R-1382 (9/09)

(

)

(

)

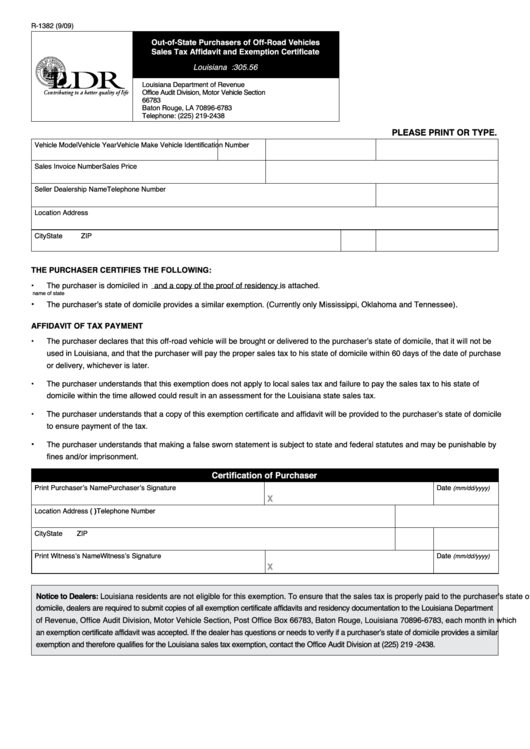

out-of-state Purchasers of off-road vehicles

sales tax affidavit and exemption certificate

Louisiana R.S.47:305.56

Louisiana Department of Revenue

Office Audit Division, Motor Vehicle Section

P.O. Box 66783

Baton Rouge, LA 70896-6783

Telephone: (225) 219-2438

Please Print or tyPe.

Vehicle Model

Vehicle Year

Vehicle Make

Vehicle Identification Number

Sales Invoice Number

Sales Price

Seller Dealership Name

Telephone Number

Location Address

City

State

ZIP

the Purchaser certifies the following:

•

The purchaser is domiciled in

and a copy of the proof of residency is attached.

name of state

•

.

The purchaser’s state of domicile provides a similar exemption. (Currently only Mississippi, Oklahoma and Tennessee)

affidavit of tax Payment

•

The purchaser declares that this off-road vehicle will be brought or delivered to the purchaser’s state of domicile, that it will not be

used in Louisiana, and that the purchaser will pay the proper sales tax to his state of domicile within 60 days of the date of purchase

or delivery, whichever is later.

•

The purchaser understands that this exemption does not apply to local sales tax and failure to pay the sales tax to his state of

domicile within the time allowed could result in an assessment for the Louisiana state sales tax.

•

The purchaser understands that a copy of this exemption certificate and affidavit will be provided to the purchaser’s state of domicile

to ensure payment of the tax.

•

The purchaser understands that making a false sworn statement is subject to state and federal statutes and may be punishable by

fines and/or imprisonment.

certification of Purchaser

Print Purchaser’s Name

Purchaser’s Signature

Date

(mm/dd/yyyy)

x

Location Address (P.o. Box not accePted)

Telephone Number

City

State

ZIP

Print Witness’s Name

Witness’s Signature

Date

(mm/dd/yyyy)

x

notice to dealers: Louisiana residents are not eligible for this exemption. To ensure that the sales tax is properly paid to the purchaser’s state of

domicile, dealers are required to submit copies of all exemption certificate affidavits and residency documentation to the Louisiana Department

of Revenue, Office Audit Division, Motor Vehicle Section, Post Office Box 66783, Baton Rouge, Louisiana 70896-6783, each month in which

an exemption certificate affidavit was accepted. If the dealer has questions or needs to verify if a purchaser’s state of domicile provides a similar

exemption and therefore qualifies for the Louisiana sales tax exemption, contact the Office Audit Division at (225) 219 -2438.

1

1