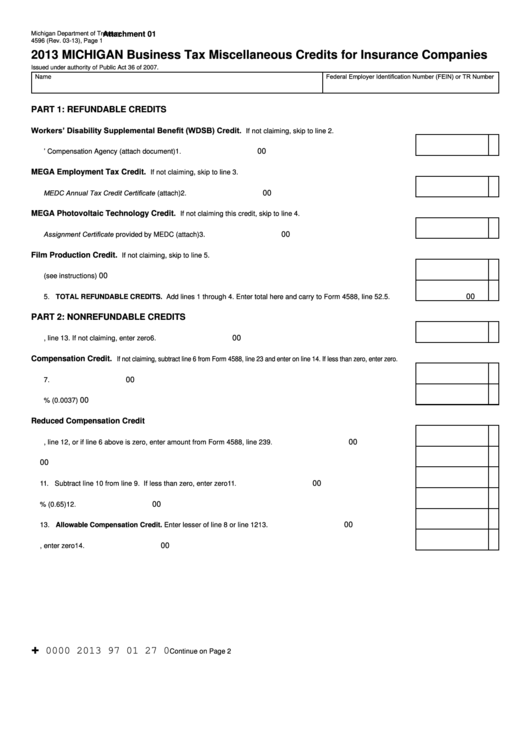

Form 4596 - Michigan Business Tax Miscellaneous Credits For Insurance Companies - 2013

ADVERTISEMENT

Michigan Department of Treasury

Attachment 01

4596 (Rev. 03-13), Page 1

2013 MICHIGAN Business Tax Miscellaneous Credits for Insurance Companies

Issued under authority of Public Act 36 of 2007.

Federal Employer Identification Number (FEIN) or TR Number

Name

PART 1: REFUNDABLE CREDITS

Workers’ Disability Supplemental Benefit (WDSB) Credit.

If not claiming, skip to line 2.

00

1. WDSB Credit allowed by the Workers’ Compensation Agency (attach document) ...............................................

1.

MEGA Employment Tax Credit.

If not claiming, skip to line 3.

2. Credit amount from MEDC Annual Tax Credit Certificate (attach) ........................................................................

00

2.

MEGA Photovoltaic Technology Credit.

If not claiming this credit, skip to line 4.

3. Credit amount from Assignment Certificate provided by MEDC (attach) ..............................................................

00

3.

Film Production Credit.

If not claiming, skip to line 5.

00

4. Assigned credit amount (see instructions).............................................................................................................

4.

00

5. TOTAL REFUNDABLE CREDITS. Add lines 1 through 4. Enter total here and carry to Form 4588, line 52. .....

5.

PART 2: NONREFUNDABLE CREDITS

00

6. Single Business Tax credit carryforward from Form 4569, line 13. If not claiming, enter zero ..............................

6.

Compensation Credit.

If not claiming, subtract line 6 from Form 4588, line 23 and enter on line 14. If less than zero, enter zero.

00

7. Michigan Compensation .........................................................................................................................................

7.

00

8. Compensation Credit. Multiply line 7 by 0.37% (0.0037)........................................................................................

8.

Reduced Compensation Credit

00

9. Tax before credits from Form 4569, line 12, or if line 6 above is zero, enter amount from Form 4588, line 23 ....

9.

00

10. WDSB Credit from line 1 above.............................................................................................................................

10.

00

11. Subtract line 10 from line 9. If less than zero, enter zero .....................................................................................

11.

00

12. Multiply line 11 by 65% (0.65) ................................................................................................................................

12.

00

13. Allowable Compensation Credit. Enter lesser of line 8 or line 12 ......................................................................

13.

00

14. Tax After Compensation Credit. Subtract line 13 from line 9. If less than zero, enter zero ...................................

14.

+

0000 2013 97 01 27 0

Continue on Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6