete Schedule D)

An organization described in Tax Law section 1116(a)(4) or section 1116(a)(5) that purchased

non-highway diesel motor fuel

residual petroleum product for its own use and consumption in a related business activity. The fuel may not be consumed

and/or

on New York State public highways

.

(complete Schedule D)

Enter your exempt organization certificate number

Explain how this fuel was used:

A consumer who used

non-highway diesel motor fuel

residual petroleum product directly and exclusively in the

production of tangible personal property for sale by mining or extracting

.

(complete Schedule D)

A consumer, not registered under Article 12-A or 13-A for the fuel for which the reimbursement is being claimed, who purchased

motor fuel,

diesel motor fuel, or

residual petroleum product, tax included, for his or her own use and consumption and

consumed the fuel in a nontaxable manner under Article 13-A

.

(complete Schedule D)

Explain how this fuel was used:

A. Total reimbursement requested

..........................................................................................................

A

(from line 16)

1

1 2

2 3

3 4

4