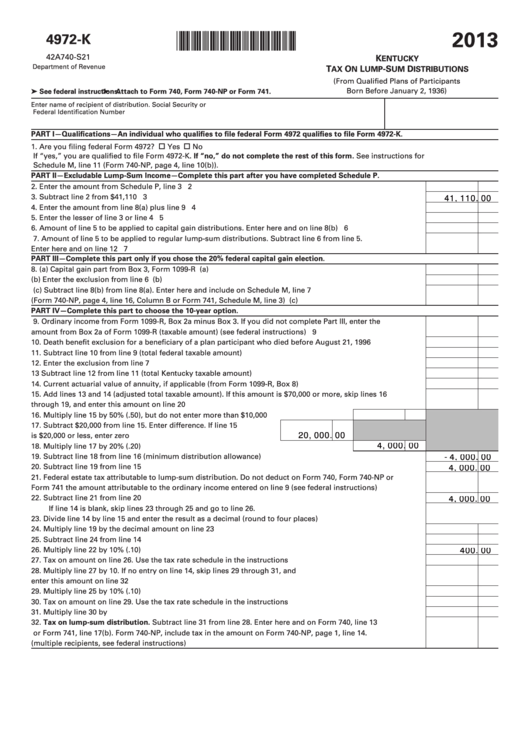

2013

4972-K

*1300030023*

42A740-S21

K

ENTUCKY

Department of Revenue

T

O

L

-S

D

AX

N

UMP

UM

ISTRIBUTIONS

(From Qualified Plans of Participants

Born Before January 2, 1936)

➤ See federal instructions. ➤ Attach to Form 740, Form 740-NP or Form 741.

Enter name of recipient of distribution.

Social Security or

Federal Identification Number

PART I—Qualifications—An individual who qualifies to file federal Form 4972 qualifies to file Form 4972-K.

1. Are you filing federal Form 4972? ...................................................................................................................................

Yes

No

If “yes,” you are qualified to file Form 4972-K. If “no,” do not complete the rest of this form. See instructions for

Schedule M, line 11 (Form 740-NP, page 4, line 10(b)).

PART II—Excludable Lump-Sum Income—Complete this part after you have completed Schedule P.

2. Enter the amount from Schedule P, line 3 ............................................................................................................. 2

3. Subtract line 2 from $41,110 ................................................................................................................................... 3

41,110.00

4. Enter the amount from line 8(a) plus line 9 ........................................................................................................... 4

5. Enter the lesser of line 3 or line 4 ........................................................................................................................... 5

6. Amount of line 5 to be applied to capital gain distributions. Enter here and on line 8(b) ................................. 6

7. Amount of line 5 to be applied to regular lump-sum distributions. Subtract line 6 from line 5.

Enter here and on line 12 ........................................................................................................................................ 7

PART III—Complete this part only if you chose the 20% federal capital gain election.

8. (a) Capital gain part from Box 3, Form 1099-R ................................................................................................ 8(a)

(b) Enter the exclusion from line 6 ................................................................................................................... 8(b)

(c) Subtract line 8(b) from line 8(a). Enter here and include on Schedule M, line 7

(Form 740-NP, page 4, line 16, Column B or Form 741, Schedule M, line 3) ........................................... 8(c)

PART IV—Complete this part to choose the 10-year option.

9. Ordinary income from Form 1099-R, Box 2a minus Box 3. If you did not complete Part III, enter the

amount from Box 2a of Form 1099-R (taxable amount) (see federal instructions) ............................................ 9

10. Death benefit exclusion for a beneficiary of a plan participant who died before August 21, 1996 .................. 10

11. Subtract line 10 from line 9 (total federal taxable amount) .................................................................................. 11

12. Enter the exclusion from line 7 ............................................................................................................................... 12

13 Subtract line 12 from line 11 (total Kentucky taxable amount) ............................................................................ 13

14. Current actuarial value of annuity, if applicable (from Form 1099-R, Box 8) ...................................................... 14

15. Add lines 13 and 14 (adjusted total taxable amount). If this amount is $70,000 or more, skip lines 16

through 19, and enter this amount on line 20 ....................................................................................................... 15

16. Multiply line 15 by 50% (.50), but do not enter more than $10,000 ..................................16

17. Subtract $20,000 from line 15. Enter difference. If line 15

20,000.00

is $20,000 or less, enter zero ............................................................ 17

4,000.00

18. Multiply line 17 by 20% (.20) .............................................................................................. 18

19. Subtract line 18 from line 16 (minimum distribution allowance) ........................................................................ 19

-4,000.00

20. Subtract line 19 from line 15 ................................................................................................................................... 20

4,000.00

21. Federal estate tax attributable to lump-sum distribution. Do not deduct on Form 740, Form 740-NP or

Form 741 the amount attributable to the ordinary income entered on line 9 (see federal instructions) ......... 21

22. Subtract line 21 from line 20 ................................................................................................................................... 22

4,000.00

If line 14 is blank, skip lines 23 through 25 and go to line 26.

23. Divide line 14 by line 15 and enter the result as a decimal (round to four places) ............................................ 23

24. Multiply line 19 by the decimal amount on line 23 ............................................................................................... 24

25. Subtract line 24 from line 14 ................................................................................................................................... 25

26. Multiply line 22 by 10% (.10) ................................................................................................................................... 26

400.00

27. Tax on amount on line 26. Use the tax rate schedule in the instructions ........................................................... 27

28. Multiply line 27 by 10. If no entry on line 14, skip lines 29 through 31, and

enter this amount on line 32 ................................................................................................................................... 28

29. Multiply line 25 by 10% (.10) ................................................................................................................................... 29

30. Tax on amount on line 29. Use the tax rate schedule in the instructions ........................................................... 30

31. Multiply line 30 by 10............................................................................................................................................... 31

32. Tax on lump-sum distribution. Subtract line 31 from line 28. Enter here and on Form 740, line 13

or Form 741, line 17(b). Form 740-NP, include tax in the amount on Form 740-NP, page 1, line 14.

(multiple recipients, see federal instructions) ....................................................................................................... 32

1

1